The right dividend share can provide passive income streams over the long term. But there are a lot of different companies to choose from, even in the FTSE 100. Dividends are never guaranteed, so as an investor it pays to do some careful research before choosing what shares to buy and hold.

Vodafone, for example, is currently the highest-yielding dividend share in the FTSE 100. It has a whopping yield of 10.7%. But Vodafone proves the point that dividends are never guaranteed. Having held its payout per share flat for years, it now plans to halve it.

That could mean that the highest-yielding share in the FTSE 100 will be the company that currently has the biggest yield after Vodafone. That is financial services giant Phoenix (LSE: PHNX), with a yield at the moment of 10%.

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

I have been eyeing Phoenix for my portfolio – could it possibly be the best dividend share in the index?

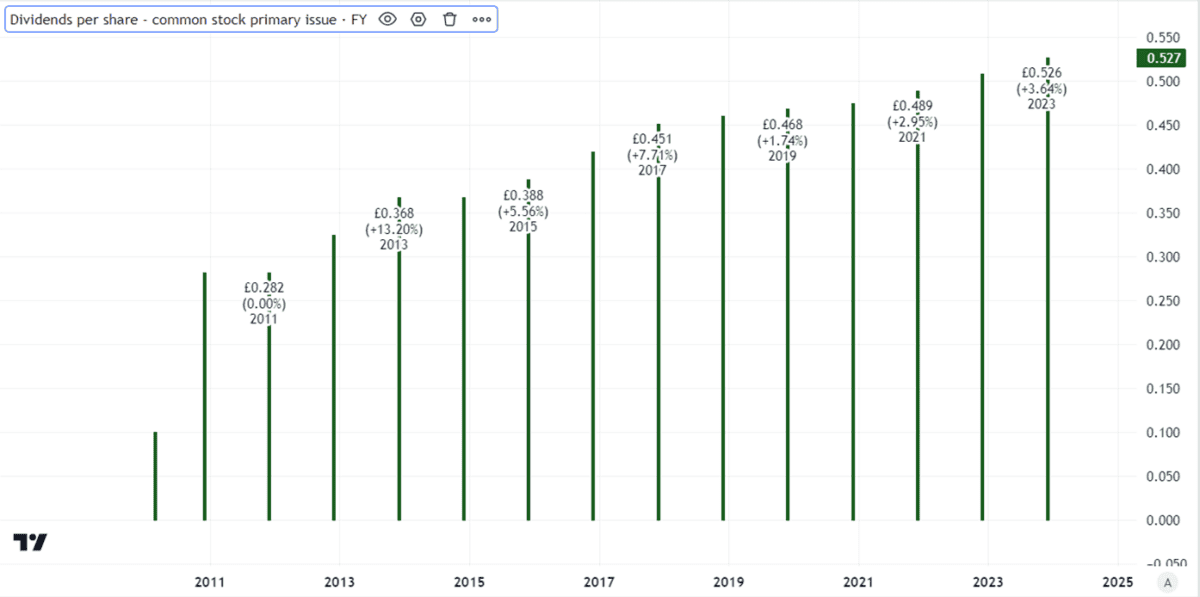

Track record of dividend growth

Past performance is not necessarily a guide to how a company will do in future. But looking at a dividend share’s track record can give some indication of the priority a management puts on its dividend (or not). Vodafone holding its payout flat for years looks in retrospect like the mark of a management that did not think it could justify increasing it.

By contrast, Phoenix has been steadily increasing its dividend for years.

Created using TradingView

This year the company announced what it called “a new progressive dividend policy”. It did not provide great detail on that, but a progressive dividend policy means growing the payout per share annually – something the likes of Diageo and Spirax have been doing for decades.

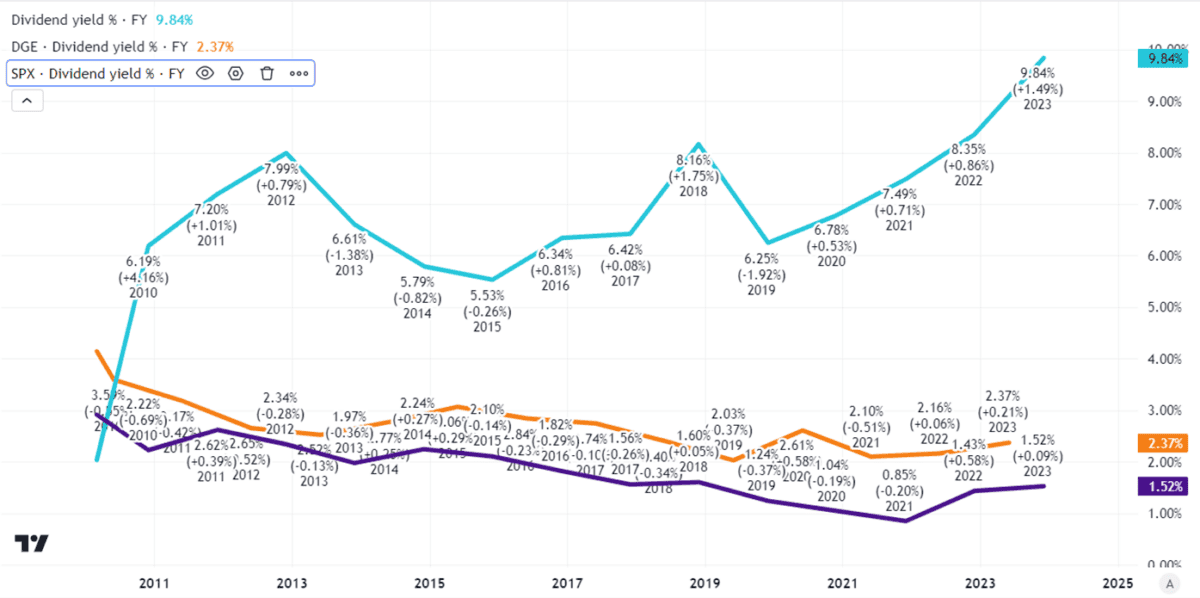

Phoenix’s track record is shorter, though its yield (shown in light blue below) is markedly higher than those two Dividend Aristocrats.

Created using TradingView

Phoenix added that it would, “continue to prioritise the sustainability of our dividend over the very long term. Future dividends and annual increases will continue to be subject to the discretion of the Board, following assessment of longer-term affordability”.

As a believer in long-term investing myself, I like that timeframe. Such a dividend policy simply states what is always the case: although the company aspires to growing the payout annually, whether it actually keeps doing so in practice will ultimately depend on whether it can afford to.

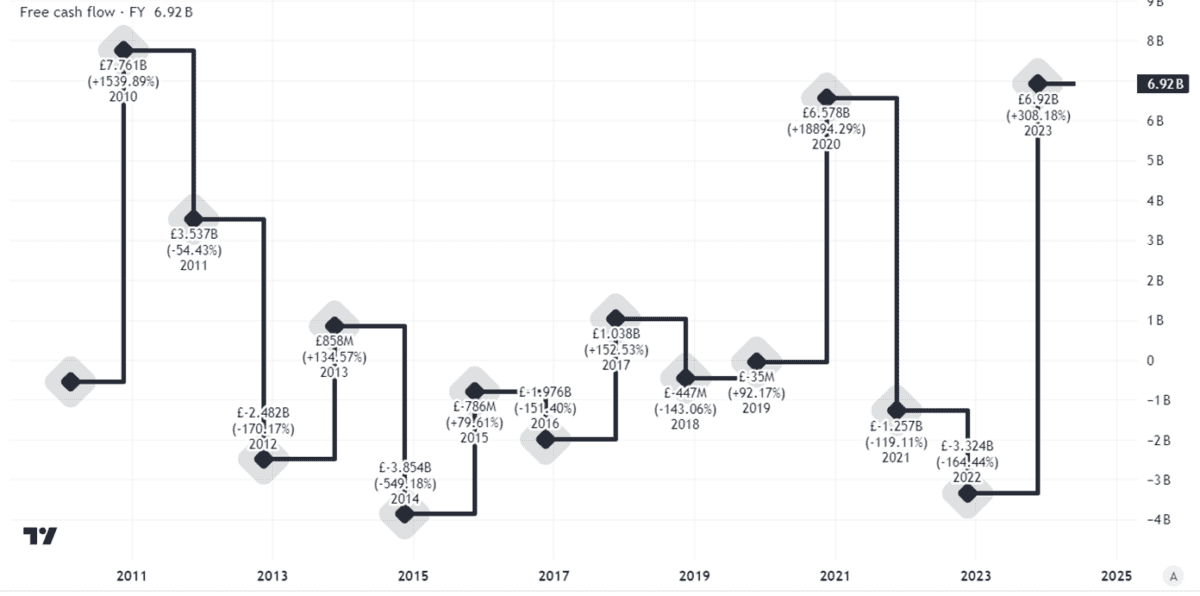

Covering the dividend

Paying dividends over the long run requires sufficient free cash flow.

Phoenix’s free cash flows have moved around significantly, as is common with financial services companies. I see that as an ongoing risk: policy holders cancelling their policies could hurt cash flows, for example. So could cash losses on mortgages in the event of a property crash.

Created using TradingView

But while its free cash flows are inconsistent and sometimes negative, when the company does well it generates a lot of free cash, as the chart above shows.

With a large customer base (it is the country’s largest long-term savings and retirement business) and strong operating brands I think Phoenix can continue to do well over the long term.

Set to have the highest yield in the FTSE 100 and with a risk to reward ratio I like, I reckon it might be the best dividend share in the index.

If I had spare cash to invest, I would be happy to add Phoenix to my portfolio today.