On Wednesday (10 April), Tesco (LSE:TSCO) reported its annual earnings for the 52 weeks to 24 February. And with a strong set of results and a confident tone, the Tesco share price pushed up around 1% in early trading, rising further by mid-day.

Strong results

The UK’s biggest retailer said group sales excluding VAT and fuel rose 7.2% over the 52-week period to £61.48bn. Including fuel, sales rose 4.2% to £68.19bn. Meanwhile, adjusted diluted earnings per share came in at 23.41p — up 14% year on year.

On a like-for-like basis, the firm said that retail sales rose 6.8%. And with inflation falling throughout the year, the retailer had seen volume growth pick up in the second half.

Revenue came in exactly as expected, but earnings were seemingly a little bit light. Nevertheless, this was a strong set of results and the market reacted positively.

Confidence high

Reinforcing this strong set of results was the management’s confident tone. Ken Murphy, chief executive, said: “Customers are choosing to shop more at Tesco, which is reflected in growing market share as they respond to the improvements we’ve made to the value and quality of all our products.”

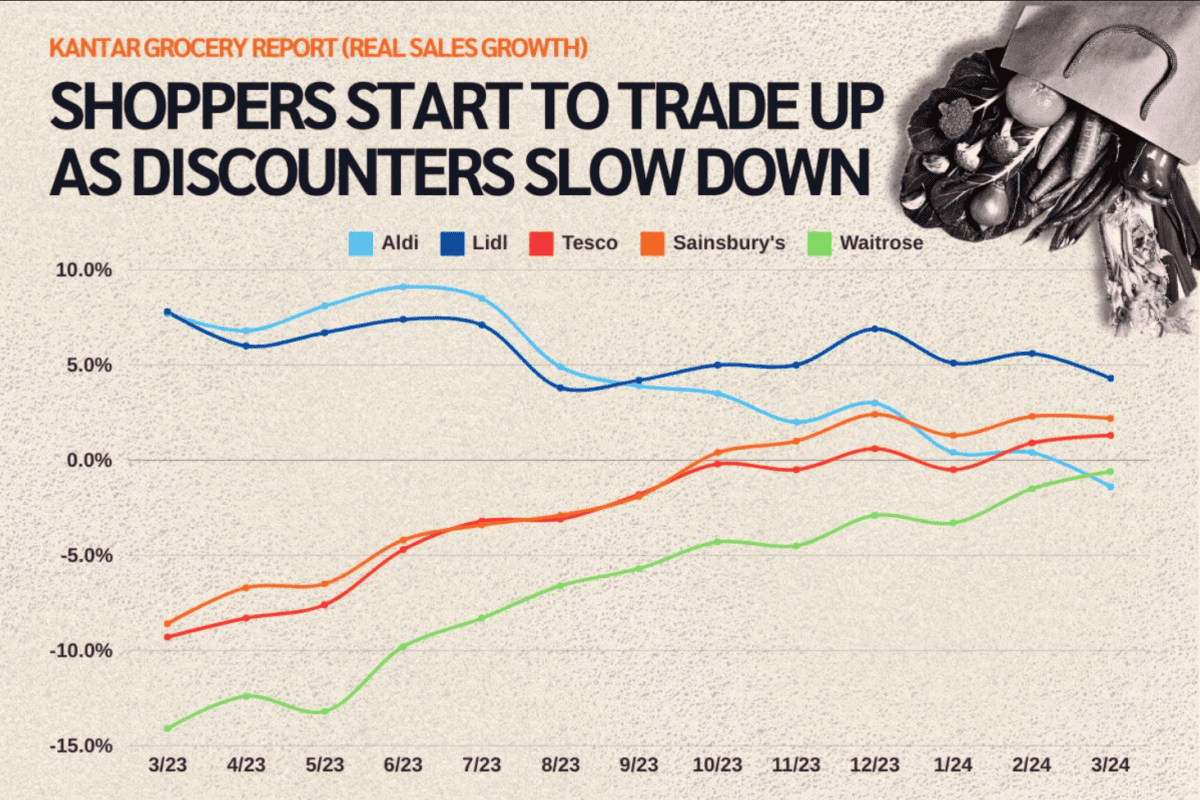

This broadly reinforces what I and several other analysts have been suggesting. With the cost-of-living crisis relaxing, shoppers are seemingly trading up from budget supermarkets to those that are a little more premium, like Tesco or Waitrose.

The latest data shows that real sales growth is slowing for the likes of Aldi and Lidl — Aldi’s sales growth is actually negative. Meanwhile, premium Waitrose has seen a huge improvement over the past 12 months, and this probably will continue as things pick up.

Trading in line with peers

When I’m evaluating how much a stock should be worth, I often start by looking at existing research and share price targets. These are the published targets issued by City and Wall Street analysts and provide insights into the perceived value of the stock.

The average Tesco share price currently targets £3.29, representing a 14.5% premium to the current share price. UK stocks tend to trade at a discount to their targets, but this discount is clearly positive.

It’s also worth bearing in mind that analysts don’t always update their outlooks that frequently. The improving economic backdrop, as outlined by management in the above results, may be reflected in forthcoming revisions.

I’d also note that Tesco’s broadly trading in line with peers. It’s currently trading around 13 times earnings and has modest growth expectations. Based on forward earnings projections, the grocer is trading around 12.2 times for 2024, 11.8 times for 2025, and 11.2 times for 2026.

Personally, I believe Tesco’s among the strongest picks in this sector, given its commanding lead in the UK retail space. This gives it pricing power and the ability to swallow higher costs when challenges arise.