Much to the delight of British investors, the FTSE 100 index is within touching distance of a new all-time high. However, not all individual FTSE 100 shares are joining the party.

Consumer goods giant Reckitt (LSE:RKT) is one Footsie company that’s having a tough time. The conglomerate, which owns household brands such as Cillit Bang, Dettol, and Durex, currently trades at levels not seen since 2012. Over the past year, the Reckitt share price has fallen 34%.

So is this a good opportunity for investors to consider buying an undervalued stock? Or could Reckitt shares plunge further from here?

Let’s explore.

Disappointing earnings

Stocks rarely fall to a 10-year low for no reason. In Reckitt’s case, a bad set of final quarter earnings precipitated a selling frenzy that shows few signs of abating.

Analysts at RBC Capital Markets branded the firm’s performance as “really grim rather than just poor“. New chief executive Kris Licht didn’t shy away from criticism, describing the results as “unsatisfactory”. These are hardly encouraging words for prospective investors to hear.

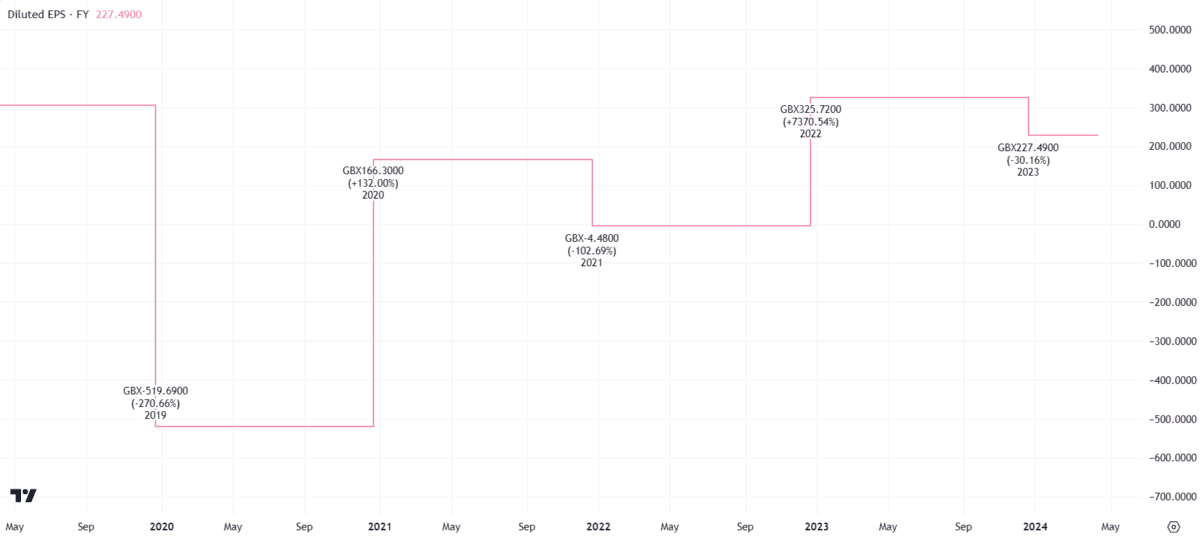

As the chart above illustrates, diluted earnings per share (EPS) slipped to 227.4p from 325.7p in 2022. This represents a 30% decline, driven by particular weakness in the nutrition division. But the bad news doesn’t end there.

Reporting anomalies in the Middle East knocked the firm’s full-year net income to the tune of £55m, damaging investor confidence. Reckitt maintains that the issue’s been isolated and it’s taking disciplinary action against some employees.

Nonetheless, I’m not particularly excited by guidance for net revenue growth of 2%-4% in 2024. There’s a significant risk that another poor quarter could send the share price tumbling further.

Valuation

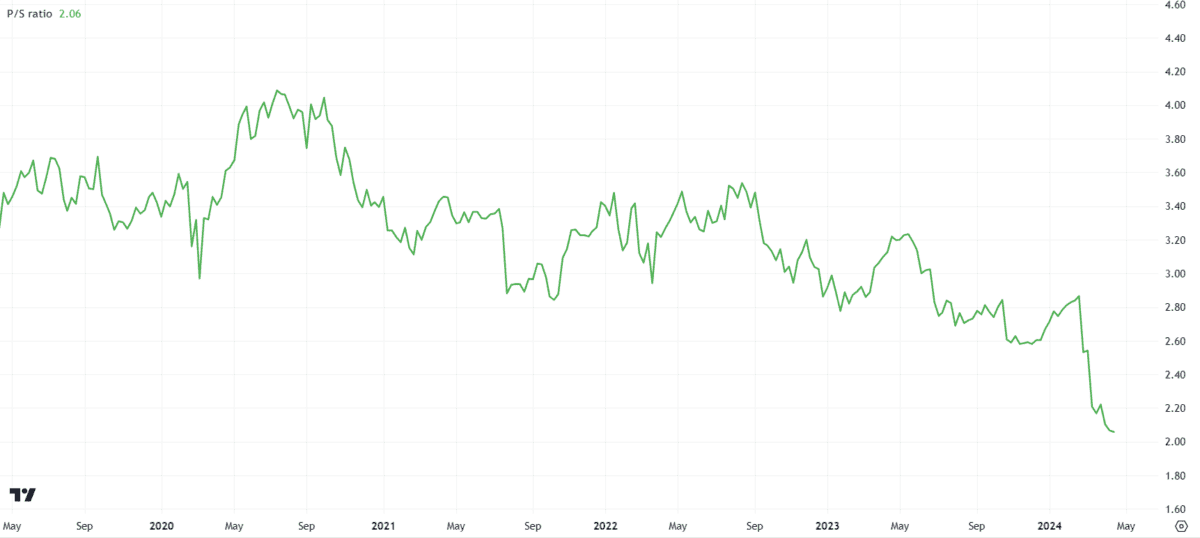

On the bright side, the company’s price-to-sales ratio is now at the bottom of its five-year range at just above two. Using this metric, Reckitt shares look cheaper than they’ve been for years.

However, the depressed valuation reflects the stock’s greater risk profile following an adverse legal ruling against the firm.

Last month, a US jury awarded $60m in damages to the mother of a premature baby who died of an intestinal disease after consuming Reckitt’s baby formula product Enfamil.

Potential investors should note the business may face more financial liabilities from product liability lawsuits, although it intends to challenge the verdict.

Dividend boost

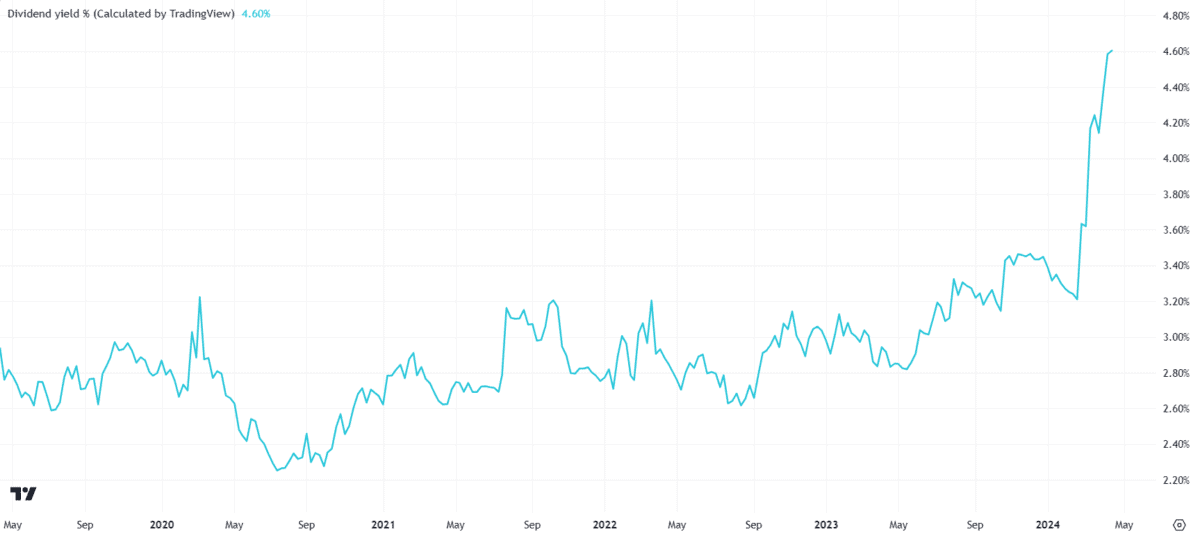

One upshot of the share price fall is the rise in the firm’s dividend payouts. At 4.6%, the yield on offer today is well above what shareholders have come to expect in recent years.

Furthermore, an ongoing £1bn share buyback programme looks secure following a free cash flow improvement from £2bn to £2.3bn. This was a rare bright spot in an otherwise disappointing set of results.

What I’m doing

At first glance, Reckitt shares may appear undervalued today and the higher dividend yield looks tempting. However, it’s not enough for me to invest.

Digging into the weak earnings report, the cheaper valuation looks justified to me, especially in light of further potential legal difficulties for the business.

While Reckitt may boast an impressive product portfolio of household staples, I’d like to see that translate into concrete financial success before adding this FTSE 100 stock to my portfolio.