It’s easy to underestimate Admiral (LSE:ADM) shares as a source of passive income. According to Google, the stock comes with a dividend yield of 2.71%.

Source: Google

That doesn’t tell the full story though – over the last 12 months the company’s paid out £1.03 per share in dividends. That’s a 3.81% yield, so what’s going on here?

Dividends

During the last year, Admiral’s normal dividend’s amounted to 73.4p per share – a 2.71% yield at today’s prices. But that’s not the only dividend the firm’s paid.

The business has also delivered 29.6p in special dividends, which amounts to an extra 1.1%. Both put cash in the pockets of shareholders, but Google only seems to recognise one.

What’s the difference? According to the company’s website, the firm’s policy is to pay out 65% of its post-tax profits to shareholders as a normal dividend.

On top of this, Admiral distributes any cash not required by the business to meet solvency or insurance reserve requirements as a special dividend.

Special dividends

Companies sometimes distribute special dividends to investors when they have an unusual cash surplus. CostCo’s a good example of this.

Dividends are never guaranteed, but special dividends are even less predictable than regular ones. With Admiral though, things are somewhat different.

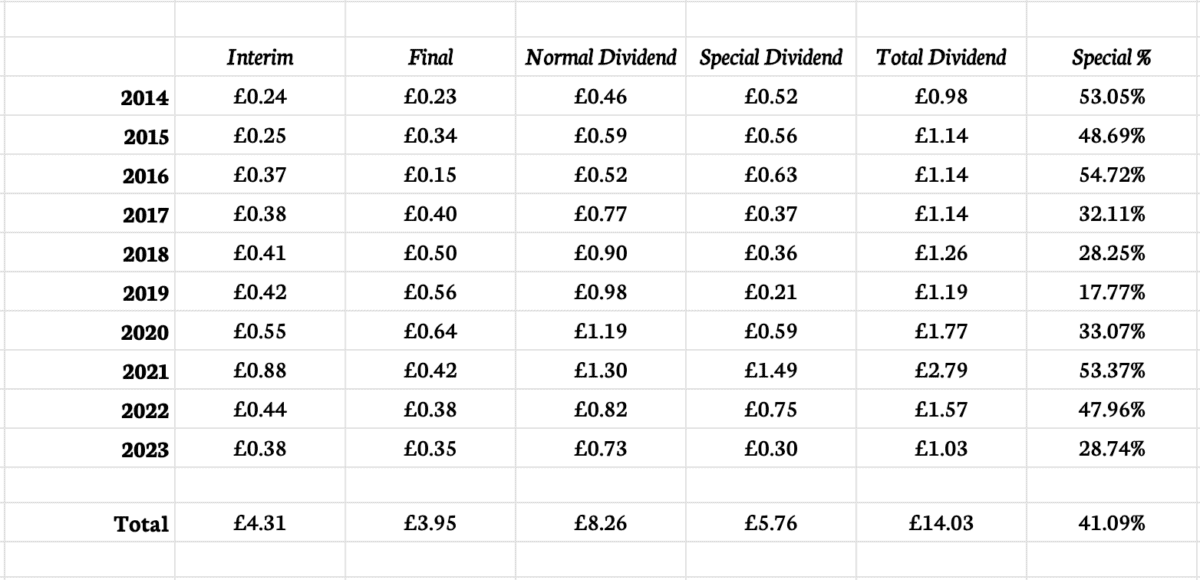

Source: Admiral Investor Relations

The firm’s paid special dividends consistently for the last decade. While these have varied (like the normal dividend) they’ve been an important part of the total dividend each year.

Since 2014, the special dividend has accounted for 41% of Admiral’s total distribution. Leaving that out of the calculation makes the dividend yield seem much lower than it is.

A quality company

Buying shares in Admiral come with some significant risks. The insurance industry is fiercely competitive and customer loyalty is essentially non-existent.

There’s also the issue of inflation to contend with. As the price of cars increase, repairs become more expensive, increasing costs for the companies that pay for them.

Despite this, Admiral has produced unusually good results. The firm’s data and technology has allowed its underwriting to be consistently more profitable than its rivals.

I think this will prove durable. And a business that has a unique advantage in providing a product people need could be a terrific source of dividend income for a long time.

A stock to buy?

Admiral doesn’t initially look like an obvious target for investors looking for passive income. A 2.7% dividend yield’s below the FTSE 100’s 3.36% average

A closer look though, reveals there’s much more going on beneath the surface. As I see it, it’s a quality business with an above-average yield.

That’s a winning combination for me, which is why I’ve been buying the stock for my portfolio. And I plan on continuing to do this.