Lately, it has seemed like every single major index in the world has hit a new record high except for the FTSE 100.

However, that might be about to change because the Footsie has been creeping up and is now within striking distance of the 8,000 points it briefly reached in early 2023.

Here’s why I think it will breeze past its record close of 8,012 this year.

It’s all about the rates

The market now appears to be pricing in three central bank interest rate cuts by the end of this year. That would take the base rate down to 4.5%.

That’s not an unreasonable assumption given that inflation has been falling rapidly.

In fact, Bank of England Governor Andrew Bailey said markets are “reasonable” to expect more than one rate cut in 2024 given that UK inflation is moving in the “right direction”.

Compared to his usually cautious tone, that’s actually bullishness.

Meanwhile, forecasts for FTSE 100 earnings, dividends, and buybacks remain strong for this year and next.

Given all this, it’s hard not to be optimistic. And I’ve just been reading that economists at KPMG see interest rates falling to 3% in 2025. In that scenario, stocks will surely rise, won’t they?

Inviting egg on my face then, I’m going to say the FTSE 100 will end the year above 8,500.

This stock could have further to run

One Footsie share I see continuing to do well is Pershing Square Holdings (LSE: PSH).

This is the investment trust vehicle of billionaire hedge fund manager Bill Ackman.

The share price has been on an absolute tear, rising 48% in one year and 212% over five.

In 2023, Pershing generated a 26.7% net return, slightly ahead of the S&P 500. Incredibly, this was achieved only holding one of the ‘Magnificent Seven’ (Alphabet).

Since inception in 2004, the fund has delivered a cumulative total net asset value (NAV) return of 2,078% versus 592% for the S&P 500.

This has been achieved through holding a very concentrated portfolio of 8-12 stocks, as well as perfectly-timed macro bets using derivatives (common for hedge funds).

In early 2020, for example, Ackman made $2.6bn from a $27m outlay – almost a 100-fold return – betting that a Covid outbreak would cause a market crash. This opportunism helped offset the steep market falls.

Of course, derivatives add complexity and can increase risk. And the high-conviction portfolio means one or two laggards could drag badly on annual performance.

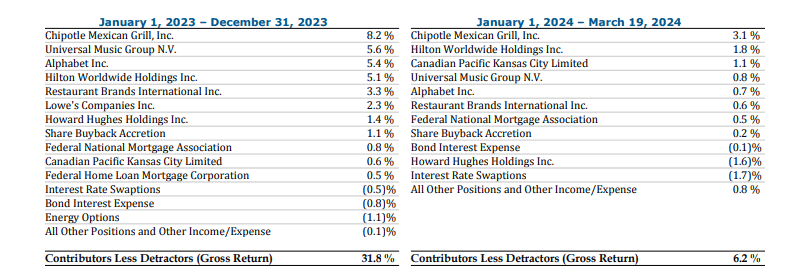

Below are the contributors and detractors to performance in 2023 and 2024 (up to 19 March).

Despite this outperformance, the shares at £41 are still trading at a 23% discount to the fund’s NAV. A perennial issue here has been the high management and performance fees.

However, Ackman’s long-term goal is to reduce performance fees to zero with strong returns and the launch of new funds. One of those forthcoming funds is a US-listed one called Pershing Square USA.

It will largely mirror the established investment strategy, but without additional performance fees. Ackman aims to raise $10bn for this.

I think this fund’s launch, coupled with a rising FTSE 100, could see the stock head higher. I’m already a shareholder, but I’d happily invest again with spare cash.