Today (16 April) is the last day on which passive income hunters can buy Thungela Resources (LSE:TGA) shares and qualify for its final dividend for the year ended 31 December 2023 (FY23).

The final payout for the year is ZAR10 (South African Rand), which is the same as the interim payment. However, all dividends from the company are subject to withholding tax at 20%. This means the total amount received by UK shareholders for FY23 will be 66.44p a share. Despite the deduction, the stock’s presently yielding a very impressive 10.6%.

Not to everyone’s taste

Before going any further, I need to address the elephant in the room. The company’s principal activity is coal mining in South Africa and Australia. It’s therefore not going to win any prizes for its environmental credentials.

But despite attempts to reduce the world’s carbon footprint, coal consumption reached an all-time high in 2023. The International Energy Agency expects global demand to peak this decade, although there’s too much uncertainty to accurately predict how quickly it will fall thereafter.

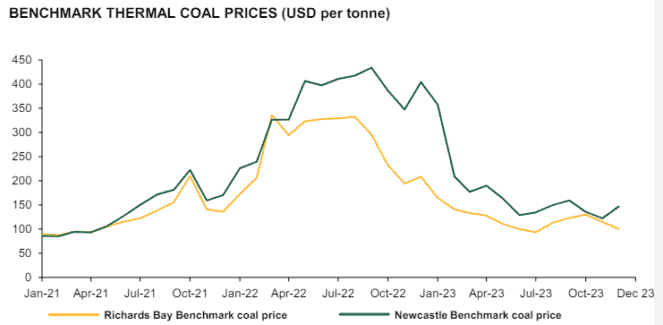

However, as can be seen from the chart below, coal prices have been falling lately. And they can be highly erratic.

The average Richards Bay Benchmark price — received by the company over the past four years — has been $121 (FY23), $271 (FY22), $124 (FY21) and $65 (FY20).

And ongoing problems with South Africa’s rail network — including regular thefts of signalling equipment and derailments — means the company frequently experiences difficulties in getting its product to the Richards Bay Coal Terminal, where it’s exported to the world.

The net result is a reduction of 40% in revenue, and a 72% fall in earnings, for FY23, compared to the previous year.

During FY23, the company exported 12.2m tonnes. Its guidance for FY24 is a range of 11.5-12.5m.

Volatility

With uncertainty over whether it can transport its coal to world markets — and the price it receives — the dividend that shareholders can expect to receive is impossible to predict. For example, in FY22 it was five times higher than in FY23. This proves the point that dividends are never guaranteed.

However, its share price has done very well recently. Since reaching its 52-week low in February, it’s climbed over 50%. I’m sure the enticing dividend has something to do with this performance. But otherwise it’s unclear what’s behind the movement.

However, looking back to the start of 2022, it appears to closely mirror the movement in global coal prices. That’s why, despite its recent good run, the company’s share price is still 65% below its all-time high of September 2022.

The headline to this article asks is Thungela Resources stock good for passive income? At first sight it does appear to offer the prospect of receiving above-average dividends. But the company’s reliance on a volatile coal price and South Africa’s rail infrastructure, which is suffering from decades of under investment, makes it a high-risk investment.

In fact, despite its attractive dividend, it’s a little too risky for me.