Stock in artificial intelligence (AI) darling Nvidia (NASDAQ: NVDA) has taken the market by storm. In the last year, it’s up 219.1%.

But have investors who are considering buying shares today missed the boat? Given the attention the business is attracting, it’s an important question that I want to answer.

Any value left?

I want to see if there’s any value left to squeeze out of the Nvidia share price today. There are a few ways I can go about this.

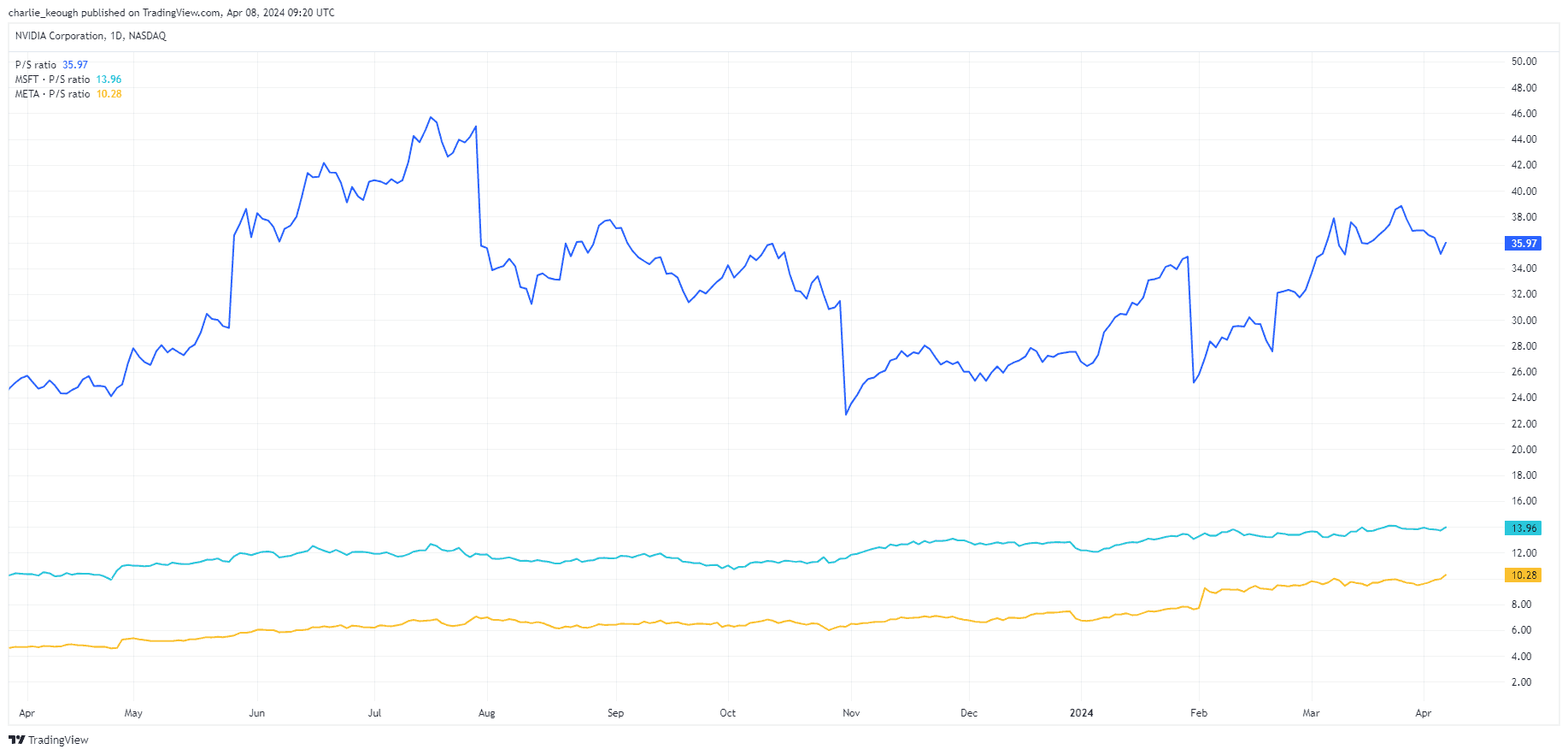

One is by looking at its price-to-sales (P/S) ratio. For Nvidia, this sits at 35.97. As we can see, that looks extremely overvalued when compared to some of its peers that form the ‘Magnificent Seven’ such as Microsoft and Meta.

Created at TradingView

Created at TradingView

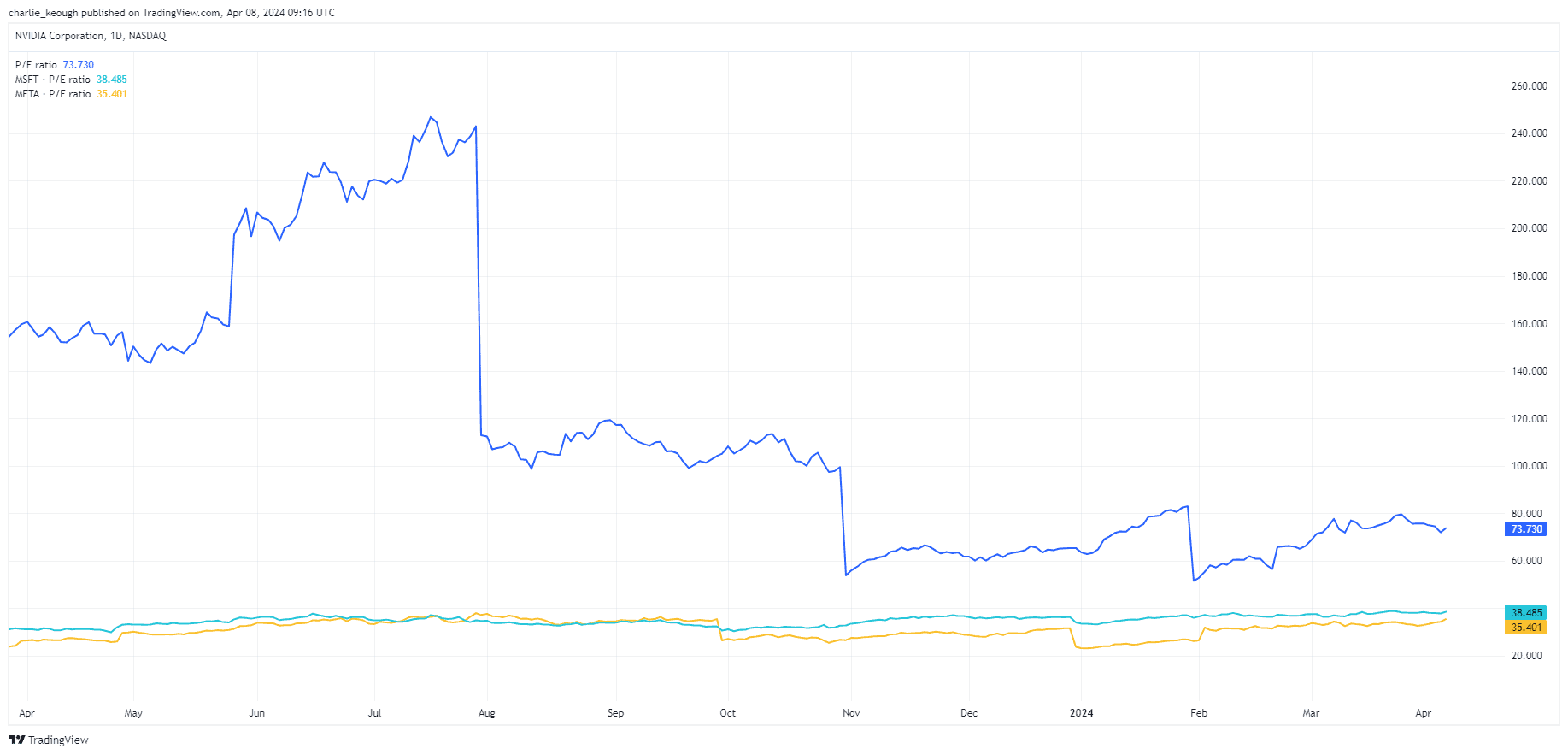

Comparing its price-to-earnings (P/E) ratio also paints a similar picture. Nvidia’s trailing P/E is 73.73. That’s well over three times the S&P 500 average (23.3).

Created at TradingView

Created at TradingView

Talks of a bubble

Going on the above, I don’t see much value in Nvidia stock at the moment. That’s probably why there’s been talk of a bubble. There’s a lot of hype around the business. Some think the risk is that retail investors are driving Nvidia’s price higher.

With that comes the potential for large bouts of volatility. A handful of institutional investors have been reducing their positions as a result.

It keeps smashing it

But should investors really be listening to this noise? The firm keeps beating expectations. What’s not to like about a company performing at the incredible level that this one is?

Last year its revenues rose 126% to $60.9bn. In the last quarter, its sales climbed a whopping 265%. It’s expected the business will keep up this fine form. By 2025, revenue is predicted to top $105bn.

While analyst forecasts shouldn’t be taken as fully reliable, some predict the stock will rise as high as $971. That’s a 10.3% premium to its current price of $880.

AI revolution

Don’t get me wrong, I’m bullish on the long-term outlook for Nvidia. The AI industry will go from strength to strength in the years and decades to come and businesses like Nvidia will be a key driving force in shaping the sector.

Even so, I don’t deem its valuation attractive at its current price. I hold Nvidia shares so I’m not looking to add to my holdings right now.

The threat is that the stock gets pulled back. Yes, it has posted impressive figures. But it’ll be impossible for the business to persist with its current sales and earnings growth.

Some shareholders will have come to expect so much that I’m conscious we could see the stock recoil at the first sign of any slowdown.

Nevertheless, I do see attractive opportunities out there for investors looking to gain exposure to the AI revolution.

That includes some of the names above, such as Microsoft. Two other stocks that are piquing my interest are Scottish Mortgage Investment Trust and London Stock Exchange Group. I’ll be delving into those companies in the weeks ahead.