Making millions in the stock market might be more achievable than you think. Many Stocks and Shares ISA investors have built seven-figure balances since the tax-efficient product launched in 1999.

According to HM Revenue and Customs, there were 4,070 ISA millionaires as of April 2021. The data, which followed a freedom of information (FOI) request by Openwork Partnership, also showed that the top 50 ISA investors had an average balance of £8.5m.

Making a fortune on the stock market isn’t easy. Just a fraction of ISA investors have managed to make a magic million. But this study by interactive investor could show me what I must do to get a place on millionaire’s row.

The rich list

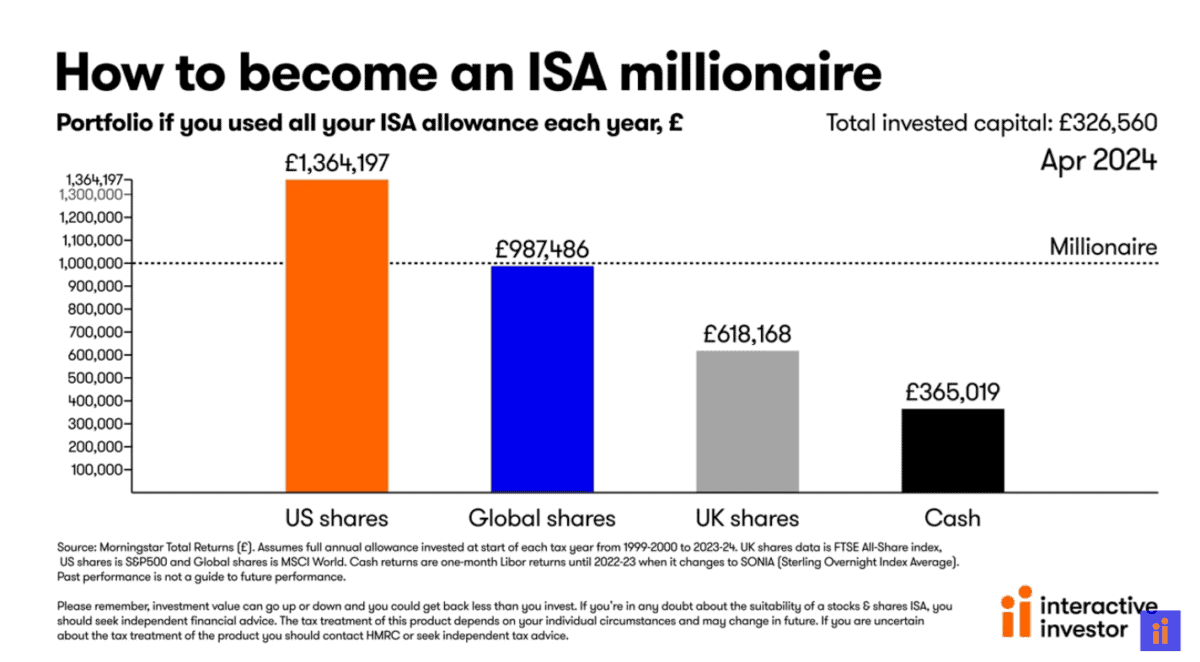

Analysts at the brokerage have crunched the numbers on the returns ISA investors would have made between April 1999 and April 2024 across four asset classes:

- US shares

- Global stocks

- UK shares

- Cash

The model assumes that investors would have maxed out their annual allowance every year and excludes the impact of trading fees. Here are the results:

US shares lead the way

As you can see, those who bought US shares would have been the biggest gainers over the past 25 years, achieving an ISA pot above £1.3m.

Next would be investors who bought global shares, building a nest egg just shy of a million. UK share investors come in third place with a final sum of £618,168.

ISA investors who just held their money in cash would have been the worst performers. They’d have made a profit of less than £40,000 on a total investment of £326,560.

So what happens next?

Of course, past performance is no guarantee of future returns. The stunning ascent of US shares could grind to a halt if the country’s Big Tech giants run out of steam.

Cheap UK shares, on the other hand, could experience a renaissance following years of underperformance.

None of us have a crystal ball. But interactive investor’s data shows that a diversified portfolio across many regions can boost our chances of striking it rich.

Here’s what I’m doing

I’ve recently decided to take a more global outlook with my own investment strategy. I continue to hold a large portfolio of UK shares, but I’ve also built positions in several exchange-traded funds (ETFs).

One of these is the Xtrackers MSCI World Momentum UCITS ETF (LSE:XDEM). This fund tracks the performance of shares that have enjoyed impressive price gains over the preceding six to 12 months.

I love this ETF because it offers substantial exposure to top US shares. With around 66% of its capital invested in Wall Street heavyweights, including tech titans Nvidia, Microsoft, and Amazon, it positions me well in the thriving US market.

As the name implies, this product also contains shares from other global indexes. Around 16% is invested in Japan, for instance, and a further 7% in eurozone stocks.

With a total of 344 stock holdings, this ETF provides me with solid protection through diversification across multiple countries and sectors.

Its international approach leaves the fund vulnerable to exchange rate fluctuations. Still, over the long term, I’m optimistic it will help me retire comfortably. It may even help me to make that million.