I believe these cheap FTSE 250 shares could too cheap to miss at current prices. Here’s why I think investors seeking top value stocks should give them serious consideration.

Centamin

Having exposure to gold can be a great way for investors to diversify and reduce risk. When times get tough and financial markets sink, safe-haven gold often rises in price and offsets weakness elsewhere in an individual’s portfolio.

I think investing in gold stocks is an excellent way to achieve this. Unlike physical gold, or a product that tracks metal prices like an exchange-traded fund (ETF), many mining companies also provide income in the form of a dividend.

To this end, Centamin (LSE:CEY) is one UK share on my own radar today. Its dividend yield sits at a solid 3.2% for 2024.

Mining stocks can also provide better returns than gold or gold-backed financial instruments if they can demonstrate ongoing operational strength. Successful expansion of its flagship Sukari mine in Egypt, positive exploration work elsewhere in Africa, and a tight grip on costs all suggest to me a stock with brilliant investment potential.

Earnings at commodity stocks are notoriously volatile given their sensitivity to raw material prices. But despite this risk, I think Centamin shares are an excellent buy.

This is not only because of the miner’s all-round cheapness. As well as providing that healthy dividend yield, it trades on a forward price-to-earnings (P/E) ratio of 8.7 times.

It’s also due to the possibility that gold prices will continue to soar. The yellow metal hit another all-time high of $2,222.39 per ounce on Thursday (21 March).

City analysts certainly think Centamin’s share price will continue its recent rapid ascent. The 11 analysts with ratings on the miner have put a 12-month price target of 203p per share on it. That’s a large premium from current levels of 111p.

Greencoat UK Wind

Renewable energy stock Greencoat UK Wind (LSE:UKW) also looks massively undervalued in my opinion.

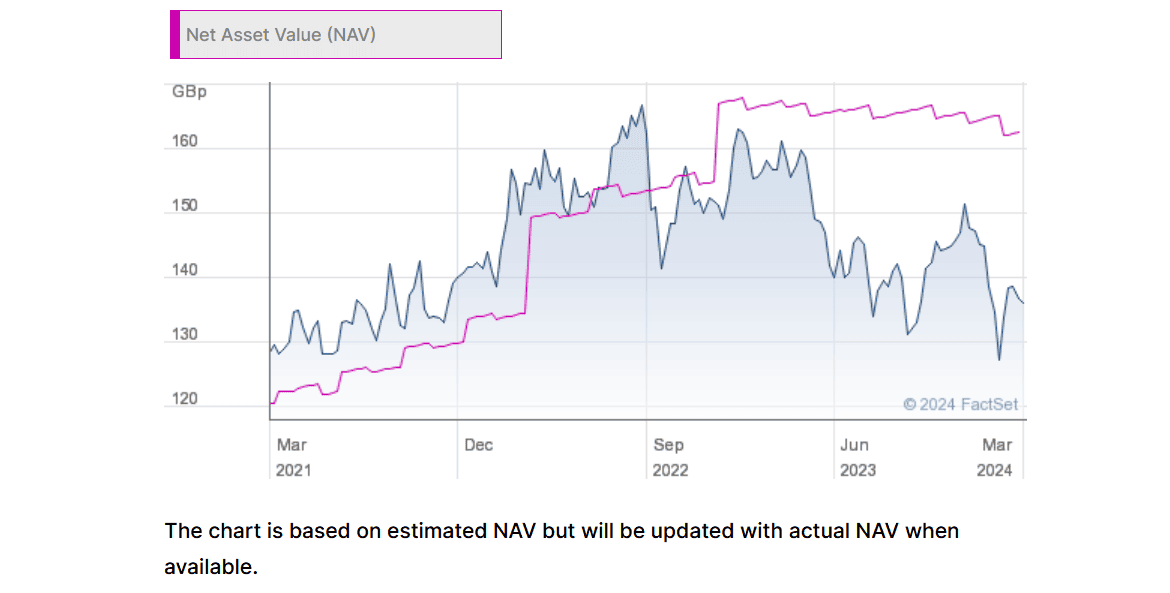

Its P/E ratio of 25.8 times might not look too appealing to investors. But at 135.6p per share, it trades at a double-digit discount to its estimated net asset value (NAV) per share of 162.9p

The seven brokers with ratings on Greencoat also think its share price will hit 178.8p per share in the next 12 months.

And finally, the wind power specialist carries a tasty forward 7.4% dividend yield at current prices. That’s more than double the 3.5% average for FTSE 250 shares.

Profits at renewable energy producers tend to be more volatile than those using fossil fuels. In the case of Greencoat, power generation can sink during calm conditions. Building turbines and keeping them up and running can also be enormously expensive.

Yet I’d be happy to accept some volatility if a stock’s long-term outlook is bright. And I think Greencoat — which operates dozens of onshore and offshore wind farms — could deliver solid profits growth as the world switches from oil and gas to cleaner energy sources.