A passive income is one that can be generated with little to no activity on our part. And in my opinion, there are very few better ways to achieve this than investing in stocks, bonds, and funds.

In fact, I believe it’s the very best way. Like most things in life, if we want a good outcome, we need to be patient and we need to make the smart decisions.

Thankfully, it’s never been easier to make the right moves, with a world of education at our fingertips.

How should I invest £500 a month?

Investing £500 a month can significantly grow my wealth over time. And the larger my portfolio, the easier it is to generate a life-changing passive income.

First, I’ll consider spreading my investments. One way to do this is by investing in diversified index funds or ETFs, which offer broad market exposure and lower risk.

As I’m still relatively young, I allocate a portion to high-growth stocks for potential substantial returns, balancing this with more stable ETFs, bonds and mature, dividend-paying stocks.

But when investing for the long run, consistency is key. Regularly investing even modest amounts can harness the power of compounding.

The results can be outstanding

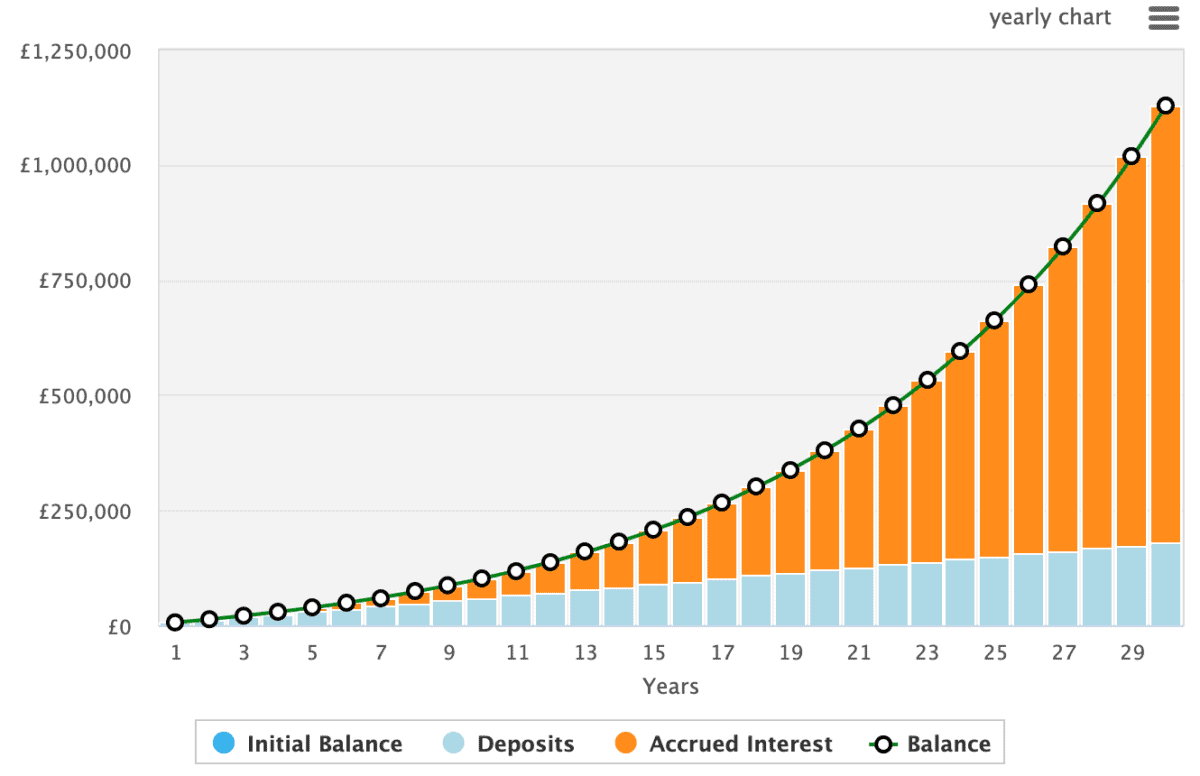

The below chart highlights how £500 a month can grow into a £1.13m portfolio over 30 years. In this case, I’ve assumed an annualised return of 10%. That might sound farfetched for some novice investors and it’s not guaranteed. In fact, I could lose money as well as make it. But it’s achievable with a well-guided investment approach.

Now, with a portfolio worth over £1.1m, I could generate around £70,000 in passive income. That’s assuming the kind of dividend yields I can get today are around in 30 years.

An investment worth consideration

Many had their fingers burnt when they invested in Scottish Mortgage Investment Trust (LSE:SMT) during the pandemic.

The growth-focused trust surged during the global health crisis and its share price actually exceeded its net asset value (NAV). Predictably, it came down with a crash.

I think some investors are a little wary of the fund, but that shouldn’t be the case. Over the last 10 years, the share price has grown with a CAGR of 15%.

In other words, £1,000 in 2014 would be worth around £4,500 today.

One concern is that many of the fund’s investments are in unlisted companies. These companies don’t tend to publish much information about their earnings. Therefore, it can be challenging to make up your own idea as to whether its a good investment for the fund.

However, Scottish Mortgage does have an excellent track record of picking the next big winner. And through its diversity of holdings, it provides me with access to some of the most exciting companies around the world, including SpaceX and Nvidia.