High-quality growth stocks can help investors create significant wealth inside their Stocks and Shares ISA portfolios over time. Even more so when the gains are tax-free, as they are with ISAs.

Here are two British growth stocks I’d tuck away for the long haul right now.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A FTSE 250 stock

First up is Games Workshop (LSE: GAW). Known for its Warhammer franchise, the war games company isn’t your average retailer.

For starters, there is a surprising lack of cyclicality in the business. It grew sales both during the 2008 financial crisis and the 2020-21 pandemic (admittedly helped by people being stuck indoors).

In its most recent H1 results, CEO Kevin Rountree said: “We continue to perform well during challenging economic times, delivering record group revenue, profit and dividends in the period. Morale is good at Games Workshop and our hobbyists are having fun too.”

The company is a clear market leader in a very profitable niche. As such, it boasts extremely high margins and returns on capital.

In December, the firm finally inked a deal with Amazon to turn the Warhammer 40,000 universe into films and a television series. There are over 200m Amazon Prime members worldwide, so this exposure could attract a new legion of fans.

Of course, there’s a risk the content is poorly received. That could hurt the brand. But with Warhammer aficionado Henry Cavill set to produce and star, I’ve got high hopes.

If I didn’t already own Games Workshop shares, I’d snap some up today.

A FTSE 100 stock

JD Sports Fashion (LSE: JD) probably needs no introduction. The sportswear retailer has been knocking about on British high streets and inside shopping malls for many years now.

To be honest, if this was a firm flogging trainers and tracksuits just in the UK, I probably wouldn’t be interested in the stock. But with over 3,500 stores in 38 countries, this is a truly global business.

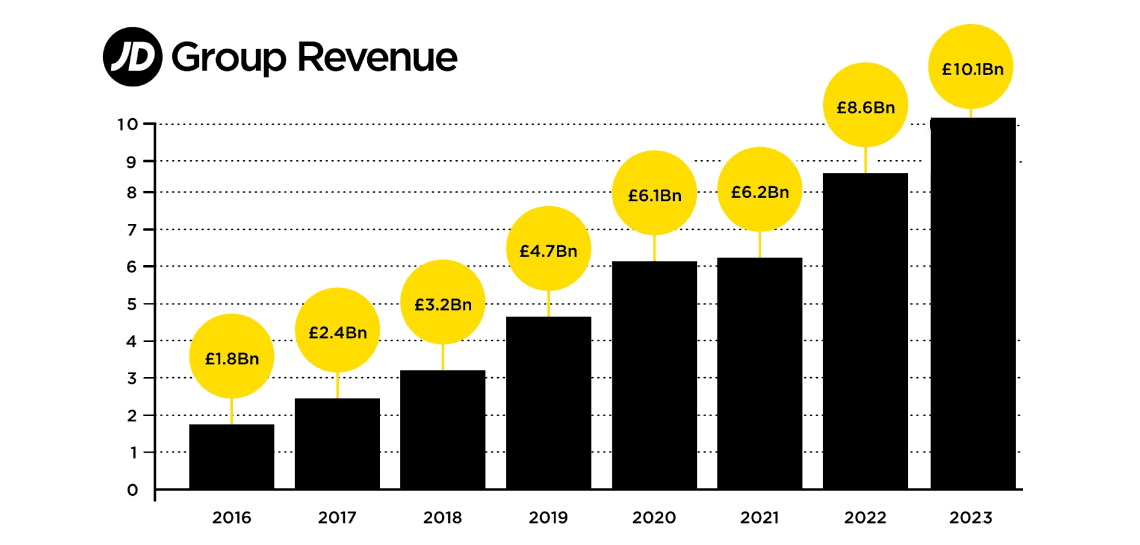

Not all of those stores are JD-branded, but collectively they contribute to a significant international presence. And revenue has grown rapidly over the past few years.

The firm was expecting to post £1bn in pre-tax profits in its last financial year (FY 2024). However, total sales came in at £10.5bn, up 3.6% on the previous year but lower than originally anticipated.

Full-year profits in the £915m-£935m range are now expected. The market wasn’t happy with this revision and the share price has fallen 23% year to date. More volatility could follow if sales weaken.

The good news is that the stock is very attractively valued right now. At 122p per share, it’s trading on a price-to-earnings (P/E) ratio of around 10.

For a growth stock, even one hitting a speed bump due to weak consumer spending, that is dirt cheap.

Plus, analysts still expect earnings to expand by around 29% in the next couple of years.

Meanwhile, the firm just splashed out $1.1bn to acquire US sportswear retailer Hibbett, which has over 1,000 stores across the pond. This strategically enhances JD’s presence in North America, the largest athleisure market in the world.

When we look back in a few years, I reckon JD shares could prove to a certified bargain at today’s price. I’m planning to add this stock to my ISA in June.