UK shares, as measured by the performance of the FTSE 100, continue to lag behind most of their peers. For example, since July 2023, the Footsie’s risen by 10.9%, a long way behind the Nasdaq (29.4%), Nikkei 225 (27.2%) and S&P500 (23.8%).

But I reckon this could soon change.

1. Cashing out

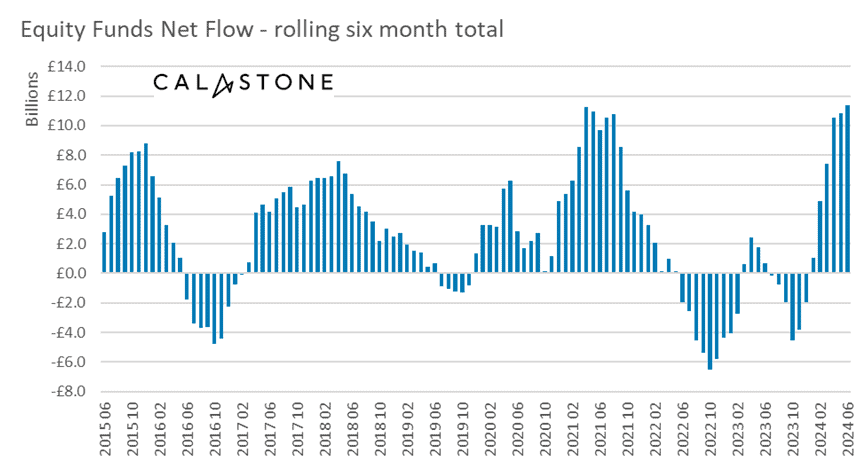

The first reason for my optimism is the flow of funds into UK investment accounts.

As the chart below shows, there has been a net cash inflow during each of the past six months.

And due to the impact of inflation, I believe it’s unlikely that savvy investors will leave these funds as cash for very long.

2. Cheap as chips?

According to St. James’s Place, UK companies have historically traded at a 15%-25% discount compared to their American counterparts. The disparity now stands at 45%-50%.

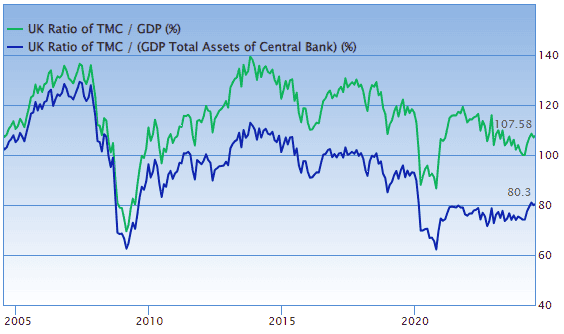

Based on history, the UK market also looks cheap. A bit like the price-to-earnings (P/E) ratio for individual stocks, Warren Buffett believes that comparing the market cap of a country’s stock market with its gross domestic product is “the best single measure of where valuations stand at any given moment“.

As the chart below shows, the so-called Buffett Indicator hasn’t been this low since the pandemic. And it hasn’t been this low for so long, for over two decades.

In addition, Jason Hollands of Evelyn Partners claims the FTSE 100 currently trades on a multiple of 10.3 times forward earnings. This compares to a historical average of 14.

3. Falling interest rates

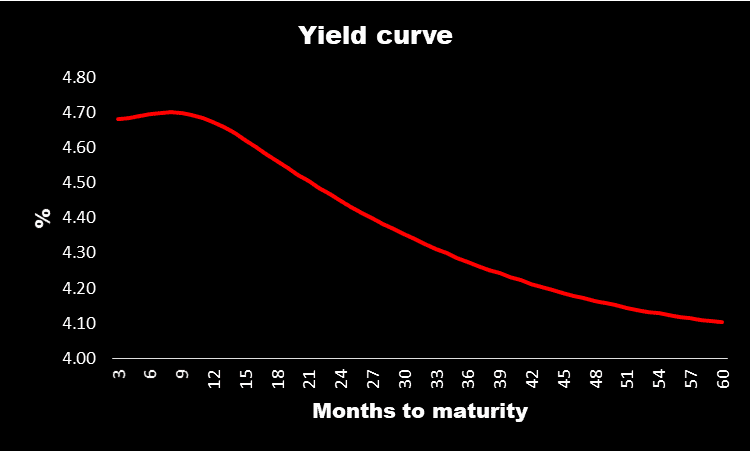

My final reason to be hopeful is the expectation that interest rates will soon start to fall.

The best indicator of this is the yield curve which plots the return currently available on government bonds.

Not only does a lower cost of borrowing create a ‘feelgood’ factor, it also means less is earned on cash deposits. Investors are therefore incentivised to switch from cash to other assets, such as shares.

The real thing

If I’m right, then the FTSE 100 will soon start to move upwards. And there’s one stock that history suggests will closely match the performance of the index.

Coca-Cola HBC (LSE:CCH) has a beta value of 0.93. This means if the market moves by 1%, it will — on average — fluctuate by 0.93%. It’s the Footsie stock that most closely matches movements in the index as a whole.

The company bottles and sells Coca-Cola — and many other brands — in 28 countries in Europe and Africa.

But it’s not the same stock that Warren Buffett has owned since 1988 — The Coca-Cola Company manages the brand globally.

However, the British stock appears to offer better value. It has a forward P/E ratio of 14.9 compared to 21.9 for its American cousin.

I’d have to do some more research before deciding whether to take a position. The stock could be vulnerable to a wider economic downturn or a switch by consumers to other drinks containing less sugar.

But having the exclusive rights to sell the world’s most valuable soft drinks brand in nearly 30 markets, sounds like a great business model to me — the first three months of 2024 have seen organic revenue growth of 12.6%.

And history suggests that if I’m right about UK shares hitting a purple patch soon then Coca-Cola HBC should have a good run too.