The FTSE 100 is packed with brilliant value shares right now. The UK’s premier share index has recovered ground from the lows of late 2022. But many top stocks continue to trade well below their true value.

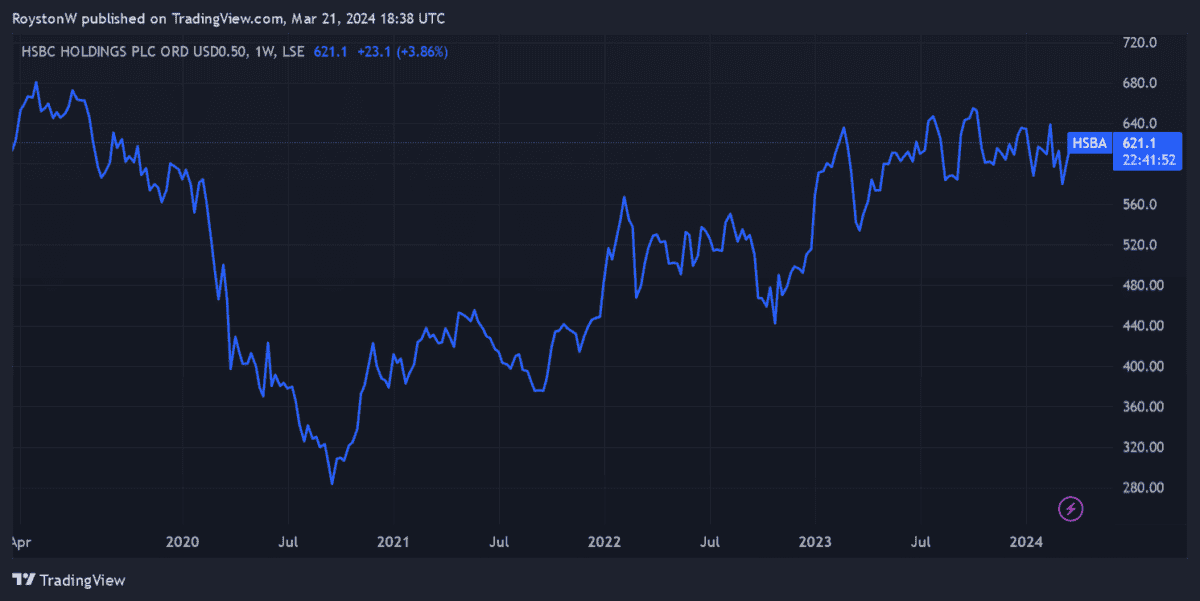

Take HSBC Holdings (LSE:HSBA) for instance. In my opinion it’s the Footsie’s greatest banking stock to buy at current prices. Let me show you why.

Earnings

The first thing to look at is how cheap the bank’s shares are in relation to the value of its earnings. At 621p per share, it trades on an historical price-to-earnings (P/E) ratio of just 6.7 times. This is well below the FTSE 100 average of 11 times.

As the table below shows, this figure is also in and around the forward earnings multiples of Lloyds and Barclays. Fellow emerging market bank Standard Chartered is more expensive on this metric, while NatWest is the best priced.

| Bank | P/E ratio |

|---|---|

| Lloyds Banking Group | 6.6 times |

| Barclays | 6.5 times |

| NatWest Group | 4.9 times |

| Standard Chartered | 7.9 times |

The average P/E ratio for all five firms sits at 6.5, meaning HSBC trades at a fractional premium to the group.

Dividends

The dividend yield is another useful way to assess the bank’s value. This expresses dividend income as a percentage of the current share price.

Today, HSBC’s historical yield comes in at 7.9%. By comparision, the wider FTSE 100 average sits way back at 3.7%.

And as the table illustrates, HSBC’s yield smashes each of those of its Footsie peers on this metric. It’s a full percentage point ahead of second-placed NatWest’s yield. It’s also well above the group’s average of 5.5%.

| Bank | Dividend yield |

|---|---|

| Lloyds Banking Group | 5% |

| Barclays | 4.7% |

| NatWest Group | 6.9% |

| Standard Chartered | 3.2% |

Assets

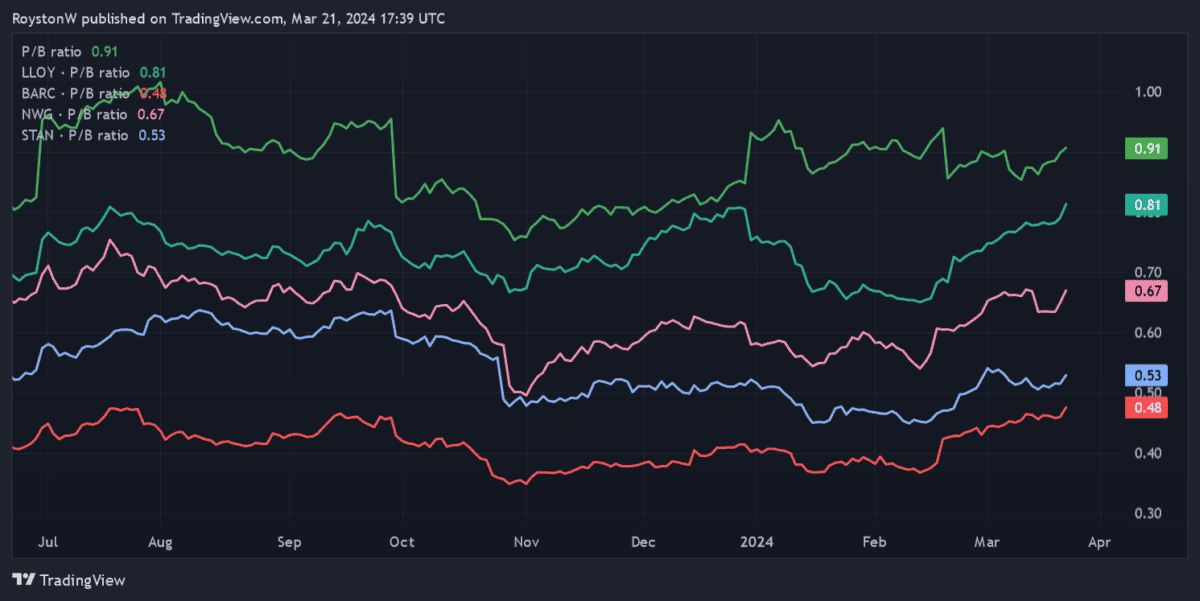

The final thing to look at is how HSBC shares are valued relative to the company’s assets. One way to do this is to consider its price-to-book (P/B) value, which divides the total book value (assets minus liabilities) by the total number of shares outstanding.

As we can see, HSBC shares trade on a higher P/B value than each of the FTSE 100’s other major banks. At 0.91, its ratio is almost twice as great as that of Barclays.

Having said that, the bank still looks dirt cheap using this metric. Any reading below 1 suggests a company’s trading below the value of its assets.

The verdict

On reflection, HSBC doesn’t look incredibly cheap compared to its peers. Indeed, it only really looks like a standout value share when it comes to dividend yield.

But all things considered, it still seems to offer excellent value when looking at earnings, dividends and assets. And I’d certainly rather buy it than any of those other FTSE banks.

HSBC does face some uncertainty over the short term as China’s economy splutters. But the long-term outlook for the country and wider region — and, by extension, for the bank — remains outstanding.

Banking product penetration in its emerging markets remains extremely low. And as population levels and personal incomes there steadily rise, HSBC has an excellent chance to grow profits.

I think it’s one of the best FTSE 100 value shares to consider buying today.