The FTSE 100 isn’t short of great companies, but this is one that I think particularly stands out. It’s the leading UK online marketplace for cars, and I believe it’s positioned to grow significantly over the next 10 years based on high long-term growth in digital versus physical retail options.

The online car showroom

Auto Trader (LSE:AUTO) doesn’t only act as an online vehicle marketplace in the UK and Ireland, it also provides car insurance, loans, valuations, and vehicle check services.

As we’ve seen, there has been massive change in retail with online giants like Amazon. The vehicle marketplace and showroom business has gone through a significant and similar shift. Companies that got into this early and rode the internet wave have done remarkably well, Auto Trader included.

An online marketplace for cars at the scale provided by the firm is particularly appealing because of the seemingly endless choice of vehicles. This is something physical showrooms can’t even begin to compete with.

Exceptional financials

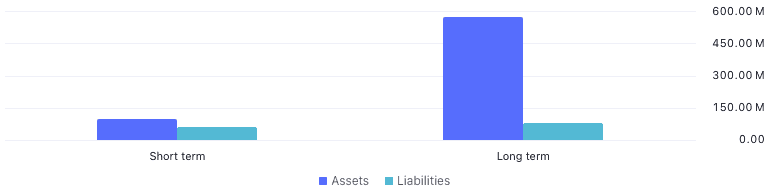

The company’s balance sheet took my interest initially. It has a lot more equity than liabilities. This means with low levels of debt, the company is more agile to innovate and expand.

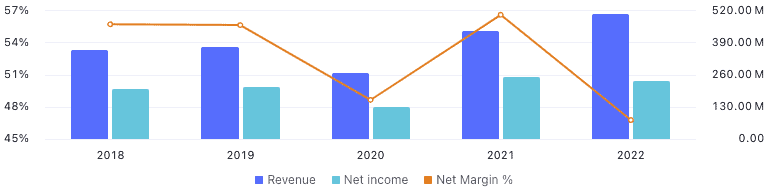

Also, while its net margin has seen some contraction recently, it’s astronomically high, at 44%.

And its revenue growth is faster than ever at the moment. Over the past three years, it’s been 10.1%, higher than its 8.7% 10-year median.

What’s more, leading analysts are expecting, on consensus, a 17% compound annual growth rate in earnings for the firm over the next three years.

This is undeniably a company that’s leading in almost all fields of its financial performance. There’s only one area that significantly worries me: the valuation.

No margin of safety

Shares that are selling at around what they’re believed to be worth have no margin of safety. This is a famous term coined by Warren Buffett‘s mentor, Benjamin Graham.

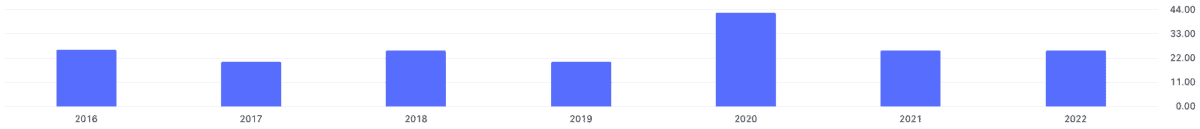

From my analysis, Auto Trader is in this position. After all, over the past 10 years, its median price-to-earnings ratio has been 26. Today, it’s 30. I feel the slightly higher number is warranted due to increased growth momentum, and there’s certainly no discount here.

Other risks

We’re also at the start of a pweriod when the internet is going through a significant shift. We’re moving from a Web2 to a Web3 world.

With artificial intelligence (AI) thrown into the picture, it’s becoming increasingly important for Auto Trader to remain agile, to iterate, and to adopt new technology to meet demand.

Additionally, AI hasn’t only helped enterprise productivity and capability, but it’s also fuelling criminal cyberattacks. As such, Auto Trader is going to face higher threats to its customer and business data than ever before.

High up on my watchlist

But I still consider this one of the best investments in Britain. It’s high up on my watchlist, and I may well invest in it in the coming months.