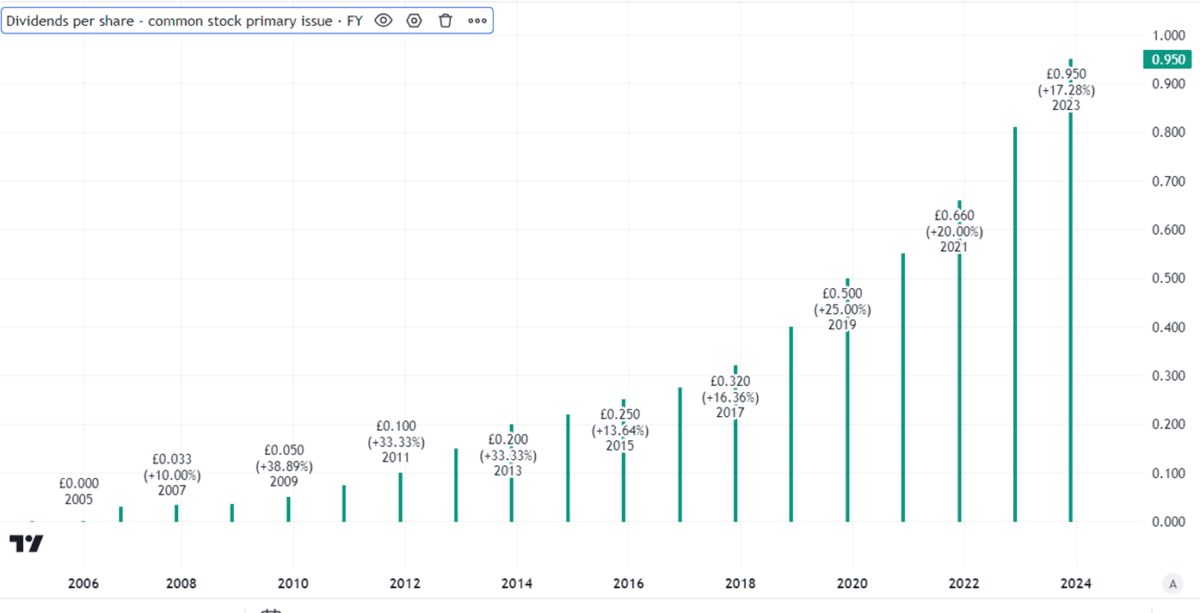

The business model of Judges Scientific (LSE: JDG) is simple yet successful. It buys up small and medium-sized specialist instrument makers, offers them the benefits of centralised support and largely lets them get on with what they do best. In some ways, it is reminiscent of the business model Warren Buffett uses at Berkshire Hathaway. But while Berkshire does not pay anything out to shareholders, the Judges Scientific dividend has been growing quickly.

Last year, it increased by 25%. That is only the latest in a series of double-digit percentage increases.

Created using TradingView

Should you invest £1,000 in Rentokil Initial Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rentokil Initial Plc made the list?

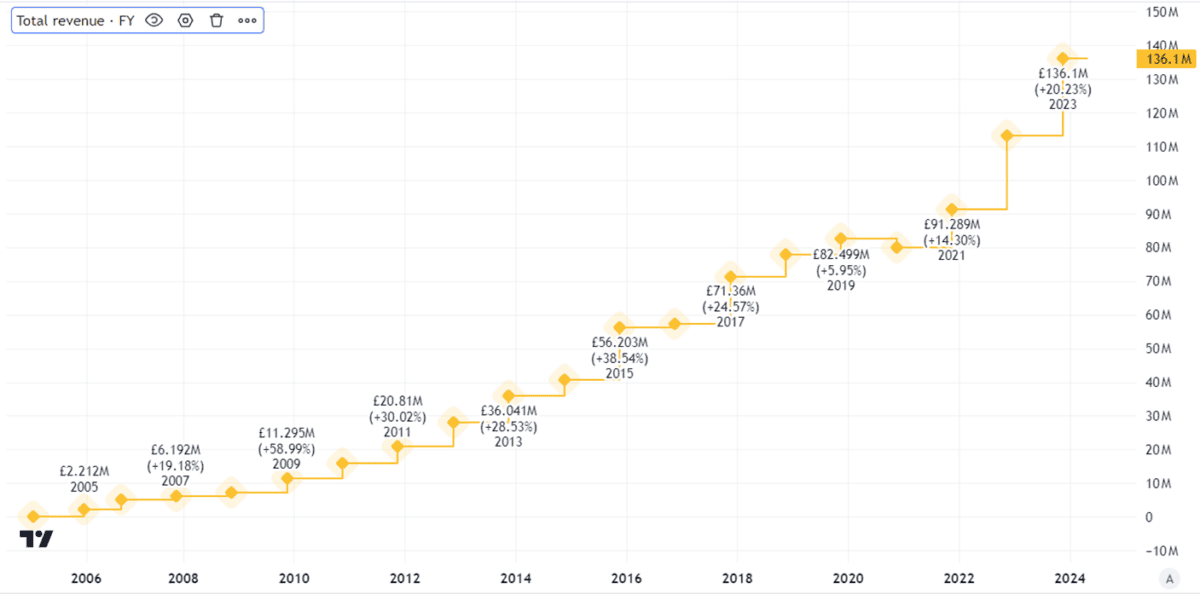

The future looks bright

I think Judges might only just be getting going. It has proven its business model and is now scaling it up. Its fast-growing revenues pay testament to this.

Created using TradingView

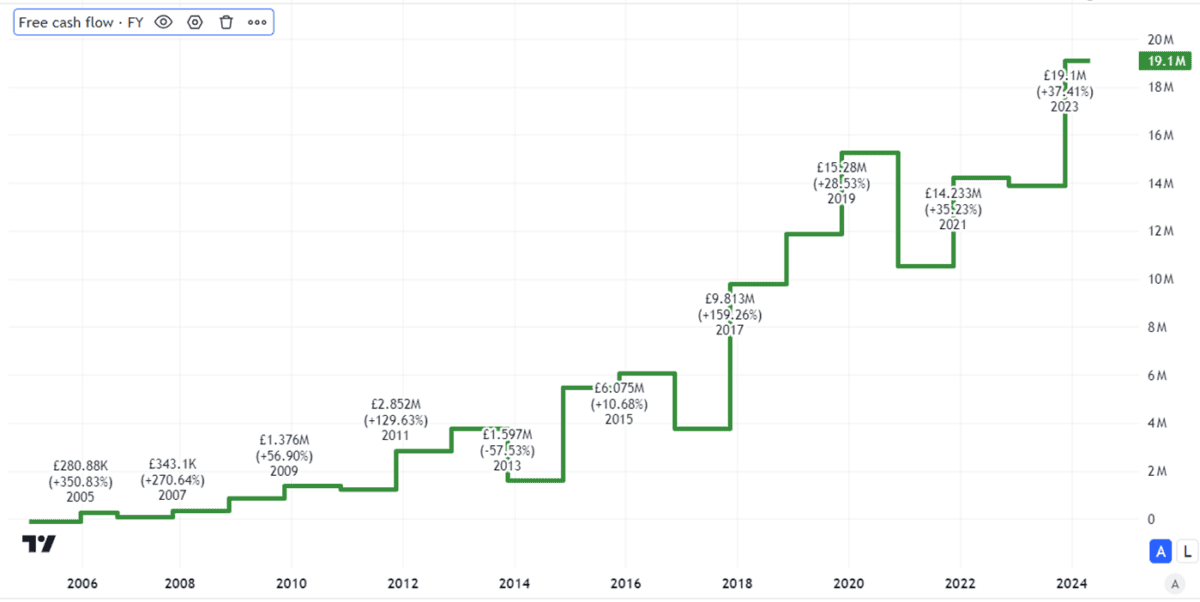

The company has also proven that it can grow profits, not just revenues.

That is important from an income perspective because ultimately to pay dividends, a company needs to be making money. Not only is Judges profitable, it is also cash generative. Free cash flows have been growing healthily.

Created using TradingView

Dividend could keep rising

I think that is good news when it comes to the Judges Scientific dividend. Already, it is well-covered. Indeed, last year the dividend was covered more than four times by earnings. That means that Judges has substantial scope to keep increasing the dividend at a good clip even if earnings are flat.

In fact, though, I expect earnings to grow over the long term. Judges can help acquired companies improve their sales organically, thanks to its wide customer base and marketing prowess. The company also continues to grow through acquisition. Last year saw organic revenue growth of 15% and the company acquired several firms.

The rate of increase may slow over time as the baseline gets bigger (although that remains to be seen). But I see no reason to expect the company to stop growing dividends.

It has the cash to do so and I think dividend growth has been a key part of the investment case for the company thus far. Changing that suddenly could hurt the share price.

Why I’m not buying

There are risks. They could prevent growth, or lead to the dividend falling.

One would be if the firm overstretches itself trying to fund larger acquisitions that do not turn out well. Another is the emergence of competitors aping Judges’ successful business model, making it harder for the business to find attractively priced acquisitions.

Still, I like the company and would happily own the shares. But I do not like the valuation at all.

The price-to-earnings ratio of 80 is way too high for my tastes. That high valuation has also served to depress the dividend yield. Despite a growing payout, the yield is just 0.8%.

So unless the valuation becomes more attractive, I will not be buying.