The US offers a vast selection of stocks that investors can buy to build a five-star diversified portfolio. By concentrating primarily or wholly on companies listed on Wall Street, investors can strategically manage risk while aiming for substantial returns.

Growth stocks are typically at the forefront of innovation and can capitalise on new trends and consumer habits, leading to substantial profits and consequently share price growth.

Dividend stocks, meanwhile, have less capital gains potential. But they are are often less volatile, and can provide a steady return across all points of the economic cycle.

With this in mind, here are two of my favourite US stocks from each category.

Growth

Dell Technologies (NYSE:DELL) has been providing computer hardware and software for 40 years. And now it is looking to artificial intelligence (AI) to take sales to the next level.

To capture this, it is investing vast sums to provide full-stack AI solutions covering the fields of client devices, servers, storage, data protection, and networking.

As part of this drive, it recently launched Dell Factory with Nvidia, which uses the latter’s technologies to provide bespoke or full-fat products and services to speed up company adoption of AI.

It is also providing servers for xAI’s planned supercomputer, according to the startup’s founder, Elon Musk.

I like Dell shares because of their cheapness compared with many other AI stocks. It trades on a forward price-to-earnings (P/E) ratio of around 16 times, even after recent gains. This compares favourably with most other tech stocks (Nvidia, for instance, trades on a multiple of 43.4 times).

It’s early days, so predicting the eventual winner(s) of the AI wars is a tough task. But the ambitious steps Dell is making may make it one of the sector’s leading lights.

Dividends

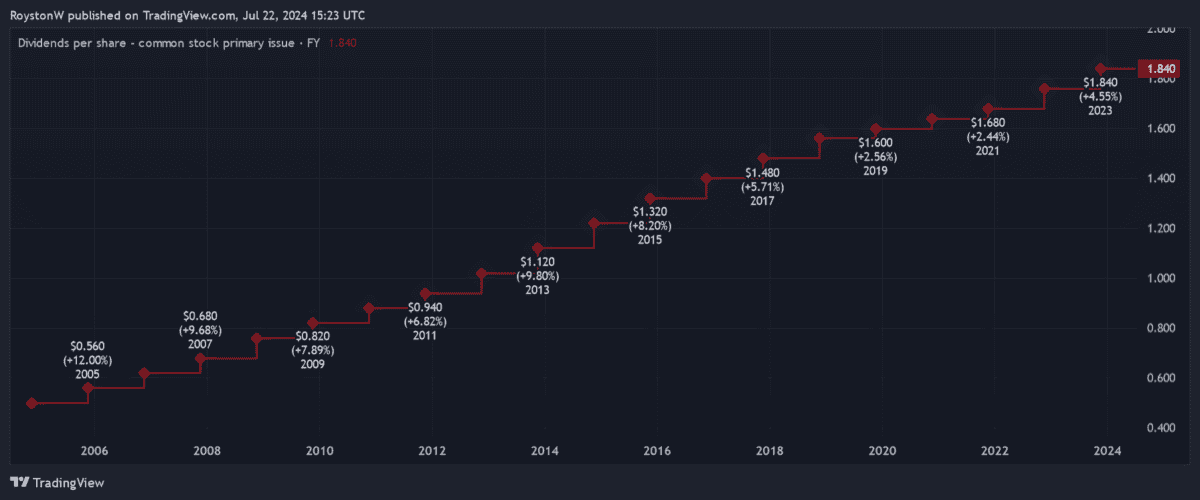

Drinks giant The Coca-Cola Company (NYSE:KO) is one of the world’s true Dividend Aristocrats. Shareholder payouts here have risen every year for a staggering 62 years.

This is thanks to the exceptional brand power of Coke and its many other soft drinks labels. They stay in high demand at all points of the economic cycle. Even during tough times, prices on these goods can be hiked to help the company offset costs and grow earnings.

Intense competition across all its categories is a threat. However, the huge investment Coca-Cola makes in marketing and product innovation means it currently remains one step ahead of the pack.

This year it launched Coca-Cola Spiced in the US and Canada to exploit surging consumer demand for spicier food and drinks.

City analysts expect dividends here to continue rising all the way through to 2026 at least. It means for this year the firm carries a healthy 3% dividend yield, supported by an expected 14% earnings rise.

And for 2025 and 2026, the yield on Coca-Cola shares moves to 3.1% and 3.3% respectively. All three forward yields beat the S&P 500 average of 1.3% by a healthy distance.