The Footsie is creeping towards record territory and interest rates are hopefully set to be reduced this summer. In theory, this is a great recipe for FTSE 100 shares and we may see a new bull market.

Of course, I can’t say for sure the next one is imminent (nobody can). But history has shown repeatedly that it’s just a matter of time before the bulls start charging again.

So, I’d get ahead of the curve now and start snapping up shares. Here are two that I’d add to my portfolio if I had spare cash lying around.

Down but not out

First up is Diageo (LSE: DGE). This is the world’s largest spirits company, which means I’d struggle to find a drinks cabinet or bar lacking any of its brands.

Diageo top brands

However, the share price has been struggling. In fact, it was higher five years ago and recently hit a 52-week low. Speaking as a shareholder, this is disappointing.

What’s been going on? Well, the main issue is that sales have been lower than expected lately, notably in Latin America and the Caribbean.

During H1, sales there plunged 23.5% year on year, and the firm expects a further double-digit decline in H2 (ending in August).

Basically, there was a build-up of unsold products in key markets across the region, where cash-strapped drinkers have been downgrading from premium brands.

A risk here is that other regions start showing weakness. That could see the share price take another leg down.

However, I’m inclined to see this dip as a long-term buying opportunity. Its premium brands, such as Don Julio tequila and Johnnie Walker whisky, still have significant growth potential in international markets like China and India where disposable incomes are rising.

The shares are trading on a forward-looking price-to-earnings (P/E) ratio of 19.4, with a prospective dividend yield of 2.8%. That appears attractive.

Looking ahead, Diageo aims to grow its share of the global beverage alcohol market to 6% by 2030. For context, it was 4.7% in 2022. And while that might not sound much, it is in fact a huge opportunity for the firm.

Bottling bigwig

The second stock I’d buy for the next bull market is Coca-Cola HBC (LSE: CCH).

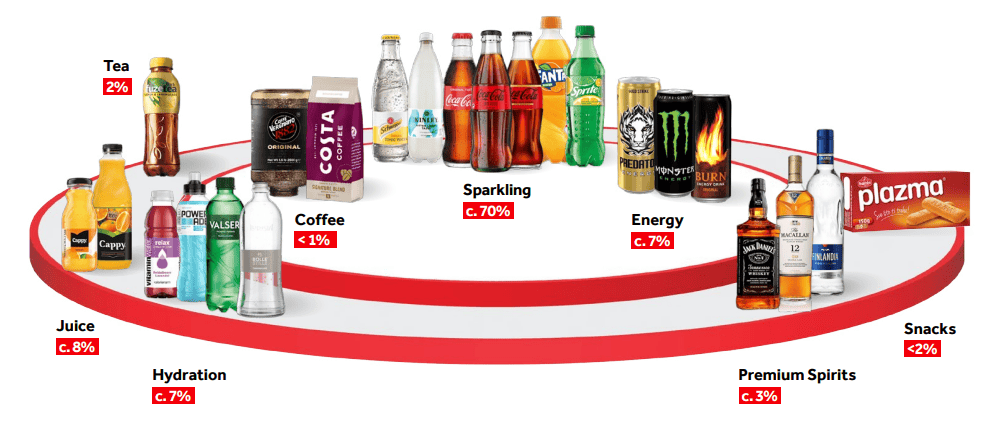

This is a Switzerland-based bottling partner for Coca-Cola. The firm produces, sells and distributes various beverage brands in 29 countries across Western, Central and Eastern Europe, and Africa.

Below, we can see that the bulk of revenue (about 70%) in 2023 came from the sparkling category (Coke, Fanta, Sprite, Schweppes, etc). However, it’s well-diversified across other areas of consumer packaged goods.

Last year, net sales revenue rose 10.7% year on year to €10.2bn – the third straight year of double-digit growth – while the dividend was hiked 19%.

The yield is 3.4%, but the payout has been growing at a compound annual growth rate (CAGR) of 10.3%. Complementing the dividend is a €400m share buyback programme launched in November.

Now, one issue here is that Coca-Cola owns approximately 23.2% of the outstanding shares. If it started selling them off, that could cause some volatility.

However, trading at just 13 times forecast earnings, the stock offers fantastic value. I don’t see Coke‘s popularity fading overnight.