Enduring a stock market crash is every investor’s worst nightmare. Unfortunately, it’s something long-term buy-and-hold shareholders will experience sooner or later. But, could it be this month?

May usually brings new predictions about plunging share prices. “Sell in May and go away” remains a popular maxim as we enter a period of historical underperformance for stocks.

Let’s examine some risks facing the stock market today.

Marching higher

Context is important. British stocks are doing well right now.

The FTSE 100 index has reached new record highs in recent days.

The FTSE 250 trades below its all-time high, but it’s also enjoying an uptrend this year.

As we climb the so-called ‘wall of worry’, I expect calls for an imminent crash will grow louder.

However, avoiding stock market exposure altogether can mean sacrificing important gains, as recent months have shown.

Interest rates

One major factor to monitor is interest rates. Lower rates generally boost stocks as borrowing costs fall.

The Bank of England will announce its latest monetary policy decision next week. We’re getting mixed clues from the bond market about what to expect. There’s often an inverse relationship between anticipated interest rate changes and gilt prices.

Hopes for rate cuts have faded in 2024, evidenced by sinking gilts. Nonetheless, yields haven’t eclipsed last year’s levels yet, suggesting there’s still some optimism for looser policy.

Bank of England policy-makers appear increasingly divided about how hawkish to be on inflation. Investors may find crucial clues about the stock market’s future direction in May’s decision and accompanying guidance.

It’s the economy, stupid…or is it?

Another risk is the fundamental health of the UK economy.

We’re awaiting confirmation that Britain will successfully exit recession. The signs are good, but hardly great. GDP growth was 0.1% in February.

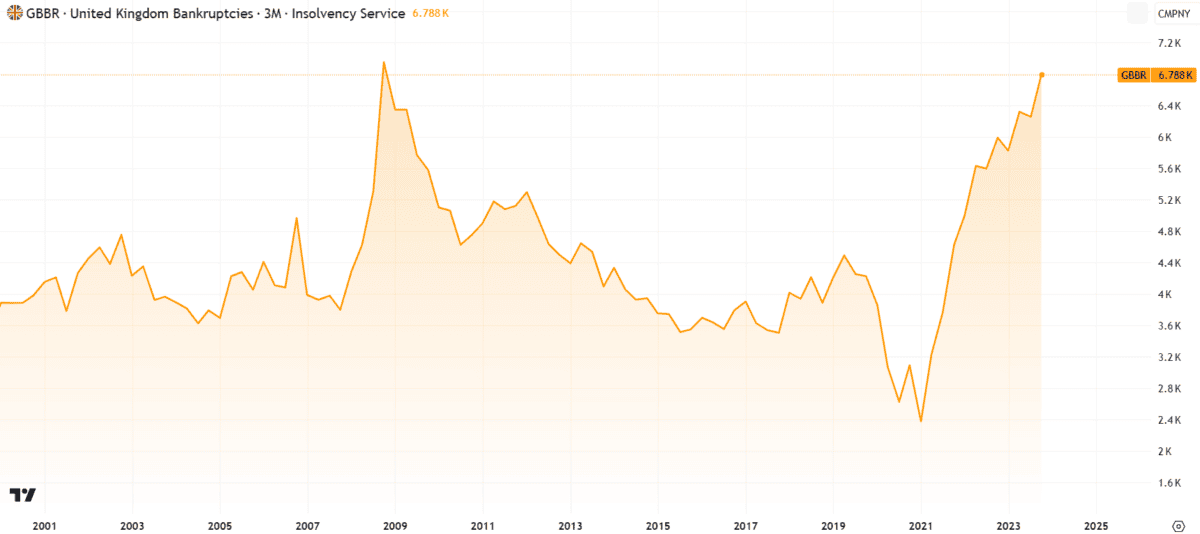

However, bankruptcies are approaching a two-decade high, just below levels last seen in the 2008 financial crisis.

Additionally, the OECD predicts Britain will be the worst-performing G7 economy in 2025. Grim stuff.

Yet, this doesn’t necessarily spell trouble for the stock market. Around 75% of FTSE 100 earnings come from overseas. For the FTSE 250, it’s roughly 57%.

How dependent FTSE companies are on the UK economy is a moot point. That said, I’m reminded of the well-worn phrase: “the stock market’s not the economy”.

A stock to consider

For investors worried about a crash, buying defensive stocks could be attractive.

British American Tobacco (LSE:BATS) is one worth considering, in my view.

With a forward price-to-earnings (P/E) ratio under seven, it’s one of the cheaper FTSE 100 stocks. Plus, given the addictive nature of nicotine products, demand remains fairly constant throughout the economic cycle.

Admittedly, the company faces significant, arguably existential, risks. Government regulations on tobacco products and electronic cigarettes are becoming increasingly stringent around the world.

Nevertheless, British American Tobacco’s confident it can reach 50m consumers for its non-combustible products by 2030. This is probably the company’s best shot at future growth, although traditional cigarettes remain highly cash-generative for now.

Overall, I believe recession-resistant qualities, a rock bottom valuation, and a chunky 9.8% dividend yield are enough to compensate for the risks. I reckon this business stands a good chance of outperforming if the stock market crashes.