Banking can be a very profitable line to be in. Take Lloyds (LSE: LLOY) as an example. Last year, the black horse bank reported post-tax profits of £5.5bn. It delivered a second consecutive year of double-digit percentage growth. The Lloyds dividend yield is 5%.

That is above the average of the bank’s FTSE 100 peers, although below some other well-known shares. Natwest yields 5.5%, for example, while HSBC is on 7.1%. In fact, HSBC has risen 143% since September 2020, so if I had had the foresight to buy its shares then, I would now be earning a dividend yield of around 17% on my investment!

I already own Natwest shares. Could the Lloyds dividend outlook convince me to add the shares to my ISA?

Should you invest £1,000 in Apple right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Apple made the list?

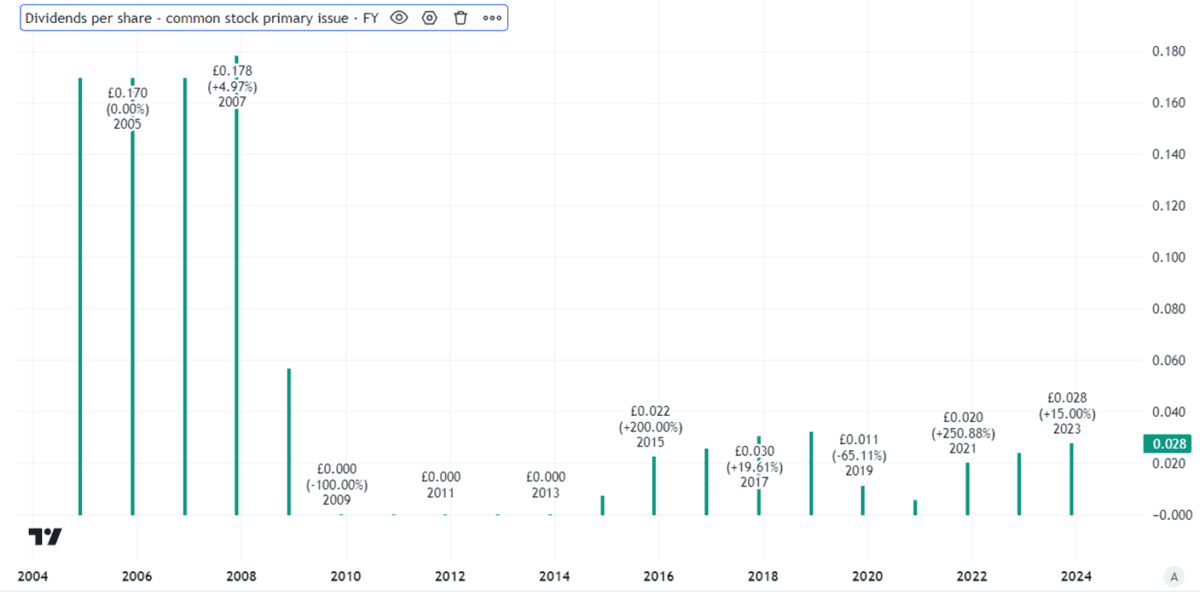

Uneven dividend history

As dividends are never guaranteed, knowing what has happened in the past is not necessarily a useful guide to what may happen in future.

In 2020, for example, the Lloyds dividend was suddenly frozen, along with those of other British banks due to a regulatory requirement.

Still, the long-term history of the Lloyds dividend unsettles me.

Created using TradingView

The chart shows a couple of things that concern me.

One is the big drop in the Lloyds dividend after the last financial crisis. It has never got back to anything like it used to be (and neither has the share price, come to that).

Additionally, the dividend has not even reached its pre-pandemic level again.

That is despite the company’s mammoth profits and free cash flows large enough to launch a £2bn share buyback programme this year.

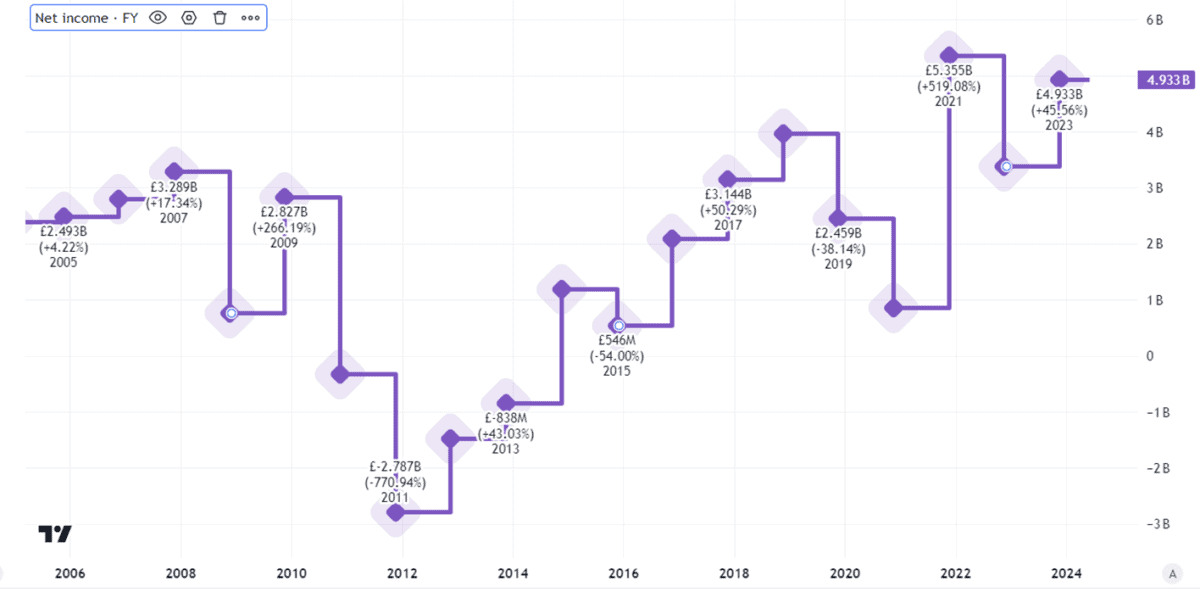

Created using TradingView

Strong assets, uncertain market

That makes me think that current management simply does not see the dividend as a very high priority. Indeed, that was one reason I sold my Lloyds shares last year. Yes, the dividend has increased sharply, but it has not got back to where it was in 2019 despite the bank being flush with cash.

Looking back to the financial crisis, my concern is that banking is a cyclical business. For now, Lloyds is doing well. It has a well-known brand, huge customer base, and the country’s largest mortgage book. Those are strengths when the property market is strong. If it tumbles, though, a large mortgage book could be a source of big losses, not profits.

British banks generally look in better financial shape now than they did going into the last financial crisis, due in part to more stringent liquidity requirements. Nonetheless, the risk of another property crash weighs on my mind as an investor.

I feel better rewarded for that risk owning bank shares with a higher yield than the dividend Lloyds offers me at its current share price.

That is why I plumped to dip my toe back into the banking waters by buying Natwest shares instead. I have no plans to buy Lloyds shares.