Perusing the FTSE 250, one dividend stock in particular stands out to me for its eye-popping yield. That’s NextEnergy Solar Fund (LSE: NESF), which has a huge 10.7% yield.

Often, such a high figure would be a red flag, suggesting that the payout may not be sustainable and that investors are pricing in a sizeable dividend cut.

However, this renewable energy fund recently raised its payout for the 11th consecutive year. And the future still looks very bright, despite a big drop in the share price over the past few years.

Should you invest £1,000 in Barratt Developments right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barratt Developments made the list?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

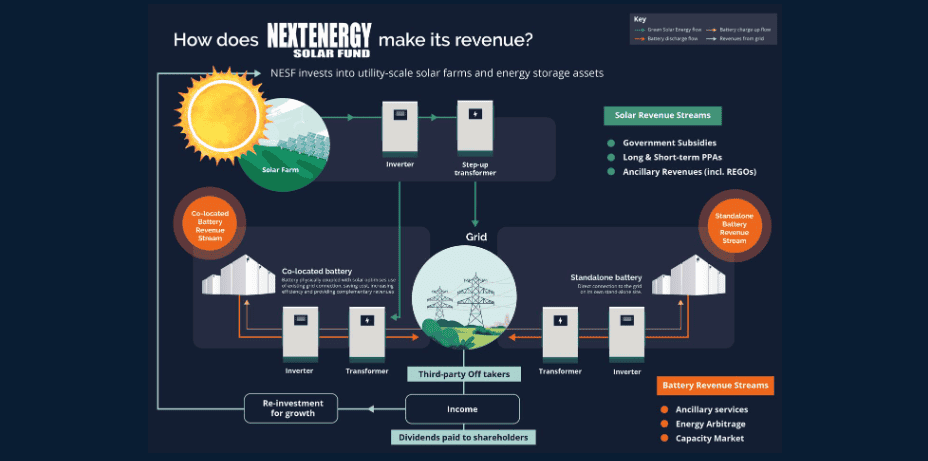

How it generates revenue

NextEnergy Solar is a specialist investor in solar assets and energy storage. At the end of March, its portfolio had 103 operating assets, enough to power the equivalent of 301,000 homes for one year.

A significant portion of the fund’s revenues comes from government-backed subsidies and power purchase agreements (PPAs). These are often indexed to inflation. This means that as inflation rises, the payments it receives also increase, providing a natural hedge.

The UK’s target is for 70GW of solar capacity by 2035. This fund’s portfolio has already reached 1GW of installed capacity! So it’s a big and important player in the space.

Why is the share price in the doldrums?

As we can see in the chart above, the share price has fallen from 126p at the start of 2020 to just 78p today. The chief culprit for this is higher interest rates. They’ve impacted the entire renewables sector by increasing the cost of financing for both existing and new debt.

At the end of March, the company’s financial debt was £338m. Of this, 32% was on a floating rate (not fixed), so the high-rate environment is an ongoing risk here.

To reduce debt, the company has embarked on a capital recycling programme. It recently sold a 35.2MW solar farm in Lincoln for £27m. This transaction represented a 14% premium to the March holding value, which is very encouraging to see.

Proceeds from this will be used to reduce the company’s debt. Three other assets are still up for sale.

Massive discount

Higher rates also tend to negatively impact the value of assets, including solar farms. Currently, the fund is trading at a whopping 26% discount to net asset value (NAV).

The board thinks this discount is unjustified and has approved a share buyback programme of up to £20m to try and narrow it.

Chairwoman Helen Mahy said: “NextEnergy Solar Fund continues to maintain a strong financial platform in a challenging environment… [We] view the current size of the company’s discount to NAV as unjustified.”

Big passive income potential

I agree and think that when the Bank of England starts to cut interest rates, the share price could be set for a nice rebound. Longer term, I remain bullish on the clean energy sector and this fund in particular.

Meanwhile, there is that massive 10.7% dividend yield. At the current price, I’d need to buy 11,987 shares to aim for £1,000 in annual passive income. This would set me back £9,350.

While no payout is guaranteed, I reckon the chance to lock in such high-yield passive income is well worth the risk here. So I’m looking to buy this stock myself.