Nordic American Tankers (NYSE:NAT) offers investors a stunning 12.3% dividend yield that’s paid quarterly. On the surface, it’s an excellent option for passive income investors. Having delved deeper, I also think it’s an excellent option in general.

Let’s take a closer look.

The dividend

For FY23, Nordic American is set to pay investors $0.48 per share. This is paid as a quarterly dividend and is equal to $0.12 per quarter. This is expected to rise to $0.50 per share per year in 2024.

The only issue is the dividend coverage. The coverage ratio tells us how many times a company can afford to pay its dividend from net earnings. Normally, we’re looking for a coverage ratio of two times as a benchmark for a healthy dividend that has room to grow.

However, Nordic American’s model is different. With earnings expected to come in at $0.63 per share in 2024, the dividend coverage ratio is just 1.26. I would consider that quite weak, but the company is at the forefront of a super-cycle in the tanker sector.

Tailwinds

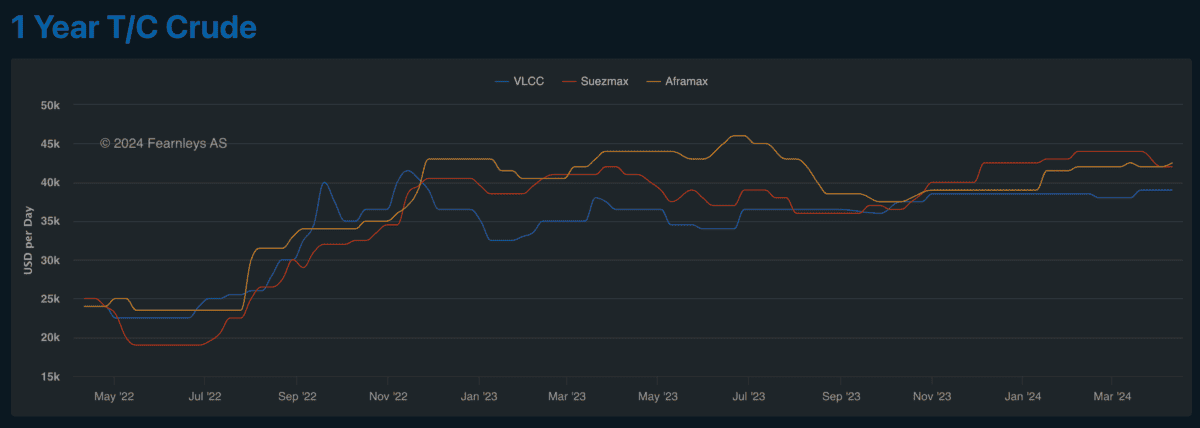

The price of leasing vessels has risen substantially over the past two years. Nordic American operates 20 Suezmax tankers — these are the largest vessels that can fit through the Suez Canal — and they’re among the most in-demand right now.

As we can see from the below chart, the cost of leasing a Suezmax tanker has risen around 133% from its lows. And since Hamas’s attack on civilians and the ensuing invasion, Suezmax tankers have been trading at a premium.

So, why has this happened? Well, there are several factors.

- A dearth of vessels: Companies ordered fewer vessels during the pandemic. As such, the global fleet is ageing and there are fewer vessels to respond to growing demand.

- Fewer shipyards: Tankers are massive vessels and they take years to build. Compounding this shipyard closures. There are less than half the number of shipyards today as in 2007.

- Houthi attacks: The attacks mean vessels are rerouting around the Cape of Good Hope to avoid the Suez Canal, adding thousands of miles to certain journeys. In turn, this means longer journeys, and less available supply.

- Panama drought: Capacity at the Panama Canal has been cut by around 60% due to a drought. Vessels either have to sit in queues or find an alternative route.

The bottom line

Nordic American’s dividend coverage ratio could certainly be stronger, but given the industry dynamics, I’m not too worried. Given the shortage of tankers in the sector, analysts are forecasting a multi-year super-cycle that will push earnings higher. It could be a transformative period for companies that are well-positioned, and I believe Nordic American is one.