When looking for a strong dividend investment from the FTSE, I want two main things.

- A great dividend yield

- A good probability of the shares growing in price, long term

Thankfully, OSB Group (LSE:OSB) seems to have both. In fact, its price is up 127% over the past decade, and its yield is currently 8%. While past returns are no guarantee of future results, those statistics look promising to me.

I could earn from mortgages

OSB is a British specialist in lending money and offering savings accounts for both people and businesses.

Here’s a quick breakdown of its core operations:

- Special loans: these include for buying rental properties, for small businesses, and for people buying homes in unique situations

- Savings accounts: these are for people wanting to save money over a range of periods, which helps OSB gather funds to lend to others

- Business loans: these help businesses for various reasons, but usually for expansion purposes or during periods of economic pressure

So, if I decide to invest in OSB, I’d actually be earning from the mortgages of others. I think many would agree that’s a refreshing break from owing money to a bank for property.

I consider it a strong investment

Here are the main statistics that I particularly like about the company:

- It has a net margin of 43%, which is at the top of its industry

- It has a three-year revenue growth rate of 12.7%, which is competitive

- Analysts are expecting earnings to grow at 43% over the next year and 20.6% annually over the next three years

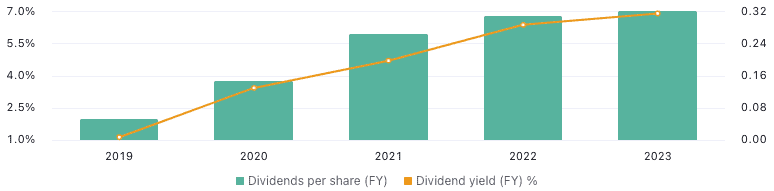

Also, let’s look at the dividend history, which is remarkably strong, in my opinion. Consider the following graph, showing healthy growth in passive income over the past five years:

One of the things I like about OSB is that it has a niche in specialist lending in the mortgage sector. Because its expertise is in these unique situations for property buyers, it means it has cornered a small portion of the market. That could protect its revenue and dividend over the long term.

Risks if I invest

The largest risk with OSB pertains to the challenge that comes when its mortgage buyers can’t pay their fees because of economic hardships, which could result in times of recession. Because the firm is catering to special situations, it faces a higher risk of defaulted mortgages.

Additionally, if central banks raise interest rates, OSB can benefit, but lower interest rates mean its net margin could contract. Therefore, the business is highly susceptible to the effects of recessions, and I’ve got to be careful if I rely on the dividend from my OSB shares, because this could be cut during hard times.

How I plan to protect myself

I like this business, and I think it’s a suitable investment for me. However, if I buy it, I need to make sure I diversify my portfolio properly to protect me from any hardships that affect OSB specifically. If I do that, I think the investment has a strong place in my financial plan.

When I have some spare cash, I’ll look at potentially buying a stake in OSB.