The FTSE 100 is home to many of the UK’s favourite shares. And with some of them seeing significant price falls in recent months, a number of stocks appear to be currently out of favour with investors. This could be an excellent opportunity for bargain hunters. Even so, there’s one that I wouldn’t want to own.

Ocado Group (LSE:OCDO) describes itself as “a global, technology business redefining ecommerce, fulfilment and logistics in online grocery and beyond”.

Personally, I think it’s a retailer. That’s because sales of groceries accounted for 85% of turnover during the year ended 3 December 2023 (FY23).

And I think this distinction is important.

Ocado’s own description encourages investors to view it as an innovative pioneer at the forefront of cutting-edge technology. Higher earnings multiples can then be justified.

And this strategy appears to be working. The company currently has a market cap of £3bn despite only recording three annual profits since it was formed. Also, its stock market valuation is twice that of its book (accounting) value.

An upbeat assessment

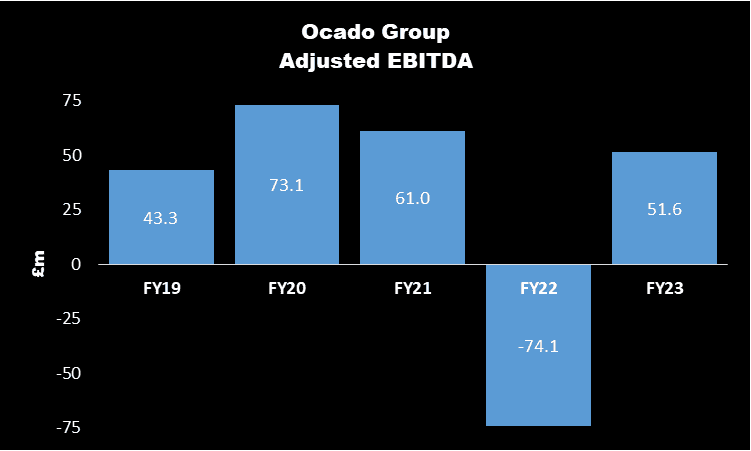

This positivity extends to the company’s 2023 annual report. On page two it talks of “financial progress” — in fact, the word ‘progress’ appears 109 times in the document — and growth in its adjusted EBITDA (earnings before interest, tax, depreciation, and amortisation).

Indeed, as the chart below shows, for FY23, EBITDA was positive after having been negative during the previous financial year.

A different story

But Ocado has spent heavily on its infrastructure and borrowed to fund much of this expenditure.

This means there’s lots of depreciation, amortisation, and interest in its accounts — the company has recorded a loss after tax for the past five years. Putting this financial measure alongside adjusted EBITDA paints a different picture (see below).

The consensus view of brokers is that the losses will fall over the next three financial years. But a post-tax profit appears to be several years away.

Not surprisingly, the poor results have taken their toll on the company’s share price. It’s fallen 70% since May 2019. In July 2023, shares were changing hands for nearly £10. They were driven higher by speculation that Amazon was about to launch a takeover bid. This never materialised and the shares are now trading around £3.60.

Even so, because of the company’s poor financial performance, I wouldn’t want to invest.

But I accept one person’s trash can be another’s treasure.

And Ocado is still one of the UK’s most popular stocks. I think shareholders have bought into the idea that the company will ultimately make more money from the licensing of its technology to others than through selling groceries. The company believes the global market for its innovative solutions is worth $130bn.

Also, the company’s most recent trading update for Ocado Retail — its joint venture with Marks & Spencer — contained some encouraging signs.

During the 13 weeks to 3 March 2024, it saw increases in the average number of orders (8.4%), basket size (2.1%), active customers (6.4%), and average selling price (2.2%), compared to the same period a year earlier.

Despite this, I think Ocado is a long way from being a global technology company. And, more importantly, several years away from being profitable. Therefore, the company’s recent share price fall is not going to tempt me to invest.