There are few investments in the UK I am as confident about as I am in Greggs (LSE:GRG) shares. I think the company has stellar growth, both in the past and estimated to come.

Also, with what I deem to be a good valuation at the moment, the firm’s risks just can’t seem to deter me.

Here’s why the investment is high up on my watchlist right now.

Top of the British bakery world

If you live in the UK, you have likely heard of Greggs. It certainly has a presence in almost all major towns and cities across the country.

The business particularly appeals to customers who are looking for convenience, cheap prices, and filling foods. However, for me, the more appetising aspect of the business is its shares.

An immense track record

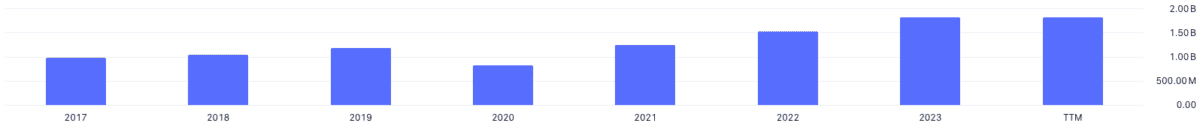

Greggs has had an incredible history of great performance in its shareholders. In fact, over the past decade, the shares have appreciated in price by 455%:

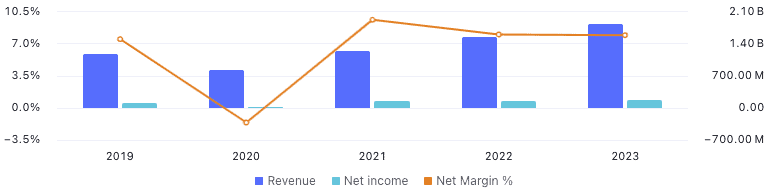

Investors who bought in during the pandemic dip in 2020 have gotten very lucky. Over the past three years, the firm has managed to grow its revenues by 30% annually from its setback during the crisis. Its revenue growth has been more like 9% annually over the past decade.

But where this company really shines is in its profitability. It has a net income margin of almost 8%, which out-competes 89% of other businesses in its industry.

I think one of the things Greggs has shown promise in, which has supported its financials, is making itself adaptive to consumer trends. For example, as veganism started to become all the rage, Greggs introduced the vegan sausage and vegan steak bake. This contributed to significant sales growth.

Good value for money

Greggs products have a reputation for being good value, and I think the shares can be considered so, too, at the moment.

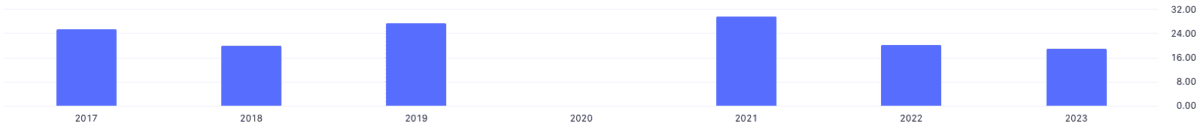

You see, while the investment sells at a high price-to-earnings ratio of around 20 right now, over the past 10 years, it’s been normal for this to be roughly 21.

Considering that analysts expect its earnings to grow at a compound annual growth rate of 9.6% over the next two years, I think the present valuation of the business is appealing.

What about the risks?

All of the above suggests that I think Greggs is in for a stellar future, continuing on from its prosperous past. However, every investment comes with a set of risks.

As the company is dependent on the UK market for all of its revenue, it unfortunately might find that it struggles more than global businesses during a British recession.

Also, Greggs is considered a less healthy option, and with massive health trends underway, I can see its total addressable market shrinking if it doesn’t evolve more aggressively to satisfy the changing market.

I think it’s a fantastic investment

This is undeniably one of the strongest businesses in the country based on financial performance. The growth doesn’t look set to stop any time soon, either.

So, Greggs is high up on my watchlist for when I next invest.