Rolls-Royce Holdings (LSE:RR.) has proved to be one of London’s hottest growth shares in the post-pandemic era. Driven by the rebounding airline industry and impressive restructuring measures, the FTSE 100 engineer has risen a whopping 180% in the past 12 months alone.

Solid momentum in its civil aerospace and defence markets suggests the company could continue flying, so to speak. City analysts are certainly optimistic. They expect earnings here to rise 8% in 2024 and then 23% next year.

But I’m concerned at the company’s stratospheric rating following these price gains. Rolls-Royce’s share price now commands a meaty price-to-earnings (P/E) ratio of 28.3 times.

Lofty valuations can prompt a share price correction if cracks begin to appear in a stock’s investment case. And confidence in Rolls could suddenly tumble if the airline industry faces a fresh downturn, supply chain problems worsen, or its self-help initiatives begin to run out of steam. These are very real threats, in my opinion.

2 better buys?

I don’t believe investors need to pay a king’s ransom to acquire white-hot growth shares. Many top FTSE 100 and FTSE 250 stocks currently trade on rock-bottom earnings multiples.

Here are two I think savvy investors need to consider buying today.

QinetiQ Group

As with Rolls-Royce, QinetiQ Group (LSE:QQ.) shares have been boosted by strong conditions in the defence market. But with a forward P/E ratio of 11.8 times, the business still offers top value, in my opinion.

The defence sector average sits considerably higher, at around 32 times.

Business is booming at QinetiQ as the West responds to rising tension with Russia and China. Organic sales and operating profit rose 19% and 25% respectively in the six months to September. New orders meanwhile, struck record highs of £953m.

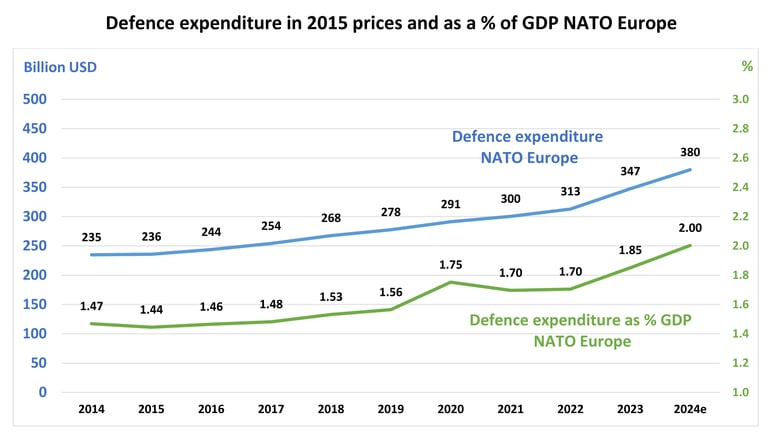

Revenues growth could lose momentum once Western arsenals are rebuilt. But for the time being, rapid rearmament measures look set to accelerate. NATO expects spending among its members to continue rising in 2024 following an “unprecedented” step up in spending among European allies and Canada last year.

Against this backdrop, City brokers expect QinetiQ’s annual earnings to rise 11% in each of the next two years.

Vodafone Group

Unlike Rolls-Royce and QinetiQ, Vodafone Group‘s (LSE:VOD) share price has been underperforming for years. The telecoms giant’s struggled to grow profits as tough conditions in Germany and huge capital expenditure have weighed.

These remain risks. But City analysts believe the Footsie firm could be about to turn the corner. Earnings are tipped to jump 22% and 18% in the next two fiscal years.

As a consequence, Vodafone shares trade on a forward P/E ratio of just 9.2 times. At these levels I think it’s worth considering opening a position.

In Germany — where revenues have been hammered by recent changes to service bundling laws — conditions are beginning to improve. The company’s also recently sold its Spanish and Italian divisions to raise much-needed cash and sharpen its focus on its core markets.

Vodafone can also expect demand in its African territories to keep surging, now and in the years ahead. Service revenues at its majority-owned Vodacom unit leapt 8.8% between September and December.