Looking for ways to make a huge passive income for retirement? Here are three tips that could make a spectacular difference to long-term returns.

Cut costs

The first task is to pick a financial product that reduces trading costs and expenses as much as possible. One of the most effective ways is to choose a tax-efficient Stocks and Shares ISA, or Self-Invested Personal Pension (SIPP).

Tax is one of the biggest expenses we face in life. Pleasingly, these products exclude investors from paying any tax on either capital gains or dividends, which can add up to a huge amount over time.

Investors should also choose a broker that offers low transaction costs and management fees. Selecting a low-cost product can provide another handy boost to long term returns. And competition’s fierce among providers, so shop around!

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Prioritise blue-chip stocks

Investors love the idea of finding the next Apple, Amazon, or other stock market minnows that could become a global phenomenon. Buying small growth shares has certainly been a recipe for success for many stock pickers.

However, a portfolio packed of small-cap companies like penny stocks is also extremely high risk. Not only can their share prices be extremely volatile, over the long term, a great number of smaller equities provide disappointing returns due to tough competition, industry pressures, and/or economic stress.

This is why focusing on stable, blue-chip companies is usually the most successful (and stress free) route for investors. Businesses on the FTSE 100 and FTSE 250 are often market-leading companies with diverse revenue streams, competitive advantages (or economic moats), and robust balance sheets.

Largely speaking, these sorts of companies don’t deliver spectacular share price growth. But they do provide a solid and reliable return over the long term.

Diversify

The next important thing to do is to spread capital across a wide range of companies. This helps shield investors from sector, economic, or even stock-specific shocks that can damage eventual returns.

Share pickers can build their own diversified portfolio by buying individual shares. They can also open a position in an exchange-traded fund (ETF) which holds a variety of different assets. I own both individual shares and ETFs in my portfolio.

The Vanguard FTSE 250 UCITS ETF (LSE:VMID) is one such fund that could help me effectively diversify my holdings and build long-term wealth if I had some spare cash.

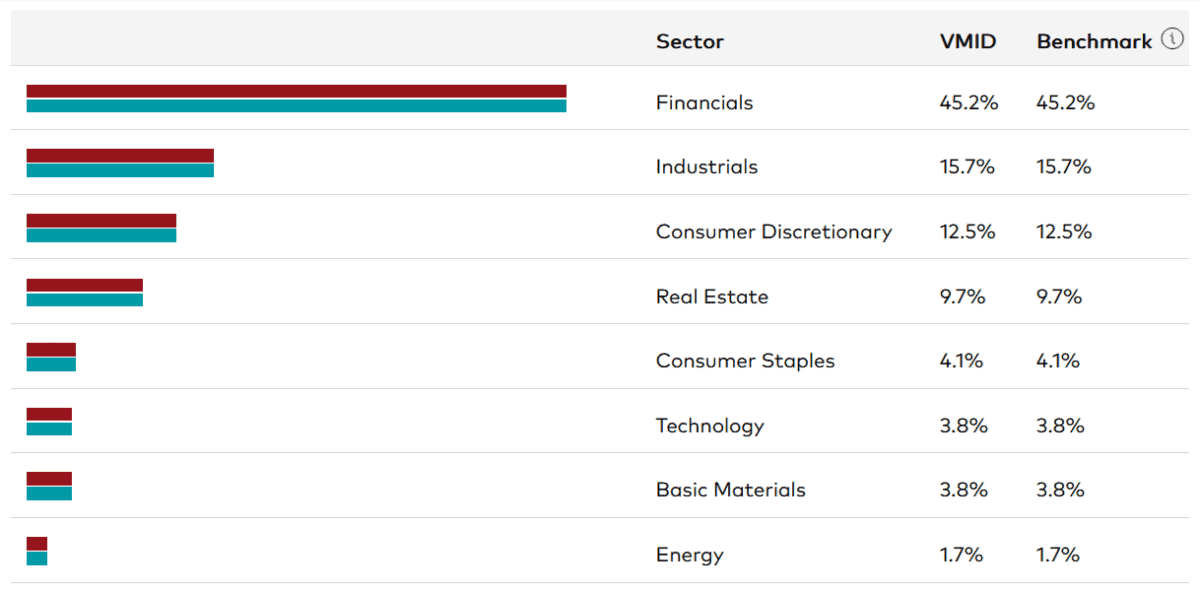

As the name suggests, it uses the FTSE 250 as a benchmark and has holdings in each and every blue-chip company on the index. So it gives me exposure to a multitude of different sectors, a taster of which can be seen below.

And while the fund has a high gearing towards the UK, many of the companies it holds also operate abroad, giving me decent geographic diversification.

The downside however, is that economic or political turbulence in Britain can spell trouble for FTSE 250 funds like this. But over the long term, investing in such shares can be a lucrative strategy.

The FTSE 250 has delivered an average annual return of 11% since its inception in 1992. If this continues, a £20,000 investment starting today would give me £923,521 after 35 years. This could then turn into a £36,941 passive income if I drew 4% down each year.