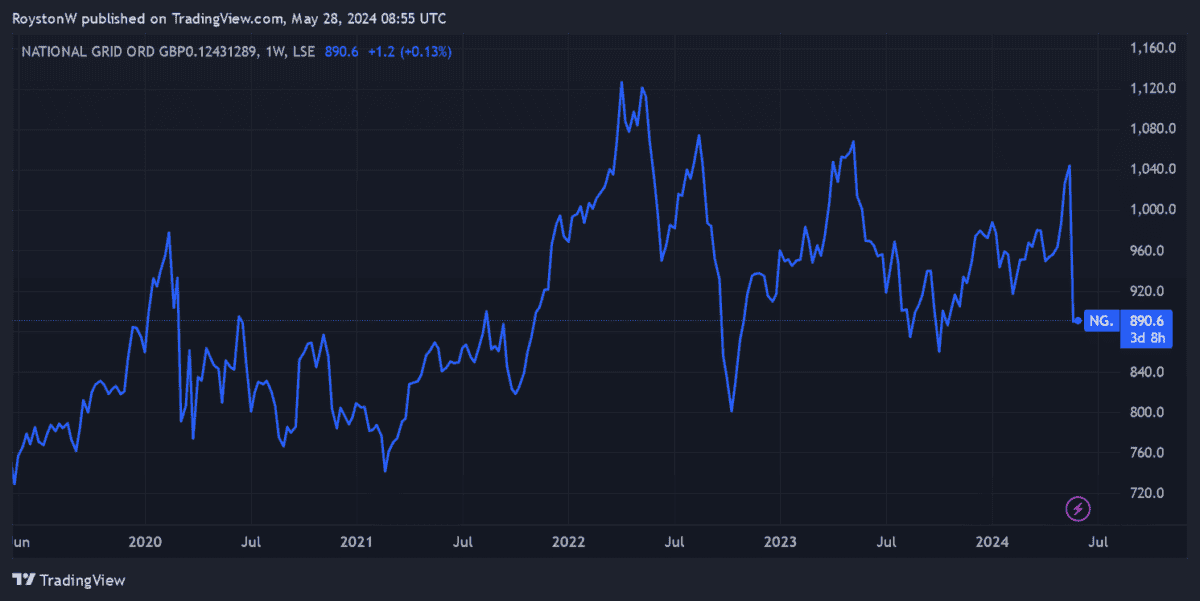

National Grid‘s (LSE:NG.) shares have been on a wild ride in recent days. News of a £7bn rights issue on Thursday (23 May) started a slump that continued in the run-up to the Bank Holiday weekend.

Demand for the FTSE 100 utility’s shares have stabilised today. Indeed, it’s currently the second-most purchased share among Hargreaves Lansdown investors, reflecting healthy interest from dip buyers.

I’m taking a close look at National Grid following its share price collapse. And I’m asking: is now the time to load up on this beaten-down blue chip?

Double whammy

National Grid is a victim of its reputation as a largely drama-free investment. This went up in flames last week following news of a £7bn rights issue that will increase the share count by roughly 29%.

Under the plans, existing shareholders will be able to buy seven shares for each 24 they already own. At 645p, these new shares will be made available at a significant discount to the company’s pre-update price.

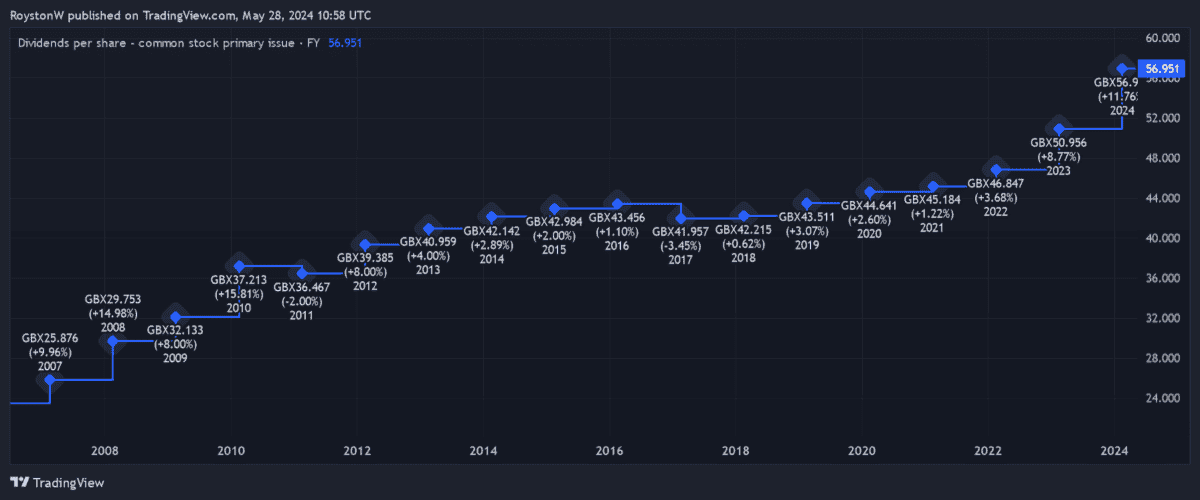

The placing will also have implications on the firm’s dividends, National Grid said. While vowing to continue its progressive payout policy, the dividend for last year (to March 2024) will be rebased to reflect the issuance of those new shares.

The placing will help the business attain higher growth in the coming years, it said. The business plans to spend £60bn on infrastructure through to financial 2029 to facilitate the energy transition in the UK and US.

Expensive business

Investing in the green transition is enormously expensive business, as the company’s new spending plans show. In fact, keeping the UK’s pylons, substations, and other critical hardware in working order is generally extremely costly.

This can have massive implications for annual earnings, and results in the business having high debt levels. It also raises the prospect of further share issuances later on down the line.

Looking long term

But National Grid also has enormous long-term earnings potential as the decarbonisation of the power grid rolls along. And this is highly attractive to me.

Under its 2024-2029 investment plan, the company intends to grow its asset base at a compound annual rate of 10%. It is confident that underlying earnings per share will rise between 6% and 8% annually as a result.

This could provide the bedrock for National Grid to continue paying a large and increasing dividend to its shareholders. The company already has a strong record of long-term dividend growth, as the chart below shows.

Here’s what I’m doing

National Grid’s new plans have increased execution risk and created uncertainty over near-term returns. However, they also have the potential to significantly boost shareholder returns during the next decade and beyond.

And today could be a good time for investors to buy into this story. It certainly offers attractive value for money following that aforementioned price slump.

National Grid’s forward price-to-earnings (P/E) ratio of 11.2 times is now well below its five-year average of 16.2 times.

At current prices of 885p, I think the utilities giant is worth serious consideration from value investors like me.