MercadoLibre (NASDAQ: MELI), often called the ‘Amazon of Latin America’, has been a truly spectacular growth stock to own over the years. It’s up around 1,490% in a decade!

However, it’s now fallen 23% in the last two months. Here’s why I’d buy this dip today.

In continuous beta

MercadoLibre was founded in Argentina in 1999 by Marcos Galperin, who’s still the CEO.

Originally, the firm mimicked eBay‘s auction site. Today though, it’s Latin America’s leading e-commerce player, with a presence in 18 countries, and is also the region’s most powerful fintech innovator.

Here are its main businesses:

- Marketplace is an online platform connecting sellers with 54.4m unique buyers (at the end of 2023)

- Mercado Pago is a payments app that facilitates digital transactions

- Mercado Shops helps users set up, manage and promote their own webstores

- Mercado Envios is a sprawling logistics network. Over 75% of shipments are delivered within 48 hours

- Mercado Credito provides loans

The firm’s culture is always to be “in continuous beta”. This means it’s “permanently focused on innovating to bring the best experience to our users, and to extend our competitive advantages”.

Eye-popping growth rates

The company’s seized with both hands the opportunities presented by the rising adoption of smartphones across Latin America.

In 2016, its net revenue was $844m. By 2023, it reached $14.5bn.

In Q4 2023, revenue increased 42% to $4.3bn, driven by double-digit growth across its key e-commerce and fintech units.

Both Brazil and Mexico delivered growth of more than 30% in marketplace items sold, while Argentina also showed acceleration. And Mercado Pago active users hit a record high of 53m, up from 43.7m the year before.

Meanwhile, its digital advertising business, which allows brands to increase their sales inside its marketplace, has now exceeded 70% growth for seven straight quarters (excluding foreign exchange movements).

One negative however, was that quarterly net profit was flat at $165m, due to non-recurring historical tax expenses. Excluding these, net profit rocketed 166% to $383m!

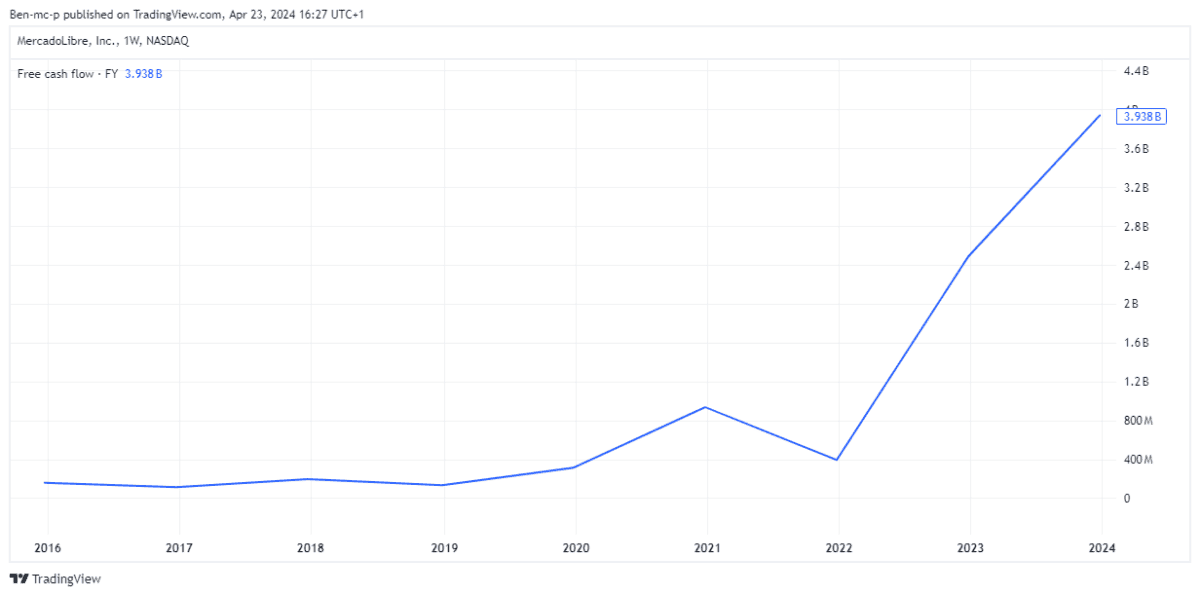

Below, we can see how the firm’s free cash flow is exploding higher as it scales.

A P/S bargain

Now the stock isn’t cheap, trading at 40 times forecast earnings. That premium valuation adds some risk to the investment case here, especially if growth unexpectedly slows.

However, it’s not uncommon for high-quality growth stocks like this to trade at a premium. The company actually has better profit margins that Amazon, who it continues to out-complete in the region because of its local knowledge and partnerships.

On a price-to-sales (P/S) basis, the stock actually looks like a bargain at 4.91 times.

I’d buy the dip

Revenue’s tipped to grow to $25.8bn in 2026. And analysts currently have a $1,960 price target on the stock. That’s 40% higher than the current share price of $1,397.

Looking ahead, I fail to see how more shopping, payments and advertising doesn’t shift online in Latin America over the next few years. MercadoLibre is at the heart of all these digital trends.

The stock’s a top five holding in my own portfolio. But if I wasn’t, I’d take advantage of the share price weakness today and buy this superb growth stock.