Nvidia (NASDAQ: NVDA) stock has become synonymous with the artificial intelligence (AI) boom. And with good reason too, as the firm controls about 90% of the AI chip market, according to most estimates.

Following the November 2022 release of ChatGPT, which was trained using thousands of Nvidia’s graphics processing units (GPUs), the stock took off like a rocket. It ended 2023 nearly 239% higher!

But how much would I have today if I’d invested £5k in the stock at the start of this year? Let’s take a look.

I’d be well ahead

The share price ended 2023 at $495. As I write, it’s at $796, which represents a gain of 61%.

This means that my five grand investment would now be worth around £8,050, on paper. Nice.

Nvidia also pays a dividend, but it’s miniscule so is hardly worth calculating. No investor has been buying shares of the world leader in AI computing for dividends!

Unprecedented growth at scale

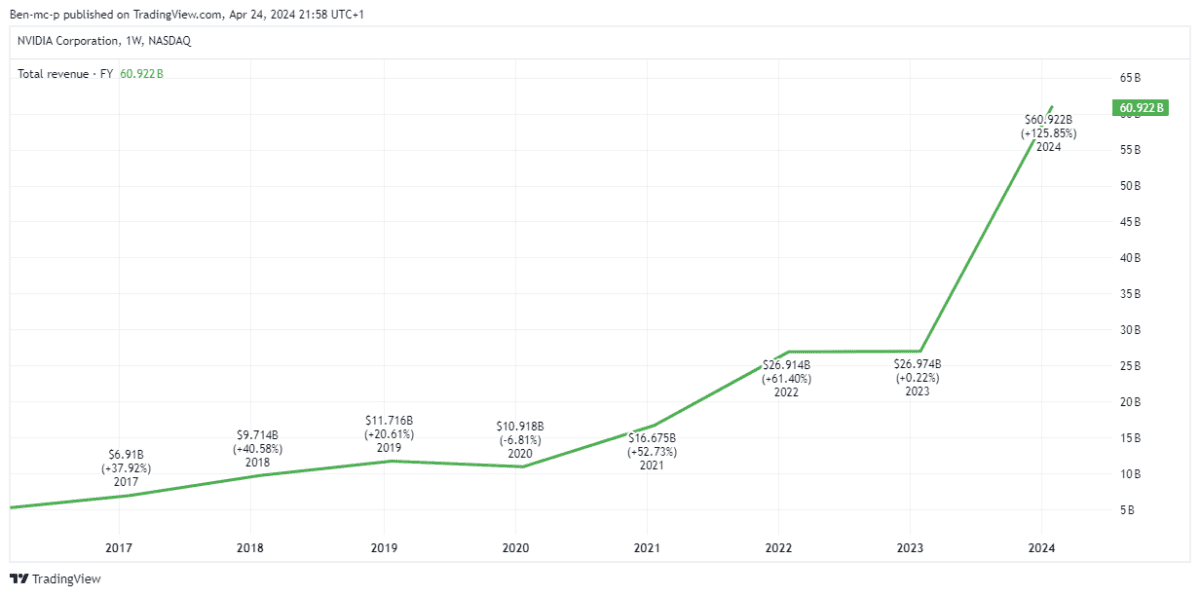

The rate of growth at Nvidia last year was truly breathtaking. In fact, I’ve never seen anything like it from an already very large company. And I’m not sure we will witness such a thing again.

| Revenue | Operating profit | |

| FY 2025 (forecast) | $112bn | $72.8bn |

| FY 2024* | $60.9bn | $37.1bn |

| FY 2023 | $27bn | $9bn |

As we can see, the firm is expected to more than quadruple its revenue in three years. And increase its operating profit by around 700%.

Last year, its data centre business generated $47.5bn in revenue compared to $15bn in the previous year.

What exactly is fuelling this insane growth?

Well, cloud computing giants like Amazon, Google and Microsoft have been lining up to get their hands on tens of thousands of the firm’s data centre GPUs. These are used to train and power their large language models (LLMs).

Essentially then, we’re bang in the middle of an AI ‘arms race’ and Nvidia is selling the ammo to all sides. It has been struggling to keep up with demand.

I had concerns

Given this, it may be surprising to learn that I offloaded my Nvidia shares last month. I did so with a heavy heart because I think this is clearly one of the world’s greatest firms.

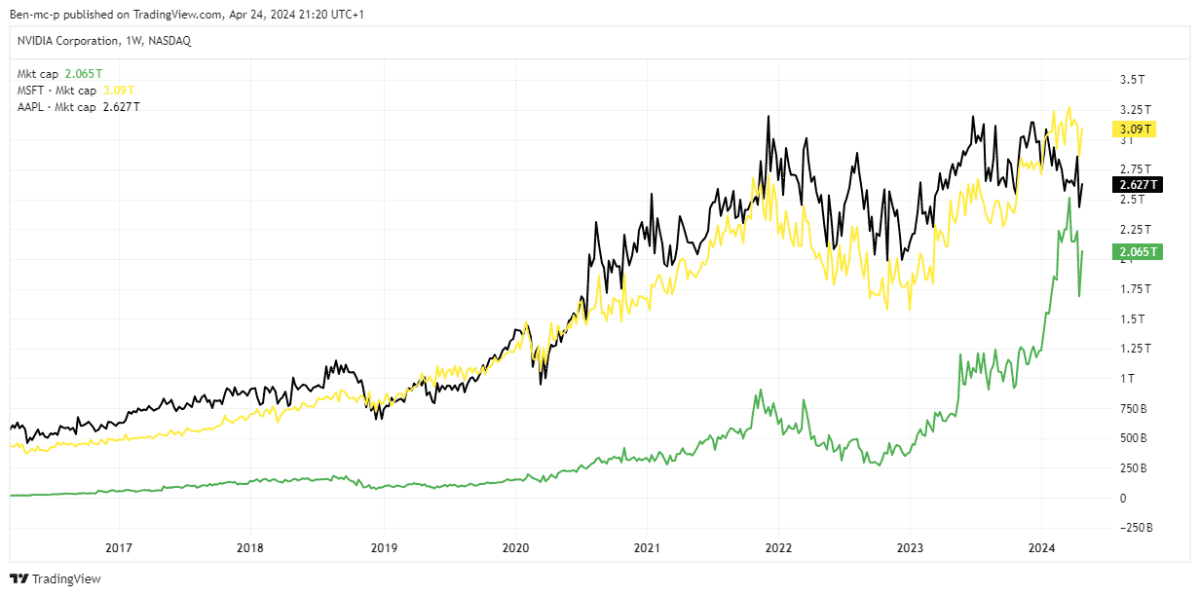

But when I sold, Nvidia had become a $2.2trn company. If the stock surged another 200%, the firm’s market cap would be more than Apple and Microsoft combined.

That is still broadly the case today, even after a pullback in the Nvidia share price.

However, this didn’t sit well with me. Apple and Microsoft currently have stronger foundations in recurring revenue streams. Indeed, I see both of these companies as predictable tech utilities.

Consequently, I reckon their earnings are far less likely to drop off a cliff, as Nvidia’s could at some point if AI mania wears off. So I cashed out.

All eyes on guidance

Of course, I may come to regret my decision. Analysts see the firm increasing its earnings at an annualised rate of 35% over the next few years.

If it achieves that, then we may well see it become the world’s largest company by market cap.

The next key thing for Nvidia investors is the forward guidance given in Q1 results due 22 May. That will almost certainly dictate where the share price heads next.