Tesla (NASDAQ:TSLA) stock is finally trading below its average target price. That’s a good sign, but I’m still a little cautious about this electric vehicle (EV) frontrunner. After all, the Elon Musk company’s trading at 56.7 times forward earnings — it’s incredibly expensive.

Anyway, if I’d invested £1,000 in Tesla stock a year ago, today I’d have around £970. That might not add up for my eagle-eyed readers because Tesla stock is up 2.5% over the period. However, as Tesla stock is denominated in dollars, I’ve got to factor in a 5% appreciation of the pound.

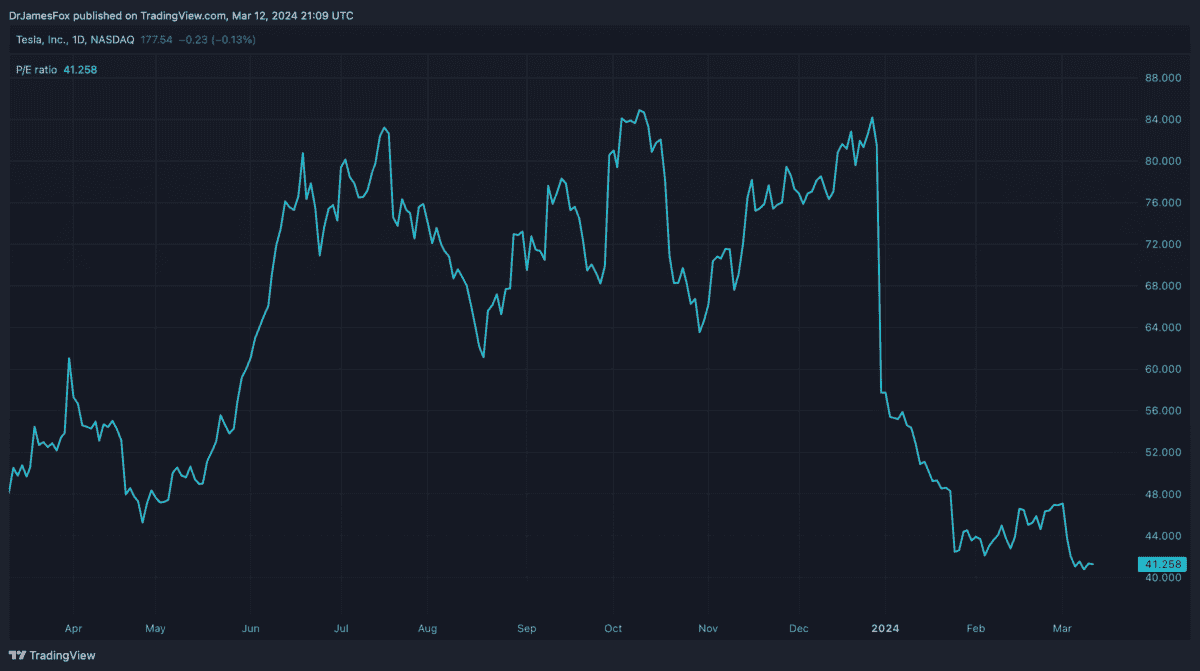

In other words, it wouldn’t have been an overly successful investment. However, it’s worth noting that I’d have been doing well until the turn of the year. Since the start of 2024, Tesla stock has lost 28% of its value. It’s the worst performing member of the Magnificent Seven tech titans (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, Tesla).

Average target price

When I wrote about Tesla towards the end of last year, the EV giant was trading above its average share price target. Companies frequently trade at a considerable discount to their share price target, but it’s rare to see a stock trade at a premium.

Currently, the average share price target is $210, that’s 18.5% above the current price. The highest price target is $320 and the lowest just $85. Interestingly, the average has fallen considerably since the turn of the year.

As the average share price suggests, there are now more ‘buy’ than ‘sell’ ratings.

Not worth the price tag

Tesla isn’t cheap at 56.7 times forward earnings. But is it worth the price tag? Taking the expected earnings growth into account, Tesla trades at 41.5 times 2025 earnings, 36 times 2026 earnings, and 27.9 times 2027 earnings.

My concern is that while 27.9 times earnings sounds fine for a tech stock, it’s a lot for a non-luxury car manufacturer. While Ferrari trades at 40.7 times forward earnings for 2027, it’s something of an exception to the rule, and it does have incredibly strong margins — Tesla doesn’t.

Personally, I see great potential in Musk’s plans to roll out fully autonomous cars and create a self-driving taxi fleet that would be a new revenue generating stream. However, as pointed out by analyst Michael Tyndall at HSBC, we may not see these projects positively contribute to earnings until the end of the decade.

The bottom line

I want to put my faith in Tesla. Musk’s company has done a huge amount to develop this once-nascent and unproven technology. However, I’m not sure I can put my own money behind the company.

In addition to being rather pricey, Tesla is facing stiff competition from established car manufacturers and Chinese new energy vehicle (NEV) manufacturers.

Personally, I favour Li Auto, which trades at a much more agreeable 16.6 times forward earnings and 7.5 times 2027 earnings.