The Rolls-Royce (LSE:RR.) share price seems to be the gift that keeps on giving. It was one of the most unloved FTSE 100 stocks during the pandemic, but Rolls-Royce’s subsequent recovery has been spectacular. The shares have climbed nearly 1,000% since sinking to a five-year low in 2020!

So, can the aerospace and defence company’s spectacular rise continue?

Here’s my view on the possible trajectory for Rolls-Royce shares over the coming months.

The recovery story isn’t over

Rolls-Royce has achieved a remarkable return to health as various metrics show. Large engine flying hours — a crucial aviation yardstick — reached 88% of 2019 levels last year. The company expects this will rise to 100%-110% by the end of this year.

Furthermore, in 2023, underlying operating profit climbed from £938mn to £1.6bn, revenues rose to £15.4bn, and free cash flow reached a new record of £1.3bn. Impressive stuff.

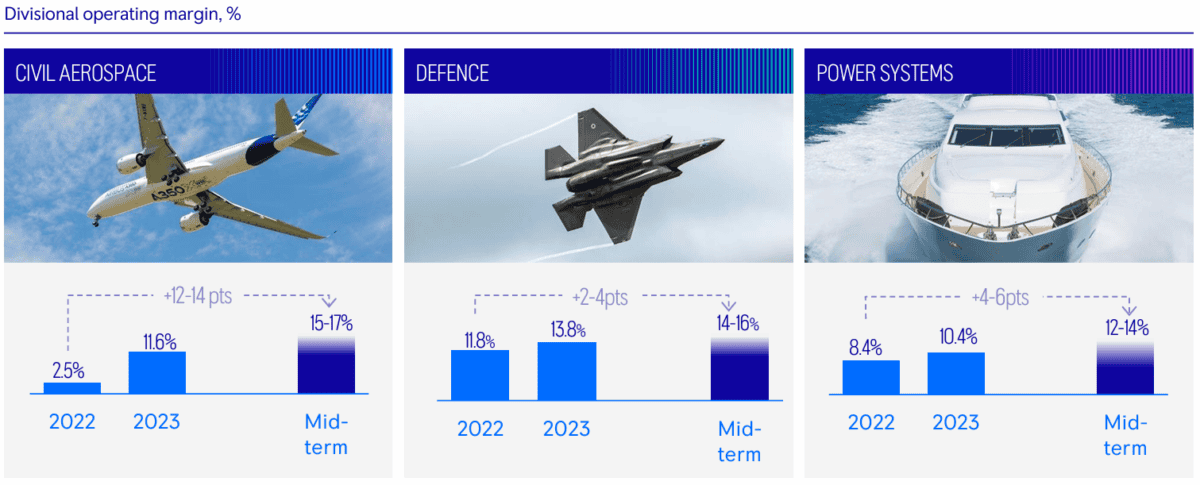

Yet the engineering giant could just be getting started. CEO Tufan Erginbilgiç has set out ambitious goals for the firm’s mid-term future (a timeframe that extends to 2027). Four major ambitions include:

- Operating profit between £2.5bn and £2.8bn

- Free cash flow between £2.8bn and £3.1bn

- Return on capital between 16% and 18%

- Operating margins between 13% and 15%

Should the company show clear progress towards achieving these objectives, I can see the Rolls-Royce share price climbing even higher from today’s level.

The route to get there seems credible. Proposed efficiency savings from a headcount reduction of 2,000-2,500 personnel, new business from the AUKUS defence pact, and a 10%-15% budget reduction in targeted areas are parts of the puzzle.

Plus, shareholders might benefit from a resumption of dividend payments soon, providing a further boost to investor confidence.

But risks could stall progress

Although there are reasons to be optimistic, potential investors should account for risks that could slow the pace of share price gains, or even send them into reverse.

None of the company’s targets are guaranteed to be met. A bad earnings miss would undoubtedly hurt the share price. Prospective investors should watch out for any guidance updates at the firm’s AGM on 23 May.

In addition, the valuation isn’t cheap. Trading at around 29 times forward earnings today, Rolls-Royce shares are more expensive than most FTSE 100 stocks. Currently, the average price-to-earnings (P/E) ratio in the index is around 12.

Finally, Rolls-Royce remains susceptible to shocks. The pandemic was brutal for the business. Planes remained grounded and demand for the firm’s services evaporated. A nasty, unforeseen surprise — just as Covid was — could derail the company’s progress.

My prediction

The 12-month analyst forecast for Rolls-Royce is 448p, implying limited potential growth from today’s price of 423p. Provided we don’t experience any black swan events in 2024 (like another pandemic, God forbid), I’m a little more optimistic than that.

The company’s consistently surprised the market under Erginbilgiç’s leadership with strong earnings performances and I wouldn’t like to bet against it happening again. If Rolls-Royce proves it’s on track to meet its targets, I could see the stock reaching £5 by the end of the year.

However, a lot will need to go right for that to happen and I could end up with egg on my face. Nonetheless, I think Rolls-Royce shares are well worth considering today.