Building a large portfolio doesn’t have to break the bank. Indeed, investing £1,000 a month can result in a portfolio worth £1.16m after 30 years. That could generate a very sizeable second income.

The great news here is that this scenario assumes a 7% average annual return. That’s actually below the long-term total return from the FTSE 100 and significantly less than the average returns of the S&P 500.

Here’s how I’d go about trying to reach a £100k+ passive income portfolio.

Get the ball rolling

A no-brainer starting point would be to set up a Stocks and Shares ISA. This would literally open up a world of investing possibilities because most ISA providers today allow international dealing.

The benefit here is that it would give my portfolio diversification, allowing me to buy US stocks as well as those listed in London. My own portfolio today is split about 50/50 between US and UK shares.

Even better, an ISA allows me to invest £20k a year and pay no tax on any capital returns or dividends. That’s why I use the term no-brainer.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Which stocks to buy?

Here, I’m going to highlight a FTSE 100 stock I’ve currently got on my buy list. It often flies under the radar despite growing earnings impressively for years. It’s Coca-Cola HBC (LSE: CCH).

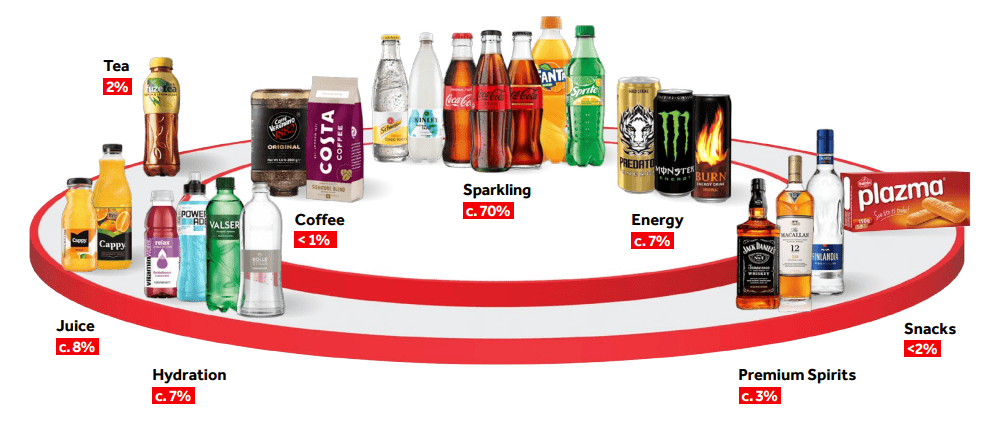

This Switzerland-based company has the exclusive rights to bottle and distribute products from The Coca-Cola Company in 29 countries across Europe, Asia, and Africa. The HBC bit at the end stands for Hellenic Bottling Company, hinting at its roots in Greece in the 1960s.

The firm buys core concentrates, syrups and bases from the US soft drinks giant. These are the formulas that give Coca-Cola, Sprite, and Fanta their specific tastes. Meanwhile, Coca-Cola retains a significant ownership stake in the company.

In 2023, net sales revenue increased 10.7% year on year to €10.2bn, representing the third straight year of double-digit growth. Net profit was €637m and brokers see this rising to €864m in 2026.

The dividend was raised by 19% and its five-year compound annual growth rate is 10.3%. The forward-looking dividend yield today is 3.1%, which I find attractive given its long-term growth potential.

Naturally, an economic downturn is a risk here, as this could lead to weaker demand for soft drinks, especially in the tourist hotspots it operates in (Italy, Greece, Switzerland, and so on).

That said, Coke sales tend to hold up pretty well even during downturns. Trading at 14 times forward earnings for 2024, I think the stock offers tremendous value.

Passive income

As mentioned, such stocks achieving a 7% annual return could help me build a £1.16m portfolio in 30 years.

However, I think it’s realistic to aim for an average return of 9%. This isn’t guaranteed and there will be tricky periods along the way, including perhaps the odd major crash. But pound cost averaging (investing regularly so sometimes I buy when prices are high, sometimes when they’re low) would help smooth out these ups and downs.

Assuming this 9% return (which, of course, isn’t guaranteed and could be much lower), my hypothetical £12,000 compounding at this higher rate over three decades would become £1.7m, excluding any brokerage fees. Lovely.

At this point, I could choose to invest in dividend-paying stocks yielding an average 6%, giving me a potential yearly passive income stream of £102,000.