The Halma (LSE:HLMA) share price has gone from £6.08 in June 2014 to £23.50 today. That makes it one of the best-performing FTSE 100 stocks of the last decade.

With any business, it’s important to keep up with its trading updates. But it’s especially important for companies like Halma.

Valuation risk

The share price is up 289% over the last 10 years. Never mind the FTSE 100 – that’s enough to outperform the likes of Berkshire Hathaway.

Investors should note where the increase has come from though. Earnings per share have increased by 121%, but the rest is due to an expanding price-to-earnings (P/E) ratio.

Halma shares now trade at a P/E ratio of 37, compared to 22 a decade ago. That’s enough to make a certain kind of value investor feel uncomfortable, and they might have a point.

The biggest risk with the stock is the possibility of the P/E ratio contracting if earnings growth slows. That’s why it’s important to pay attention to the company’s trading updates.

Full-year results

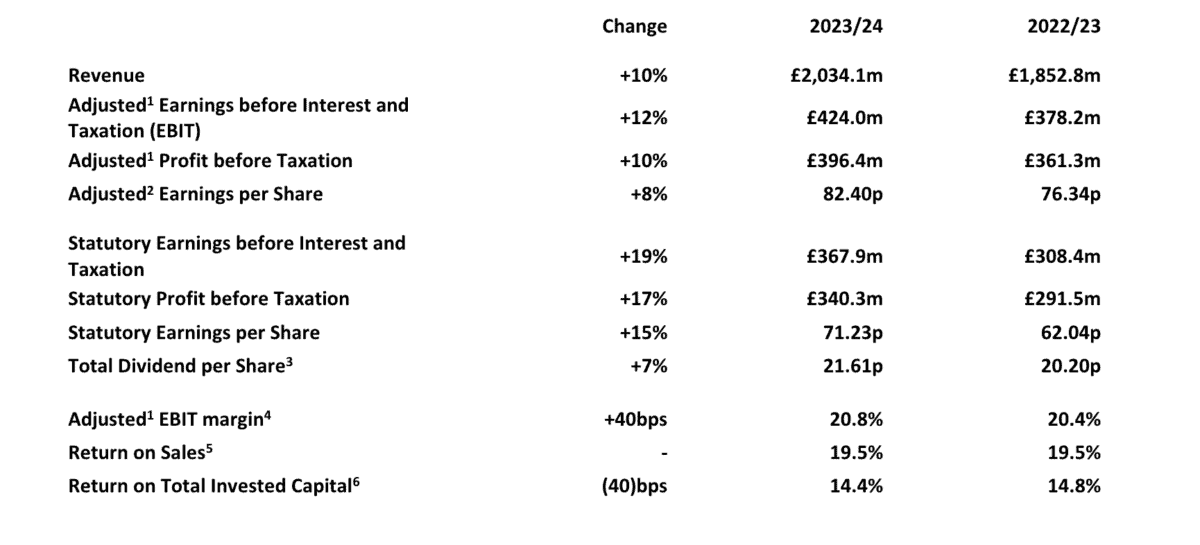

Over the last 12 months, Halma’s revenues reached record levels after growing 10%. This was driven by a mixture of acquisitions and organic growth.

Halma FY 2023-24 Financial Performance

Source: Halma Investor Relations

When businesses grow through acquisitions there can be a risk of overpaying. But there doesn’t seem to be an imminent danger of this with Halma.

The company made eight acquisitions, but returns on invested capital remained steady – at 14.4% compared to 14.8% the year before. That indicates the firm is investing at good rates.

In addition to record revenues, pre-tax profits (+10%) and earnings per share (+8%) also reached new highs. And management indicated there might be more to come.

Outlook

Acquisitions are the engine that drives Halma’s growth and management stated that there’s more to come here too. That’s important for investors, given the high P/E ratio the stock trades at.

In addition to a healthy pipeline of opportunities, the company has already completed one deal for £44m since the end of the year. That’s quite significant.

Halma’s eight acquisitions in 2023-24 cost around £292m in total – or £36.5m on average. A £44m deal to start the new financial year is a sign that growth could be set to continue.

The company is also expecting organic revenue growth and margins to be strong in the year ahead. Overall, things look positive for the business.

Should I buy Halma shares?

I think it’s not controversial to say that Halma is a terrific business with outstanding management. The only question for investors is whether it’s worth buying at a P/E ratio of 37.

The company boosted its dividend by 7%, but I wouldn’t buy it for short-term passive income. For long-term wealth creation though, I think it could be a terrific investment to consider.