Nvidia (NASDAQ: NVDA) stock has risen more than 32 times in value in just five years. To put that in context, the firm’s market cap was about $100bn half a decade ago. Now, it’s over $3.3trn!

Would I buy this surging stock today with a spare five grand knocking about? Here’s my take.

The future is here

Nvidia is at the very heart of the artificial intelligence (AI) revolution, which most experts reckon will change everything in the coming decades.

To quote Jensen Huang, the firm’s founder and CEO: “Twenty years ago, all of this [AI] was science fiction. Ten years ago, it was a dream. Today, we are living it.”

All this reminds me of The Singularity Is Near, a 2005 book by futurist and Google AI researcher Ray Kurzweil. In this, he said that exponential improvements in computing power would lead to a tech revolution that would utterly transform humanity.

Now, nearly 20 years later, his prediction that computers would reach human-level intelligence by 2029 doesn’t seem so wacky. However the singularity, where AI becomes so advanced that it surpasses human intelligence and self-improves to create brand new technologies, is apparently still two decades away.

I’ve just started reading Kurzweil’s new book, The Singularity Is Nearer: When We Merge with AI. In this, he predicts that human intelligence will expand a millionfold by 2045 through the merging of brains with computers!

The future is pricey

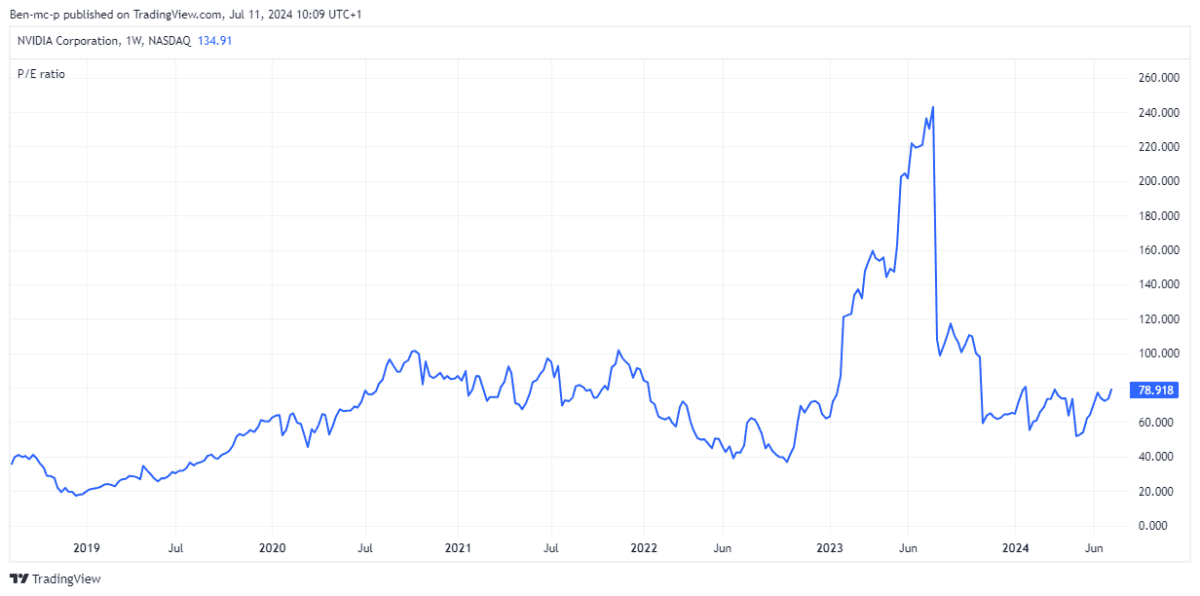

Anyway, pulling our heads out of the clouds, let’s take a look at Nvidia stock as it stands today. It’s trading on a price-to-earnings (P/E) ratio of 79. Five years ago, it was trading on a P/E multiple of around 30.

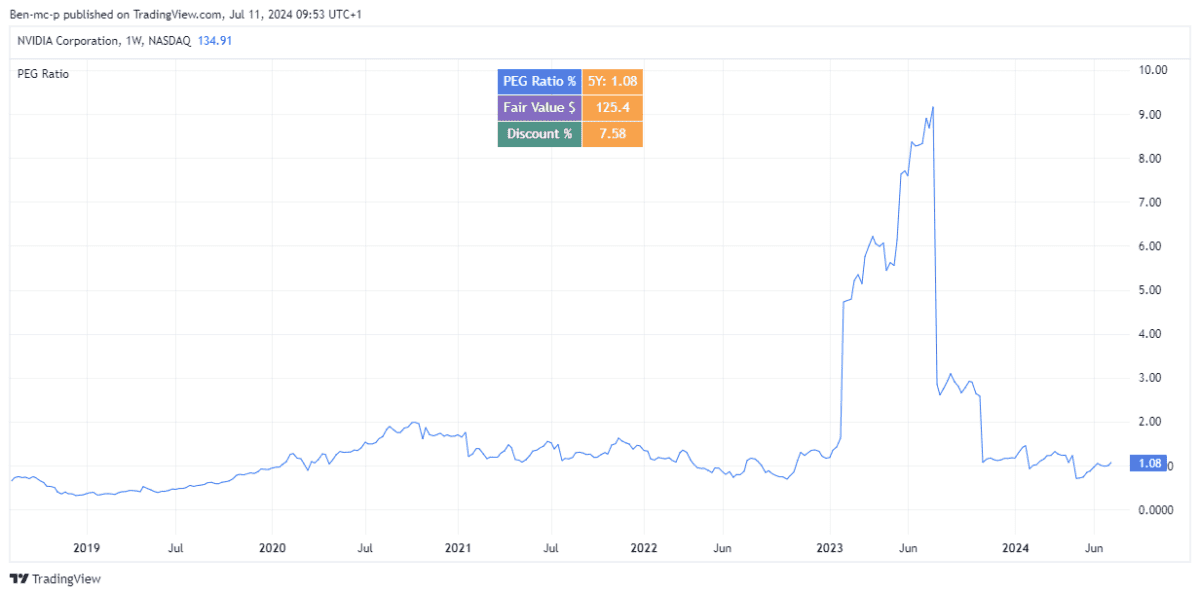

On this basis, the stock looks overvalued. However, the company is projected to grow earnings by around 30% over the next few years. So we could also consider the price-to-earnings-to-growth (PEG) ratio.

This is a valuation metric that compares the P/E multiple to the forecast earnings growth rate. A PEG ratio of 1 suggests fair value. Currently, the stock is slightly above this (1.08).

Causing headaches

So extraordinary has been the performance of Nvidia that a lot of fund managers not holding the stock have been struggling to outperform indexes that do.

One is Terry Smith, star manager of the £25bn Fundsmith Equity portfolio. In the six months to the end of June, the fund returned a very healthy 9.3%. The problem was that the S&P 500 index in sterling terms returned 17% over the same period. And 25% of that return came from Nvidia alone!

In his semi-annual letter to shareholders, Smith said his fund did not “own any Nvidia as we have yet to convince ourselves that its outlook is as predictable as we seek.”

Would I invest £5k?

I agree. Whether demand for Nvidia’s AI chips will be more or less in five years’ time is anyone’s guess. Hardly any firms are making money from AI applications and viable business models are yet to emerge. Things are still in flux.

That’s why I sold my holding in March. And while that now seems ill-timed with the stock rising another 45.9% since (not that I’m counting!) I don’t regret my decision.

For me, there are safer AI-related stocks to buy today.