The FTSE 100 is full of many great companies, and I believe this is one of them. While I don’t think this investment is the greatest for price growth, it could be one of the best for dividends.

Schroders (LSE:SDR) is currently down 43% in price, and it yields a nice 6%.

Investing in asset management

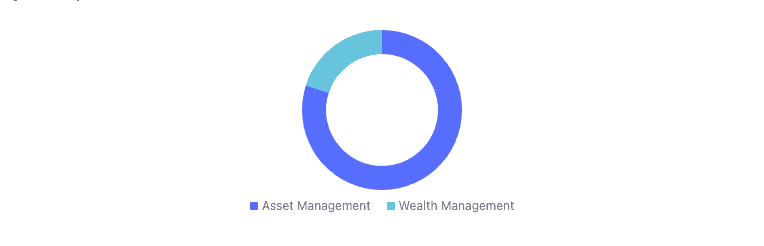

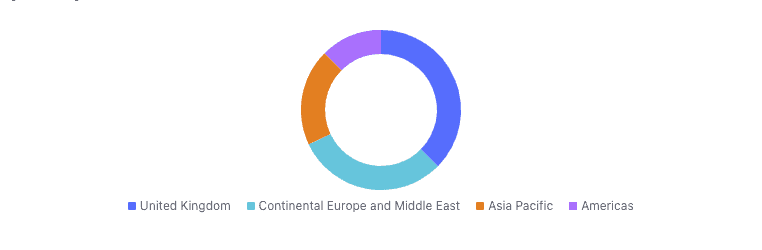

Schroders offers asset and wealth management across the world. The largest geographies it operates in are the UK, Europe, and the Middle East.

Its asset management services, which are its largest source of revenue, include services in shares, as well as fixed income, multi-asset, and alternative investments.

I think it’s a strong choice

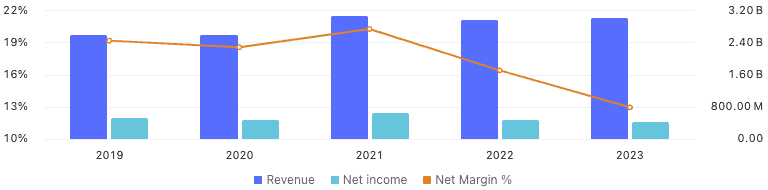

Schroders has numerous elements that I think make it a compelling holding for my portfolio. First of all, its net income margin, arguably the most important measure of a company’s profitability, is higher than the industry norm by a fair bit.

Also, while it’s not a high-growth company, and its net margin has fallen considerably recently, its revenue has been growing well over the past five years for a firm as large as it is.

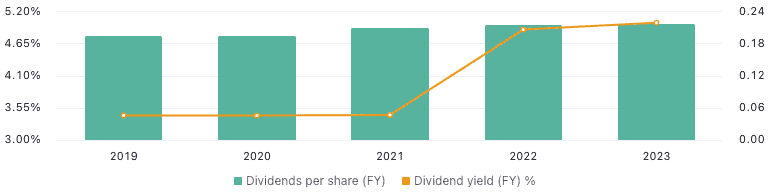

Of course, the main selling point for me is its dividend yield, which has risen sharply recently, up from 3.4% in 2021 to nearly 6% as I write.

What about value?

With the price down so significantly recently, it’s no surprise that I think Schroders is selling at a decent valuation.

Its forward price-to-earnings (P/E) ratio, which takes into account analysts’ consensus estimates on future growth, is just 12.

After the contraction recently, the general outlook is that for the next three years, Schroders will grow its earnings at 3% annually.

I always love to buy during bad times because it means I get a low price. Then, I can capitalise on this during the good times.

There are significant risks

The biggest concern I have with the company at the moment is its balance sheet. While it is in asset management, and some firms have strategies that require a lot of liabilities, I don’t like it. There are also plenty of investment businesses that don’t have lots of liabilities, and I prefer to invest in those.

I don’t think the balance sheet is a deal breaker. It just means my allocation to the company may be slightly lower than if the issue weren’t there. After all, a lot of liabilities means a firm is closer to bankruptcy in the case of a major crisis. This is true even though the company has more than enough assets to cover its liabilities at the moment, as it makes its future financial situation less certain in the case of it having to sell a lot of its assets and maybe eventually take on some debt.

I have to remember that this is a company that has actually lost 17.4% in price over the past decade. So, if I do invest for the dividends, I need to be aware my asset value is less secure than I may like. That’s why buying it at the lower present price is more appealing to me.

It’s on my watchlist

Even given the risks, I think Schroders is a good company. The dividend yield is very compelling, and I’m considering investing in it.

I’ll want to get in early though, because I could see the price rising soon.