I’ve been scouring the London stock market for passive income stocks to buy. On my wishlist are companies with huge near-term dividend yields, and the capacity to pay a decent and growing dividend over time.

I’ve also been looking for shares that offer all-round value for money. And I think I’ve found two exceptional stocks that are worth serious consideration today.

These are Alternative Income REIT (LSE:AIRE) and M&G (LSE:MNG). Here’s why I’d buy them if I had spare cash to invest.

A top REIT

Investing in property stocks can be particularly effective for passive income. The regular contracted rents they receive typically allows them to pay a stable dividend to their investors.

Real estate investment trusts (REITs) can be especially lucrative for income chasers. In return for tax perks, these firms must pay at least 90% of annual rental income to their shareholders.

Alternative Income REIT is one such company on my radar today. While some trusts invest in specific sectors, this one spreads its capital across a variety, including leisure, retail, healthcare and residential.

This provides profits — and by extension, dividends — with extra stability, as the business is more able to weather temporary difficulties in one or two sectors.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

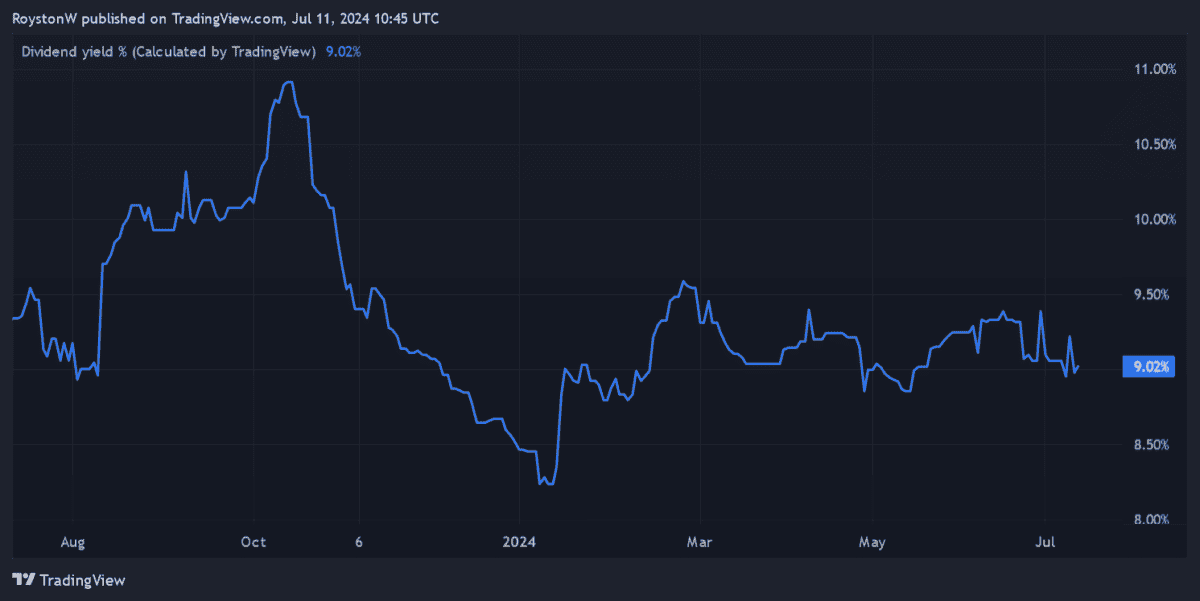

I believe Alternative Income looks especially attractive at today’s price. At 68p, its dividend yield stands at a magnificent 9%.

The trust also trades at a 14.3% discount to the value of its assets right now, according to Hargreaves Lansdown estimates. Its net asset value (NAV) per share is put at 80p.

High interest rates are putting pressure on the REIT’s asset values. This remains a threat but, on balance, I think it’s a top cheap income stock.

A FTSE bargain

As I say, FTSE 100-quoted M&G’s another UK share offering stunning all-round value today.

Firstly, it trades on a forward price-to-earnings growth (PEG) ratio of 0.2. Any reading below 1 implies a stock is undervalued relative to near-term profit forecasts.

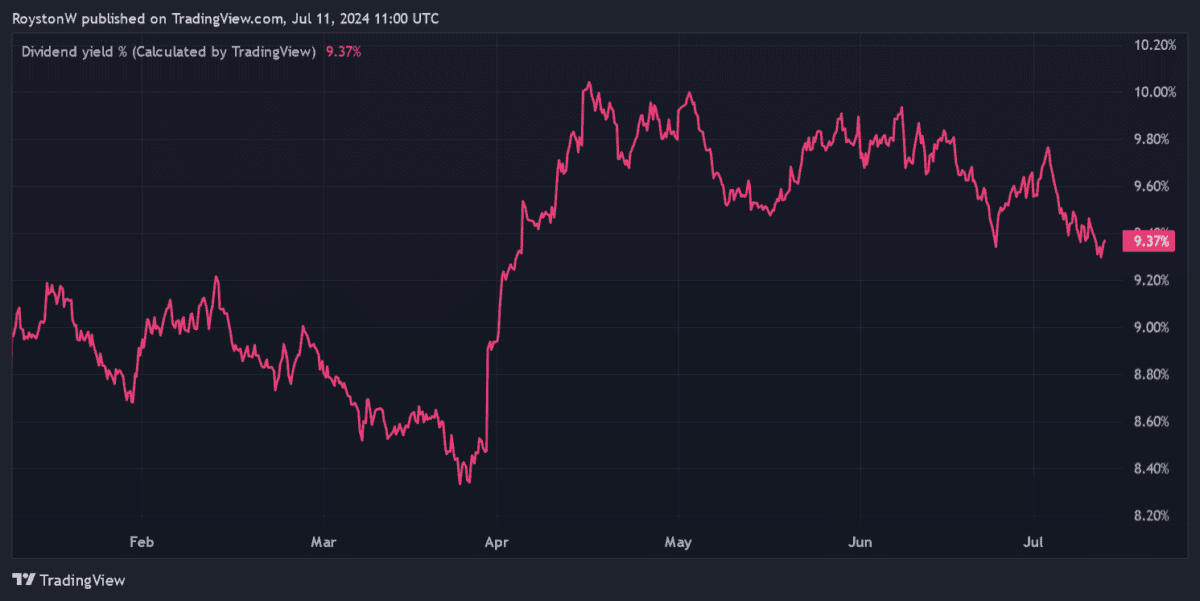

Its dividend yield meanwhile, stands at a staggering 9.4%. If the City’s payout estimates are accurate, M&G stands to be one of the top three best dividend payers on the Footsie index this year.

The financial services giant looks set to meet this year’s dividend forecasts too, given the cash-rich state of its balance sheet. Its Solvency II coverage ratio continues to improve and rose to 203% at the close of 2023.

Today, M&G serves around 5m customers. And as the older population grows it should have significant scope to also grow this number. Intensifying fears over the future of the State Pension alone could drive demand for savings and investment products through the roof.

However, I’m concerned about the ultra-competitive nature of the financial services market. This could compromise profit margins and M&G’s ability to increase its customer base.

But, on balance, I think the FTSE 100 firm remains highly attractive, and especially at today’s prices.