BT Group (LSE:BT-A) has been one of the FTSE 100‘s best performers in May. Yet on paper, it still looks like one of the index’s best value shares.

At 126.3p per share, the telecoms giant now trades on a forward price-to-earnings (P/E) ratio of 6.7 times. This is far below the Footsie average of 11 times.

Meanwhile, the prospective dividend yield on BT shares stands at 6.1%. This trumps the UK blue-chip average of 3.5% by a huge margin.

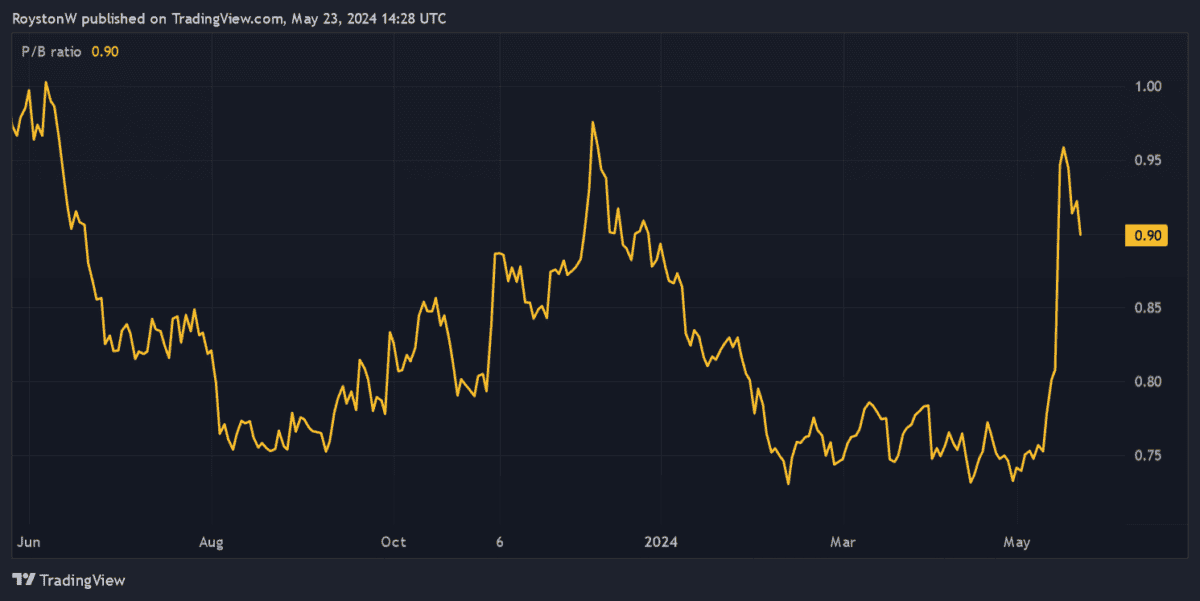

To crown things off, the firm’s price-to-book (P/B) ratio is currently 0.9. At below 1, this suggests the company trades at a discount to the value of its assets.

Mixed results

Of course, the FTSE 100’s made up of a variety of different shares spanning a variety of sectors.

Given current problems in the telecoms sector — from the pressures created by high interest rates and tough economic conditions, to large capex bills and regulatory uncertainty — it’s a good idea to compare how BT’s share price compares to that of its major industry peers.

| Company | Forward P/E ratio |

|---|---|

| BT Group | 6.7 times |

| Vodafone Group | 10.2 times |

| AT&T Inc | 7.9 times |

| Verizon Communications Inc | 8.6 times |

| Deutsche Telekom AG | 12 times |

| Orange SA | 13.5 times |

| Telefonica SA | 9.9 times |

As you can see from the table, the firm pleasingly offers industry-beating value relative to earnings. Its forward P/E ratio of below 7 times is beneath an average of 9.8 times for its peer group. It’s also the smallest among this cluster of shares.

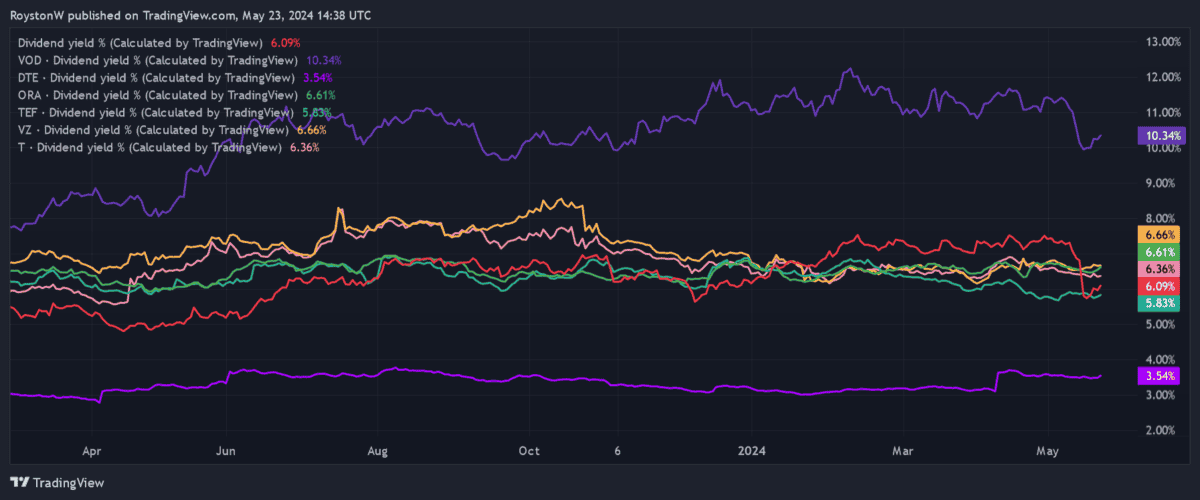

That said, BT’s shares don’t look as attractive from a value perspective when it comes to dividends. As the chart below shows, it has the fifth largest yield, behind (in descending order) Vodafone, Verizon, Orange and AT&T.

Having said that, the 6.1% forward dividend yield is pretty close to the 6.5% sector average.

The verdict

All things considered, I don’t believe BT shares provide attractive enough value for me to invest. Some shares carry low valuations based on their poor growth prospects and high risk profiles. It’s a description I think fits this FTSE 100 stock perfectly.

On the positive side, telecoms companies should receive a boost as our lives become increasingly digitalised. BT’s huge fibre-laying programme could put it in a strong position to capitalise on this opportunity too.

But as well as facing industry pressures, the firm’s focus on the weak UK economy leaves it in danger of underperforming its internationally focused peers. This certainly explains why it trades on a lower P/E ratio to those other companies I’ve mentioned.

Latest financials showed revenues rise just 1% in the 12 months to March. Profits also plummeted 31% due to a writedown in the value of the Business division.

With Britain facing a prolonged period of weak growth, there’s a good chance BT’s share price could remain under pressure. So while it looks cheap on paper, I’d much rather buy other FTSE 100 value stocks today.