Vodafone Group‘s (LSE:VOD) share price has shown signs of life in recent weeks. But the FTSE 100 stock remains much cheaper than it was a year ago. So I’m considering whether it could be one of the index’s best value shares to buy right now.

Let me talk you through why I think it could be too cheap to miss.

Earnings

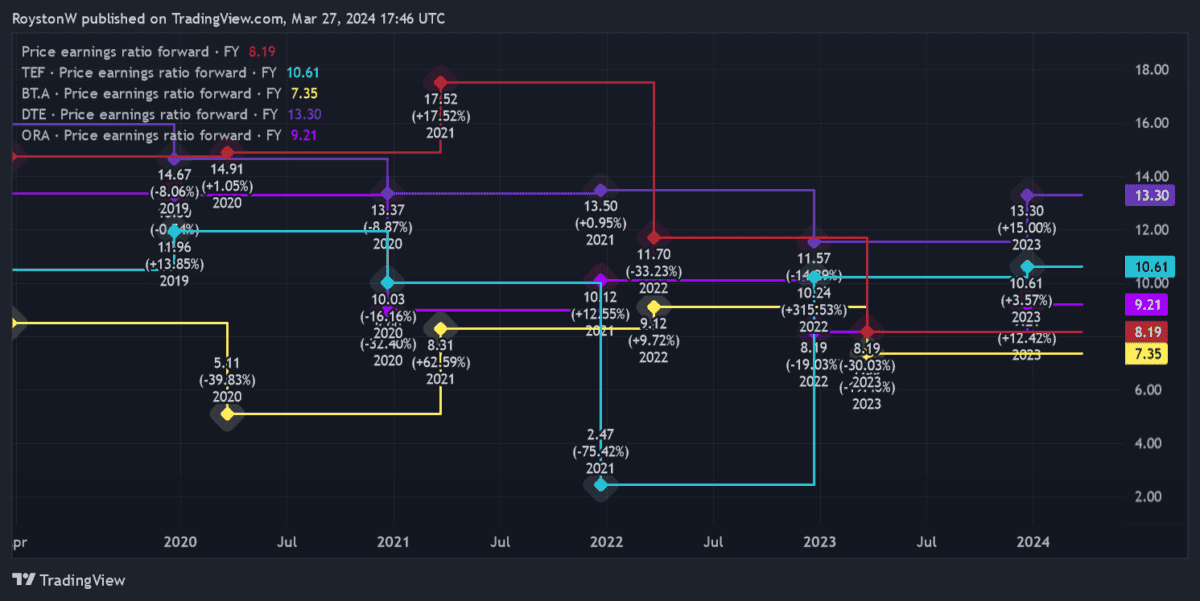

The first thing to analyse is Vodafone’s share price relative to its projected earnings. I’ll do this using the price-to-earnings (P/E) ratio.

As the chart shows, the company’s forward-looking multiple sits at around 8.2 times, beneath the corresponding readings of rivals (in descending order) Deutsche Telekom, Telefonica, and Orange.

Only fellow Footsie share BT Group trades on a lower ratio. Furthermore, Vodafone’s P/E ratio is also below the FTSE 100 average of 10.5 times.

A low earnings multiple is often associated with shares that have poor growth prospects. But this isn’t an accusation that can be thrown Vodafone’s way, at least if City analysts are to be believed.

The firm’s forecast to grow earnings 19% in the current financial year (to March 2025). And the bottom line’s tipped to swell an extra 17% in fiscal 2026 too.

As a consequence, Vodafone shares also trade on price-to-earnings growth (PEG) ratio of 0.5. Any reading below 1 indicates a share is undervalued.

Dividends

Next, we’ll have a look at the dividend yield, which expresses dividend income as a percentage of the current share price.

Last month, Vodafone announced plans to rebase the dividend to 4.5 euro cents per share. As you can see, this means it lags all of its rivals (bar Deutsche Telekom) when it comes to yield.

| Stock | Forward dividend yield |

|---|---|

| Vodafone | 5.5% |

| Deutsche Telekom | 3.8% |

| Telefonica | 7.3% |

| Orange | 6.9% |

| BT | 6.9% |

That doesn’t mean the yield’s been bombed out however. It still comfortably beats the broader FTSE 100’s forward average of 3.7%.

Assets

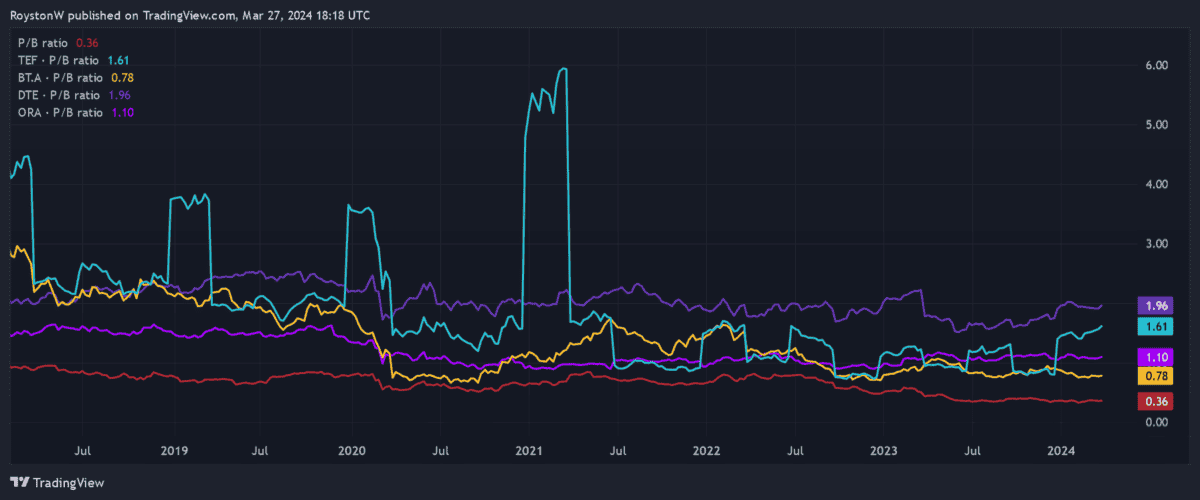

The final step is to consider Vodafone’s share price relative to the value of its assets. I can do this with the price-to-book (P/B) ratio, which divides the total book value (assets minus liabilities) by the total number of outstanding shares.

Any reading below 1 indicates that a share is cheap based on its assets. Vodafone’s reading comes out under 0.4.

On top of this, the firm’s P/B ratio also sits below those of all its industry rivals (in descending order these are Deutsche Telekom, Telefonica, Orange, and BT).

Should I buy Vodafone shares?

All things considered, I think Vodafone is a bargain at its current price around 69p. Despite that recent dividend cut, it still offers an excellent dividend yield, while the firm also looks mega cheap using those other metrics.

There’s still much uncertainty hanging over the telecoms giant. Its turnaround in the key German market’s only in its early stages, for instance. And its fibre broadband and 5G rollout programme is massively expensive and could impact future dividends.

But the long-term outlook here remains attractive, in my opinion. Huge restructuring could leave Vodafone in a great place to effectively exploit the rising digitalisation across Europe and Africa. Now could be a good time to consider opening a position given the cheapness of its shares.