Lots of us dream of having a passive income. That might mean a couple of hundred pounds a month to pay for dinners out, or it might be thousands of pounds a year that could, in theory, allow us to retire early.

However, many of us might think investing is reserved for people with lots of money. And that’s simply not true. That’s why I’m here to show you how I’d create a passive income stream worth £15,313 a year, by investing just £10 a week.

A tried and tested strategy

If we don’t have a lot of money to invest, the key is time and patience. We can’t expect to turn our £10 a week into a huge portfolio overnight despite what you may hear on social media. We need to build our portfolios without taking unnecessary risks. Because if I make poor investment decisions I could easily lose money.

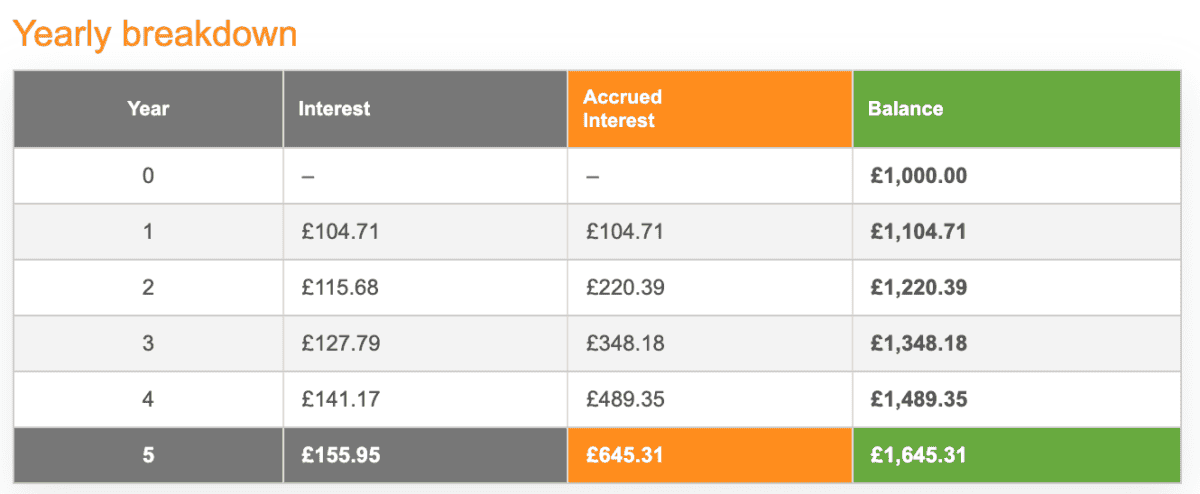

The key is something called compound returns. This is what happens when we reinvest what our portfolio earns each year allowing it grow from a bigger base. Just take a quick look at how £1,000 grows at 10% each year. The interest is bigger time after time.

But if we want to turn £10 a week into something more sizeable, we need to invest for a lot longer. There will be good years, and there will be bad years, but over decades it equals out.

If I practiced compound returns for 35 years and managed to realise an annual return of 10%, after 35 years I’d have £153,131. That’s enough to generate £15,313 a year as passive income.

Using the Stocks & Shares ISA

The Stocks and Shares ISA is a wrapper for our investments that shields all of our gains from tax. It’s a hugely important part of my investment strategy. It allows me to do two important things. Firstly, I can build my portfolio without being taxed when I sell profitable investments. It also means my passive income would be entirely tax free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Investing wisely

If I were investing just £10 a week, I may be tempted to put my money in a fund or ETF. Scottish Mortgage (LSE:SMT) could be a good option for the growth phase. It has underperformed in recent years, but the trust has a track record for beating the market.

Scottish Mortgage invests in growth-oriented firms. The majority of its investments are publicly listed stocks like lithography giant ASML and AI-enabler Nvidia. However, some of the trust’s investments are in non-listed companies like SpaceX.

The selling point is that Scottish Mortgage has a team of investment analysts who can scour the market and non-listed companies, to find the best investments. It owned Tesla before it was a household name.

The downside is that not all of their investments work out, and as a trust, it’s less flexible than we are as individual investors. I’d suggest, as individual investors, we have greater capacity to drop investments that aren’t working out — like Moderna.

Over the past five years, Scottish Mortgage has been pretty much flat. But over 10 years, it’s up 300%. That’s 30% a year.