When it comes to investing, fantasy can be a costly mindset. That does not mean that pragmatic investing and fantasy worlds do not go together, though. Take Games Workshop (LSE: GAW) as an example. Games Workshop shares have been star performers over the long term, more than doubling in value over the past five years.

Specifically, they are up 124% during that period.

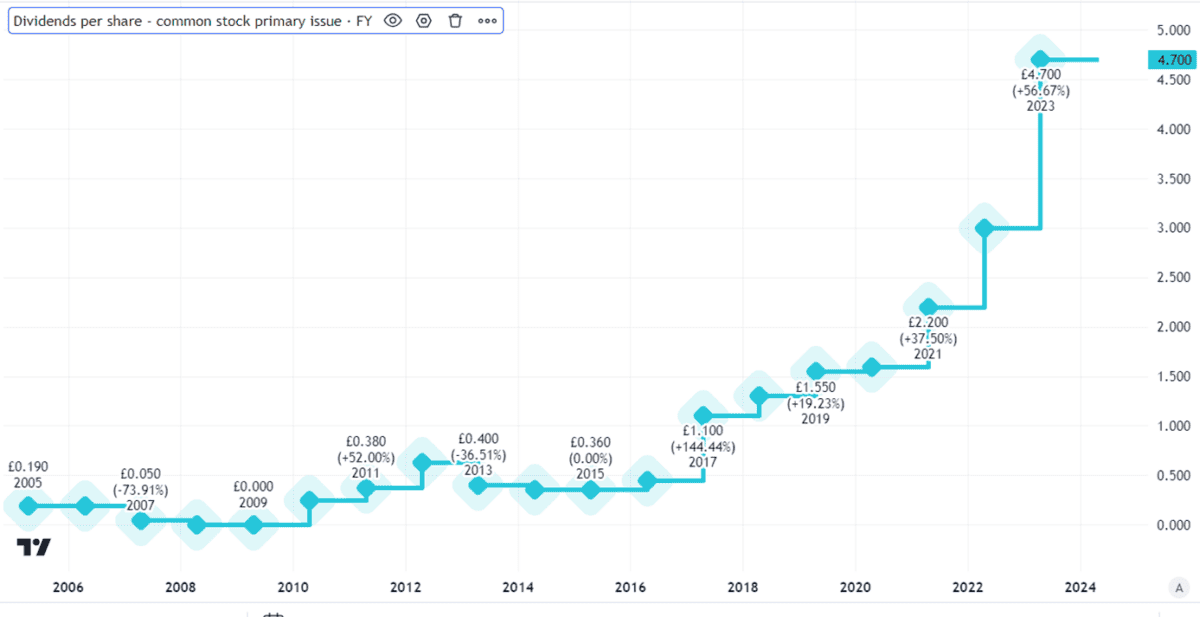

Not only that, but the FTSE 250 company has been a regular dividend payer, with as many as five dividends in some years. The current dividend yield is 3.3%.

Should you invest £1,000 in Aston Martin right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aston Martin made the list?

Created using TradingView

But while the dividends attract me, what excites me most about the idea of owning Games Workshop shares is the potential for further price gains. I think the shares could double in the coming decade.

Strong business model

That is an ambitious expectation. But I think Games Workshop has a great business model.

Many of its products are unique. By building fantasy universes, it can encourage customers to become more and more engaged in its products, likely meaning they become less price sensitive over time.

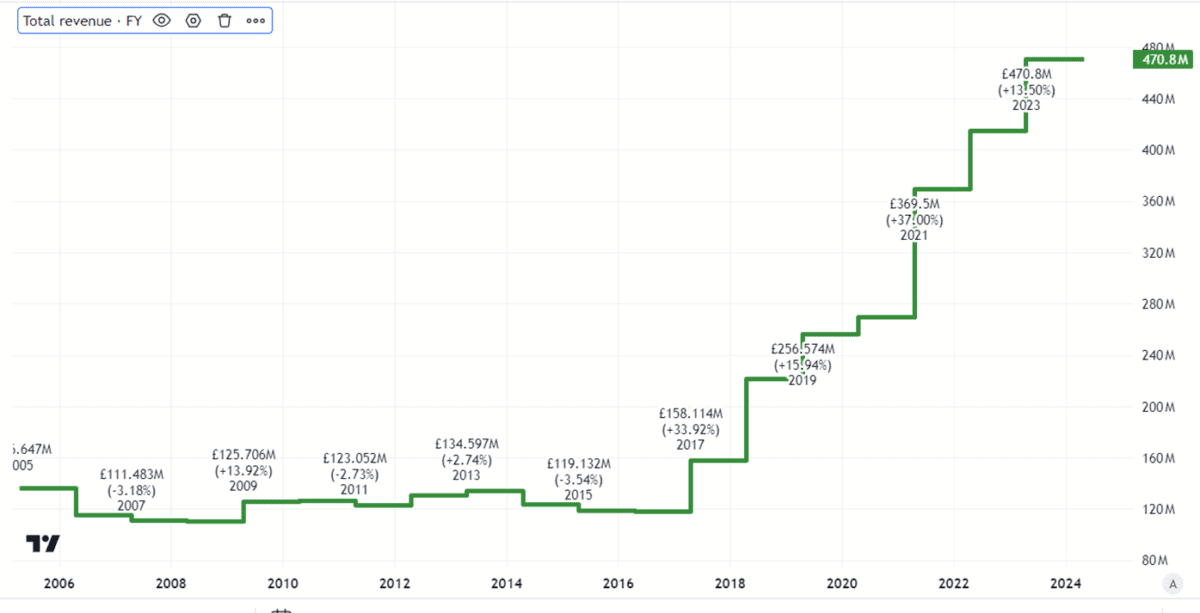

That is a formula for growing sales and profits. Look at how the company’s sales revenues have soared in recent years.

Created using TradingView

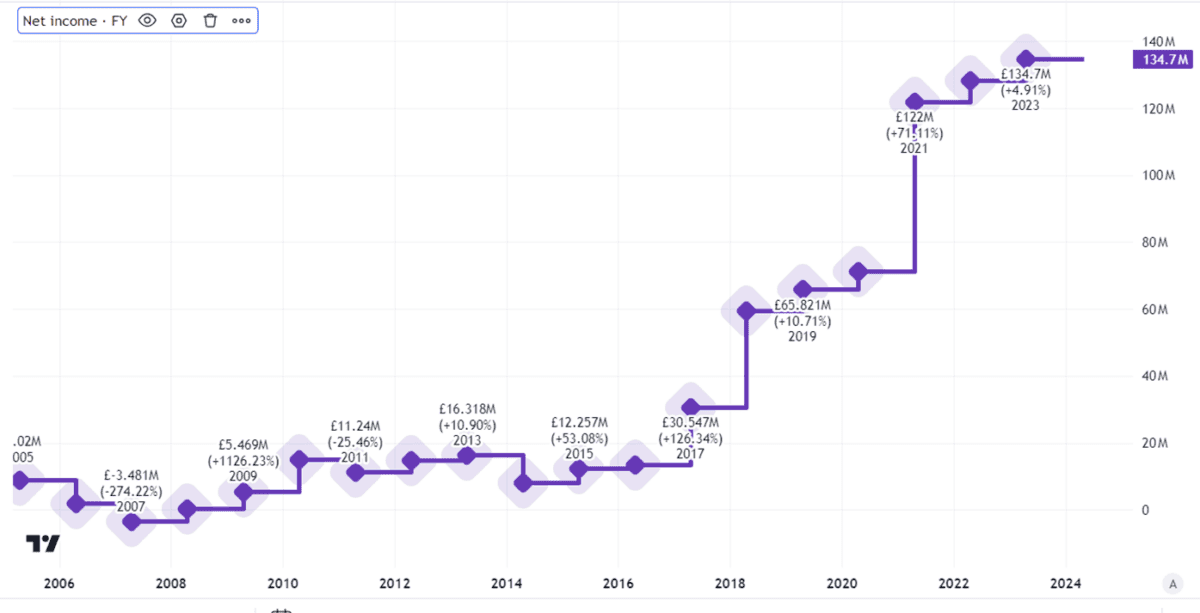

The bottom line growth has also been impressive. Net income has also jumped in recent years.

Created using TradingView

Something interesting about the profits is not just the growth trajectory but also the absolute amount. Last year, the company made post-tax profits of £135m on sales of £471m. That shows just how profitable the business model is, with a net profit margin of 29%.

Valuing the shares

The City is clearly alert to the possibilities here.

Games Workshop shares currently trade on a price-to-earnings ratio of 24. That is a bit pricier than I would like to pay and indeed is the reason I do not currently own Games Workshop shares. If they were cheap enough I would snap them up in a heartbeat.

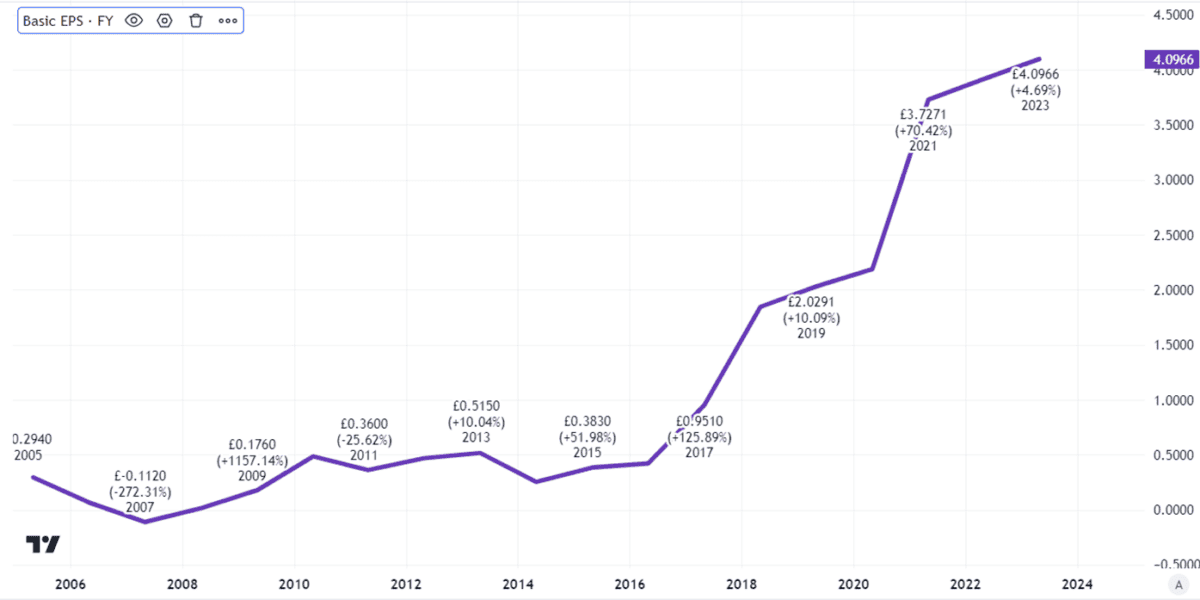

But that ratio is based on current earnings. Not only have total earnings grown handily at the company, so too have earnings per share.

Created using TradingView

If earnings per share keep growing, I expect the share price to do the same.

What would it take for them to double in the coming decade? In my opinion, basically just more of the same. Games Workshop has a proven business model that is humming along lucratively. I expect that to continue. New revenue streams like film licensing rights could add even more growth drivers for the business.

Will it happen?

Although the company is working with Amazon to bring its fantasy world to both big and small screen, it remains to be seen whether that will in fact be a money spinner.

Games Workshop’s concentrated manufacturing footprint could also be a risk if, for any reason, its main production site has to stop operating for a period.

But I think this proven business can run and run. If it successfully navigates hurdles along the way, I reckon Games Workshop shares could indeed double over the coming decade.