These FTSE 100 shares are soaring right now. And I think a £7,000 lump sum investment in one (or both) of them is worth considering. Here’s why.

Antofagasta

Soaring copper prices have pushed Antofagasta’s (LSE:ANTO) share price through the roof more recently. As a consequence, the FTSE miner now carries a hefty valuation: its price-to-earnings (P/E) ratio for 2024 now sits at 35.9 times.

High valuations like this can limit further share price gains. They can also leave companies in danger of a price correction if news surrounding the company starts to spook investors.

Yet I believe Antofagasta could continue rising. A combination of weak copper supply from China and rising consumption from the renewable energy and electric vehicle (EV) sectors, means that fears of metal shortages could continue to increase.

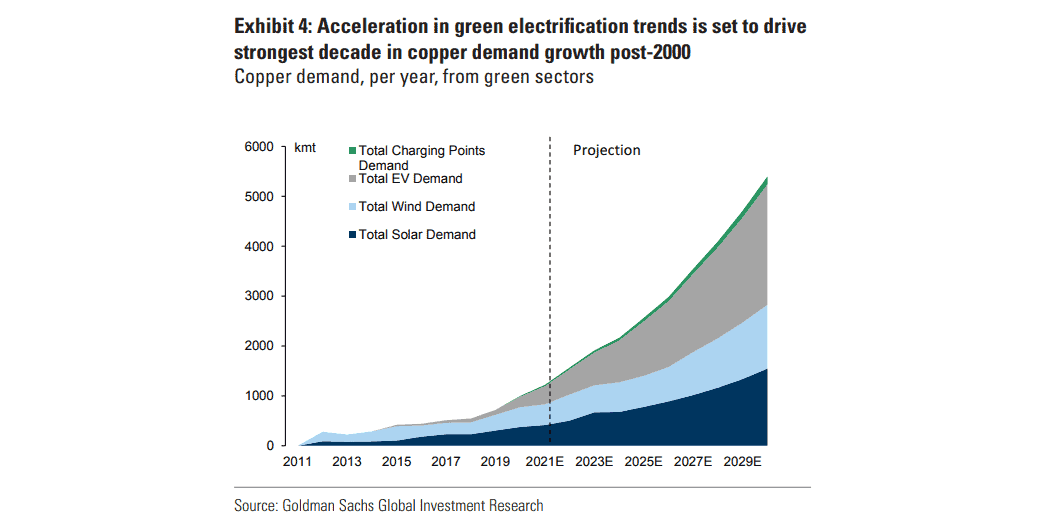

Commodities strategist Ewa Manthey of ING Bank notes that “while traditional demand drivers, such as property and construction, face headwinds, demand from the green energy sector continues to grow”. Copper consumption from the EV and clean energy sectors is tipped to keep expanding over the long term, too, as the chart below shows.

So why buy Antofagasta shares to capitalise on this opportunity? It owns a series of world class mining projects in Chile, like Los Pelambres and Centinela, and is investing heavily in them to boost annual production by around 30% by 2027.

I’m also a fan because of the miner’s robust balance sheet. Its net debt to EBITDA ratio came in at just 0.38 at the end of 2024. This gives it scope to continue investing for future growth and (hopefully) start growing dividends again.

Glencore

Diversified miner Glencore (LSE:GLEN) is also enjoying a share price resurgence as certain commodity classes recover. As well as being a major copper producer and trader, the FTSE 100 company’s role as an iron ore major is also tempting investors to pile in.

Prices of the steelmaking ingredient are currently at about $100 a tonne, boosted by ongoing stimulus measures from the Chinese government. With the country’s property sector receiving strong support, some analysts think iron ore will continue rising and strike $150 later on in 2024.

As with copper, the long-term outlook for iron ore is also looking extremely bright. As well as benefitting from the growing green economy, rapid urbanisation in emerging markets and infrastructure upgrades in the West should drive demand much higher from current levels.

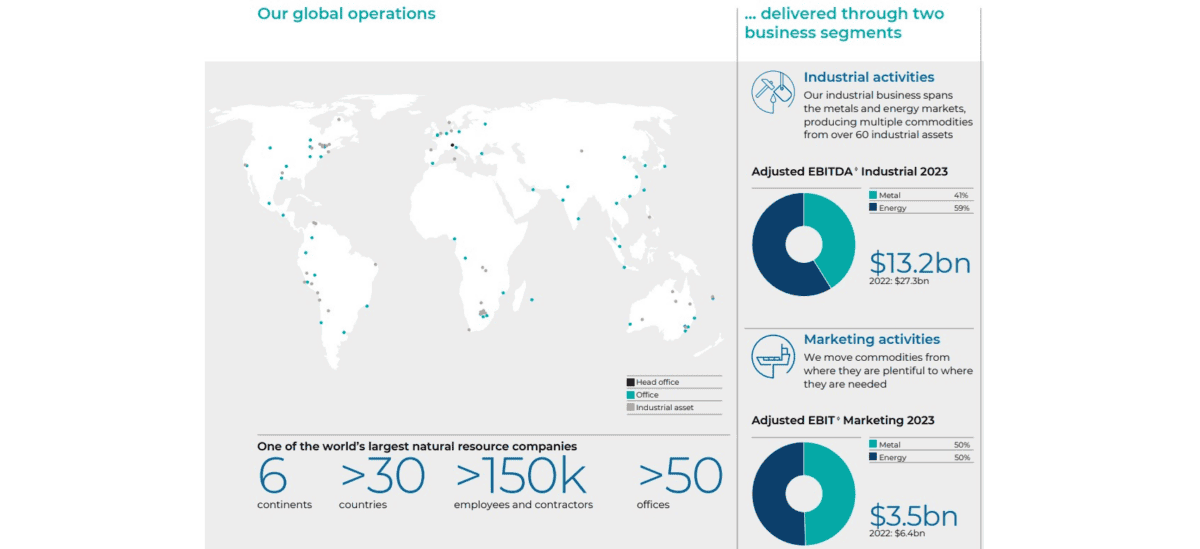

I like Glencore because of its diversified operations, which helps me spread risk. By straddling multiple commodity classes (including cobalt, nickel, lead, and zinc), the firm is less reliant on strength in one market. This differentiates it from Antofagasta, which has all its eggs in one basket (copper).

I also like the company’s role as a raw materials producer and trader. Mining is a highly complicated process where costly setbacks (like strike action, power outages, and poor exploration results) can be commonplace. Glencore’s dual role helps to mitigate this risk.

Finally, the FTSE firm also has a strong balance sheet it can use to invest for growth and pay dividend income. Its net debt to adjusted EBITDA ratio stands at just 0.29.

If I didn’t already have exposure to the mining industry through Rio Tinto, I’d buy either of these shares for my portfolio today.