When the Rolls-Royce (LSE:RR) share price hit 66p back in October 2022, I was a little worried and my conviction did falter slightly. However, I didn’t sell any of my holding until the FTSE 100 stock reached 150p. More recently, I’ve been buying the stock despite the share price pushing higher and higher.

One strong investment

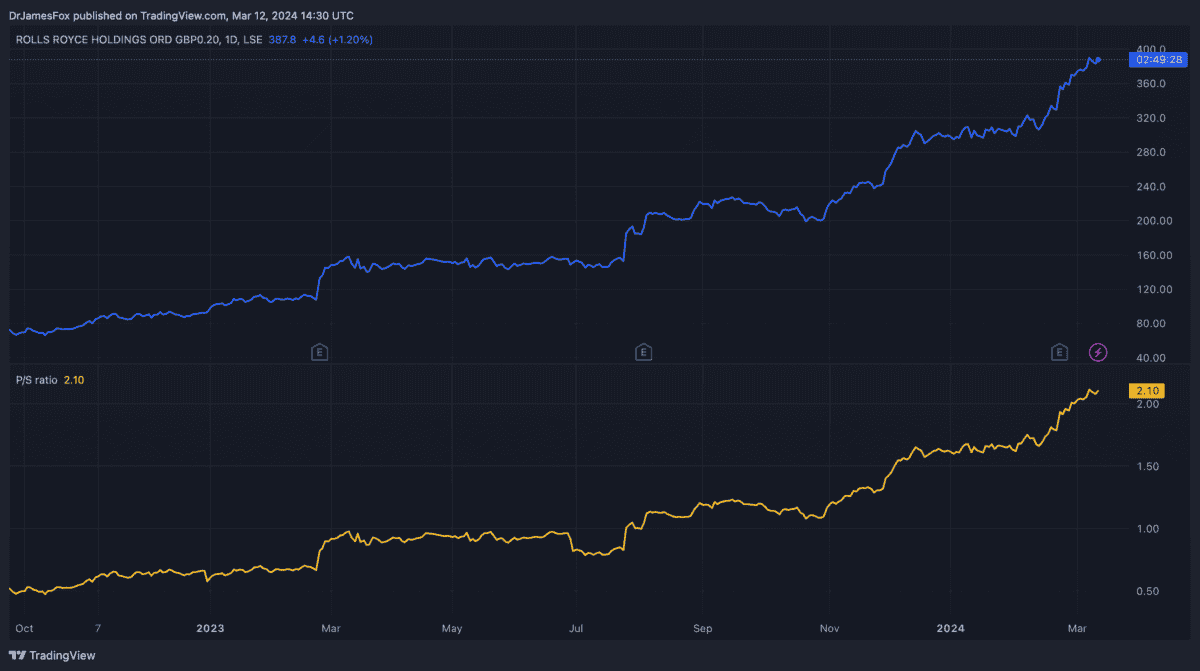

Since bottoming out, Rolls-Royce shares have surged 486%. That means a £1,000 investment made at that price would now be worth £5,860. We can all dream that we were part of a trade like this. But sadly, it’s always easier with hindsight.

Nonetheless, there were signs. In October 2022, Morgan Stanley said that Rolls-Royce was “the clearest example of mispricing” in its coverage. But other brokerages weren’t so bullish and broad investor sentiment wasn’t strong.

Fast forward six months and Rolls-Royce was trading around 150p a share. However, it wasn’t clear that Rolls would push higher. The company had beaten analysts expectations for just one quarter, and even the more bullish analysts, including UBS, admitted Rolls could still fall.

As 2023 went on, and as Rolls-Royce kept beating earnings estimates, it became clear that the engineering giant’s share price would go much higher. And this is when I stopped selling my holdings and started buying.

In the below chart we can see how the rise in the price-to-sales ratio has been more subtle than the rise in the share price. This demonstrates that improved business performance in the near term has also driven the bull run.

More tailwinds

It’s one of the most impressive turnarounds I’ve ever seen. But just because its up 486%, it doesn’t mean the stock can’t go higher. In fact, momentum is actually one of the best indicators of forward performance.

However, momentum can’t be sustained forever without an improving business. Thankfully, all of Rolls’s business segments — civil aviation, defence, and power systems — are benefiting from considerable boosts, and this has contributed to a very bullish medium-term target.

These supports are evident in the civil aviation business. In the near term, Rolls has a backlog of around 1,400 engines — equivalent to around three years production at current rates. That size of backlog provides investors with plenty of confidence.

And looking further ahead, Airbus has forecasted that the aviation industry will require more than 40,000 new aircraft over the next two decades.

While that means at least 80,000 new engines, the majority of these new aircraft are expected to be narrow body. With Rolls leaving the narrow body market a decade ago, there’s a risk the firm will be left behind.

The bottom line

Rolls-Royce is no longer a clear example of mispricing as it was described 18 months ago. However, just take a look at these forward price-to-earnings ratios. It’s certainly not expensive given the growth it is expected to deliver. I remain confident this stock will go higher.

| 2024 | 2025 | 2026 | 2027 | |

| P/E | 22.2 | 18.4 | 19.2 | 16 |