I invest in dividend shares because they give me a healthy second income. I use this cash to buy more stocks, compounding any gains.

When I come to retire, the same high-yielding shares should give me some additional income to supplement my pension.

Ground zero

If I started my investing journey again, I’d give myself 30 years to build a portfolio of stocks. Assuming a retirement age of 65, I wouldn’t have to start until my mid-thirties. Beginning earlier would be better but I know this isn’t always possible.

The next thing I’d do is open a Stocks and Shares ISA. That’s because all income and gains are tax free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The most that can be invested in an ISA in any one tax year is £20,000. I’m therefore going to assume that this amount is available to kick-start my portfolio.

Picking winners

Next, I’d need to choose some stocks to buy. I prefer FTSE 100 shares. The index is home to the UK’s largest listed companies. Most of their names are internationally recognised. Their financial stature means many of them have the ability to pay the generous dividends that will give me a second income.

There are no hard and fast rules when deciding on the number of Footsie stocks to buy. Initially, I’d divide my lump sum between five.

Generally speaking, the more individual positions that are held the more likely it is that a portfolio will replicate the performance of the index as a whole.

The average yield of the FTSE 100 is expected to be 3.8% in 2024.

If this continued for 30 years — and I reinvested all of the dividends received — my hypothetical £20,000 would turn into £61,228. This ignores any capital growth that I might achieve.

Unfortunately, dividends are never guaranteed. And share prices can move up and down. But history tells me that, over the long term, the stock market should do better than cash savings.

Better than average

Although a yield of 3.8% is attractive, I think I could do better. The average of the top five FTSE 100 shares is currently 9.3%.

One of these is Legal & General (LSE:LGEN).

The financial services provider is hoping to acquire £8bn-£10bn of new pension schemes each year. As well as earning a fee based on the amount transferred, it invests the assets hoping to achieve a return higher than what it needs to pay in pensions.

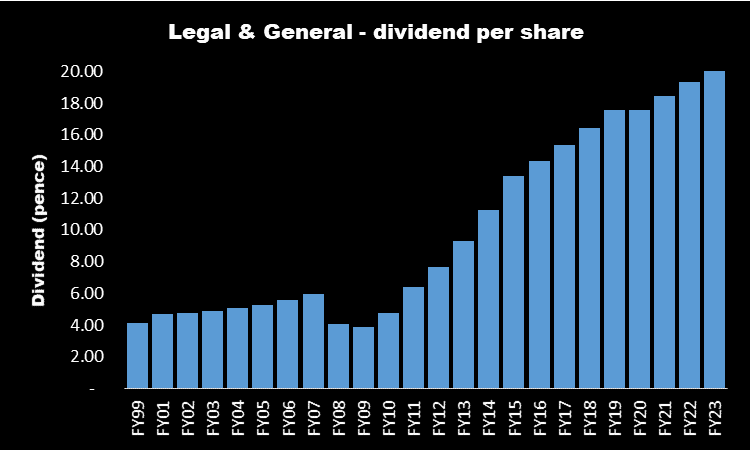

Encouragingly, the company has increased its dividend in 13 of the past 14 years.

Also, analysts are expecting earnings per share of £24.66 in 2024. This implies a forward price-to-earnings ratio of 10, which is below the Footsie average.

The company’s earnings are vulnerable to a downturn in the wider economy and, if it gets its life expectancy calculations wrong, then it could be badly burned.

However, despite these risks, I recently added the stock to my portfolio. I think it has the balance sheet strength and growth opportunities that should enable it to continue paying a generous dividend.

If I could achieve a 9.3% return on an initial lump sum of £20,000, after 30 years I’d have £288,161.

I could then draw down some of this each year. Alternatively, I could take the annual income of £26,799 and spend it on things other than shares.