One of my favourite ways to invest for passive income is through a real estate investment trust (REIT). I believe there are some truly excellent examples of these out there, and my favourites are usually American firms.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

This business I’ve found offers three compelling selling points for me:

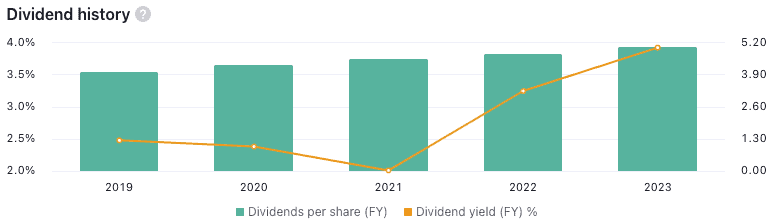

- A yield of 4%, which is in line with average rental yields in the US.

- A share price down 40% from its all-time high.

- Its tenant market, which I consider much less vulnerable than for other REITs. After all, Alexandria Real Estate (NYSE:ARE) leases space to life science and technology clients. These clients are often considered high quality. They engage in long-term leases, providing predictable revenue streams.

10-year median dividend yield = 2.9% | In $ | Source: TradingView

A closer look at the opportunity

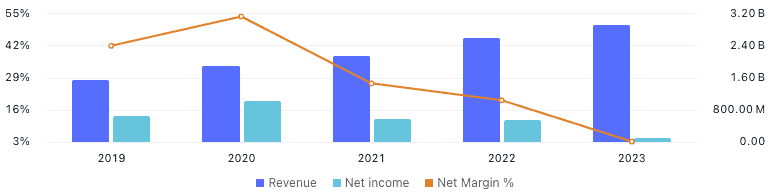

The company has much stronger revenue growth than net income growth. Part of the reason the share price has taken such a knock recently is those falling net profits.

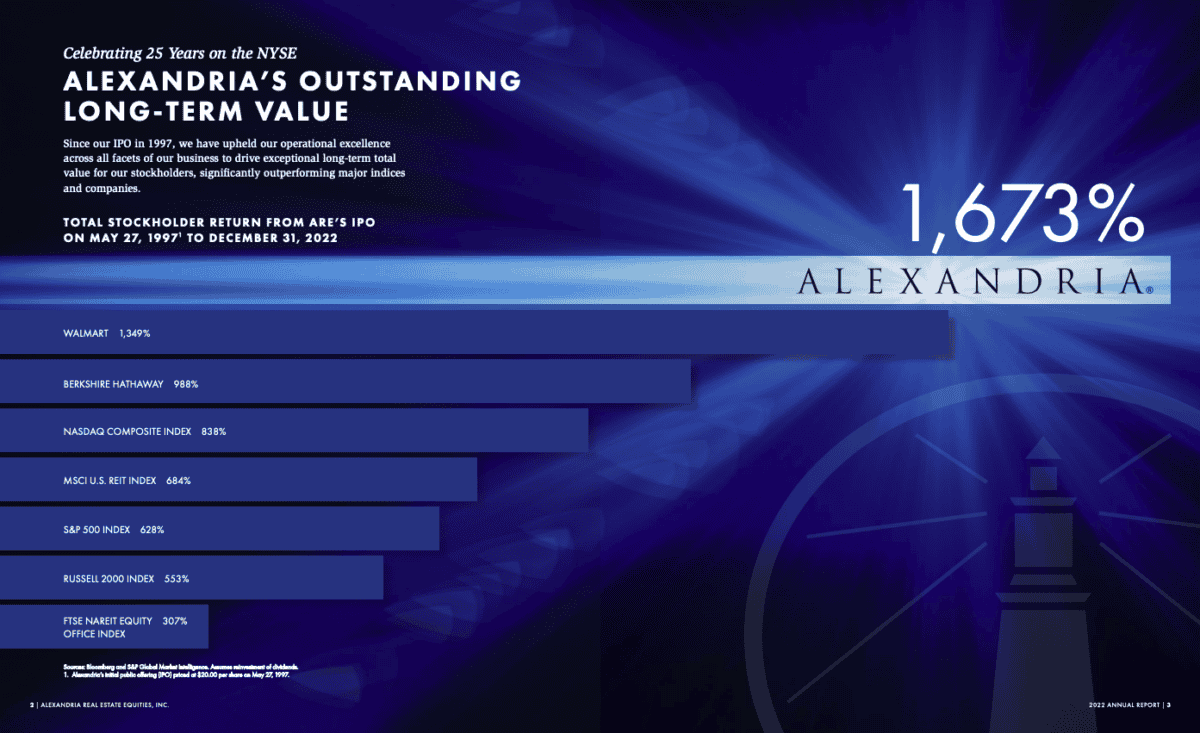

However, I think this is somewhat temporary. While past returns are no guarantee of future results, the firm’s earnings have been up and down historically, but the shares have continued to outperform massive major US businesses.

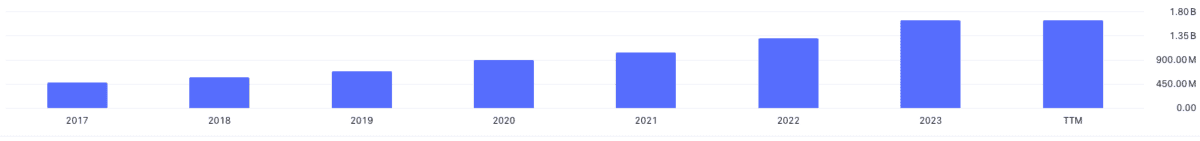

Where the firm has really managed to succeed is in growing its free cash flow over time. I think this is the better metric for ascertaining a business’s long-term fundamental value.

After all, profits are one thing, but real cash left after accounting for all of the expenses on this net income on the cash flow statement is what matters most.

Is it good value for money?

The best metric for ascertaining the value of these shares isn’t price-to-earnings. Instead, it’s a measure called price-to-funds from operations. This adjusts for the unique factors of the real estate business, like property appreciation, making it more relevant.

And at this time, Alexandria has a price-to-funds from operations ratio of 14.6. That’s just slightly higher than the industry norm of around 13. That means the shares are reasonably valued, in my opinion, because its financials look slightly better than the wider industry, justifying a slight premium in the valuation.

My core risks

Yet there are some considerable risks with this firm, even though I think it’s still worth my money.

For example, over the past three years, there have been 297,000 shares sold by people working for Alexandria Real Estate. During the same period, none of the insiders have bought more equity.

I find insider sales particularly telling, as they can often signify that those within the company know the firm has seen its best days.

Also, while protected somewhat by strong tenants in life sciences and tech, there’s always the chance of a downturn in these industries. If that happens, investors could face serious losses that are less likely in more diversified real estate firms. This is especially true because Alexandria gets all of its revenue from US tenants.

On my dividend watchlist

But this company looks strong to me. Even considering the risks, my feeling is that it will continue to do well long term.

That’s why it’s on my watchlist for when I next make some investments.