Ocado Group (LSE:OCDO) is a FTSE 100 stock that’s in danger of being relegated from the prestigious index of the UK’s largest listed companies. That’s because its share price is down 30% since April 2023. And it’s 85% lower than its all-time peak achieved in September 2020.

The company now has the second-lowest market cap on the Footsie, beaten only by St James’s Place. But despite this fall, I still think the online grocery retailer is hugely overvalued.

Some numbers

To illustrate this, the table below contains some key financial metrics for the company extracted from its accounts for the 53 weeks ended 3 December 2023 (FY23). I’ve also included some important valuation measures. For comparison, I’ve added the same data for Harbour Energy (LSE:HBR) as disclosed in its 2023 accounts.

| Measure | Ocado Group | Harbour Energy |

|---|---|---|

| Revenue (£m) | 2,825 | 2,925 |

| Profit/(loss) before tax (£m) | (403) | 470 |

| Dividend yield (%) | – | 6.7 |

| Price-to-book (PTB) ratio | 1.99 | 1.86 |

| Assets (£m) | 4,429 | 7,793 |

| Borrowings (£m) | 1,462 | 401 |

To me, the latter looks in far better financial shape. And yet Ocado has a stock market valuation of £3bn. Incredibly, this is 25% higher than Harbour Energy’s.

I should point out that the oil and gas producer has its own problems. In 2022, the government imposed a 25% energy profits levy on the industry. A year later, it was increased to 35%. Combined with other taxes, this resulted in the company having an effective tax rate of 95% in 2023. Not surprisingly, this has acted as a drag on its share price performance.

But there are many other examples I could have chosen, all of which – I believe – demonstrate that Ocado’s shares are very expensive. And for that reason alone, I wouldn’t want to invest.

Am I missing something?

However, stock market valuations are meant to be forward looking. They are supposed to reflect the potential of a business rather than its historical performance.

But in my opinion, Ocado is a long way from being profitable, although its directors remain optimistic about its future prospects.

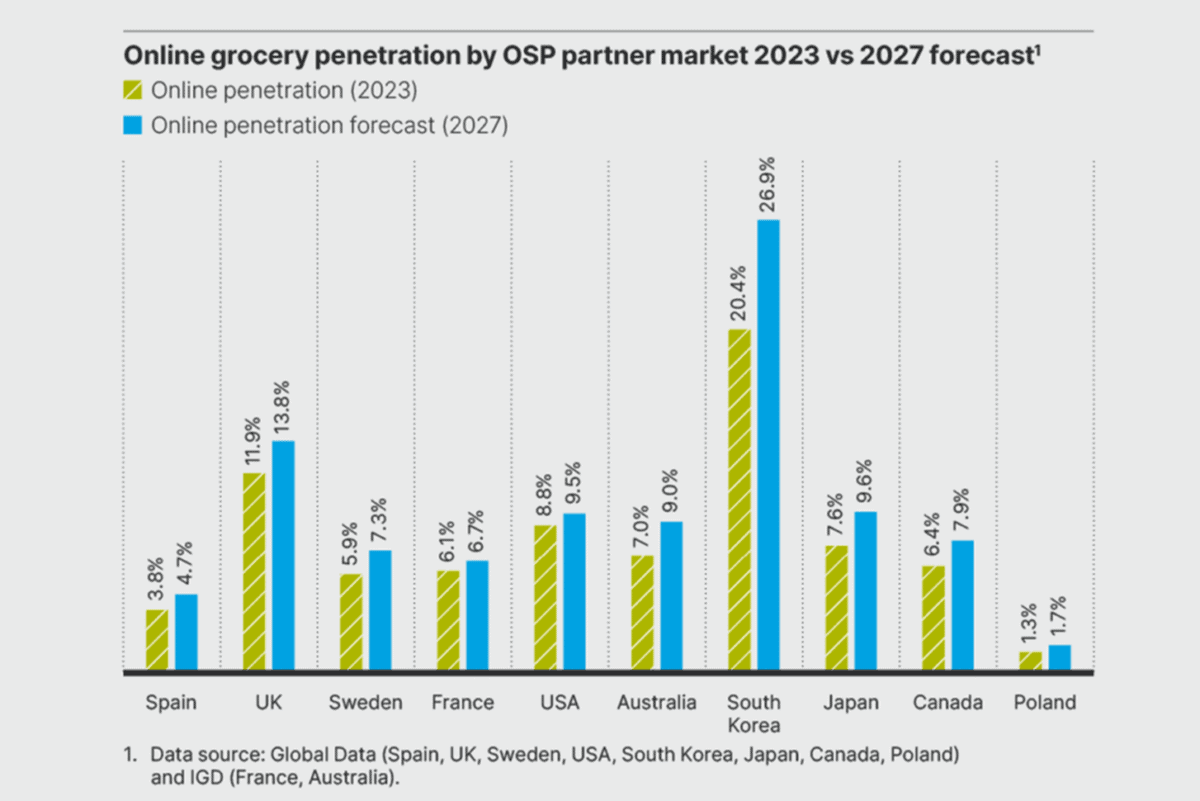

They claim that its core market is large and growing. As the chart below shows, the share of groceries purchased online is forecast to grow over the next four years in all of its key territories.

This should help boost the retail arm of its business.

But it will also create further opportunities to license its automated warehouse technology. The company also sees potential for letting other retailers use its ordering platform that it claims is “battle-tested” and protected by over 2,600 patents.

According to its website, letting third parties use its software and technology will further accelerate its “virtuous cycle of growth, investment and innovation”.

All this makes Ocado sound like a technology company. And I guess that’s the point. By establishing itself as a savvy tech business it will be able to attract a higher valuation multiple than an old-fashioned retailer.

But with 85% of its FY23 revenue coming from its joint venture with Marks and Spencer, in my eyes it’s an online grocery shop.

Final thoughts

The company claims that it has the “operational know-how to enable our partners and customers to achieve scalability and success”. Cynics (like me) will be wondering why Ocado itself hasn’t managed to do this after over two decades of trading.

And astonishingly, the company’s 2022 report states: “We are just getting started on our growth journey in grocery and beyond”.

If I was a shareholder, I’d have run out of patience long before now.