There are not many dividend shares that have raised their per-share payout annually for decades. But there are some.

One such Dividend Aristocrat is FTSE 250 food producer Cranswick (LSE: CWK). It makes sandwiches and other foods for trade customers such as supermarkets.

The storied dividend share is not cheap. But I am tempted to buy it nonetheless.

Proven business model

Food manufacturing may not sound like the most exciting of businesses. But one advantage it has is resilient demand. No matter what happens to the economy, people need to eat.

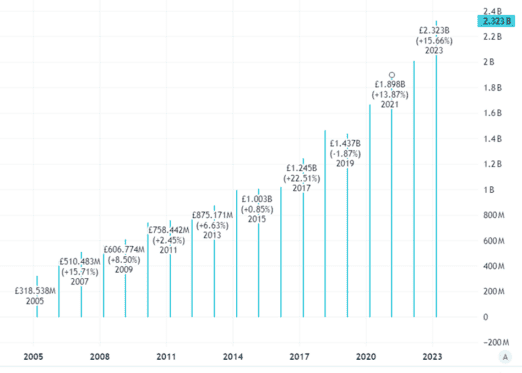

Cranswick has done a good job in growing its revenue over the long term.

Source: TradingView

But revenue is one thing. What about profits? After all, food production can be a low-margin business. By processing food, Cranswick adds value in the supply chain, helping margins.

Last year, post-tax profit was £111m on £2.3bn revenues. That is a net profit margin of 4.8%. Maybe not impressive, but in the highly competitive food industry I think it is decent.

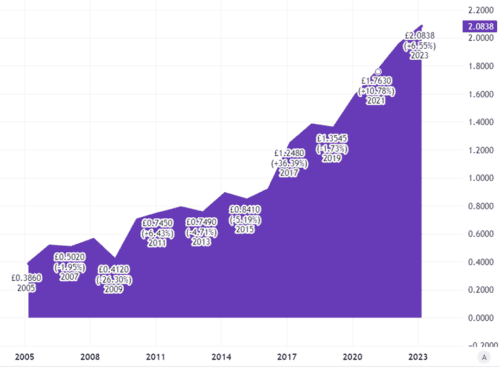

This chart shows how earnings per share have grown over time too. I see that as a positive attribute of the Cranswick business.

Source: TradingView

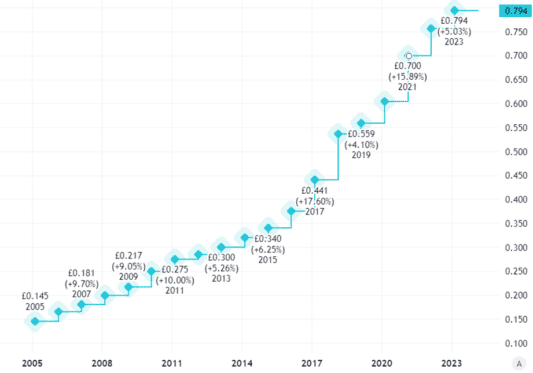

That improving profitability has helped to support the dividend share’s superb track record of shareholder payouts.

Source: TradingView

Where things go from here

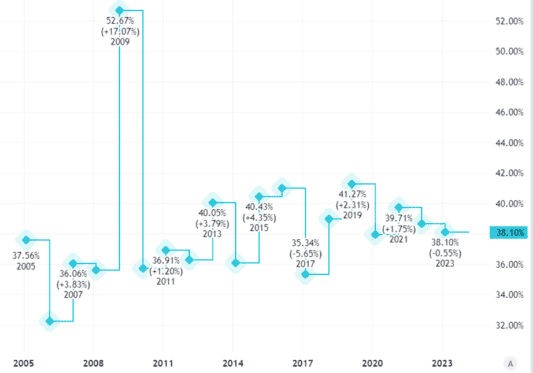

However, dividends are never guaranteed. Cranswick’s is covered more than twice by earnings. I see that as a comfortable level of coverage.

Source: TradingView

But whether the dividend is maintained, let alone keeps rising regularly, will ultimately depend on performance.

The business said in January that its adjusted pre-tax profit for the year ought to beat previous expectations.

But like any company, it does face risks. Food cost and wage inflation can eat into the bottom line. The costs of expanding and automating production facilities such as a new hummus factory in Greater Manchester could also impact earnings.

But I like the proven business model and have high hopes for the company’s future success.

Should I buy?

This month has seen a director and his wife sell shares, for ‘personal financial planning’.

Currently trading on a price-to-earnings (P/E) ratio of 18, I do not think the shares look cheap. But is it expensive? I think that depends on how Cranswick delivers in coming years.

I have been tempted to buy repeatedly in recent years and did not. The share has moved up 52% in five years. Indeed, it is up 39% just in the past 12 months. If business performance keeps improving, I think there could be room for further price growth.

I would like a wider margin of safety though. A P/E ratio of 18 does not give me that, I feel.

So for now, tempted though I am to buy this dividend share for my portfolio, I will instead just keep it on my watchlist.