One of the largest holdings in my Stocks and Shares ISA is up 26.4% since the end of January. It’s Axon Enterprise (NASDAQ: AXON), a stock that has exceeded my wildest expectations over the past few years.

In fact, it’s gone up every year since I first started buying it in 2016, even in 2022 when most growth stocks fell sharply. Over five years, it’s increased 572%.

What has been driving this relentless march higher? And would I still buy the shares today? Let’s dig in.

A hardware and software ecosystem

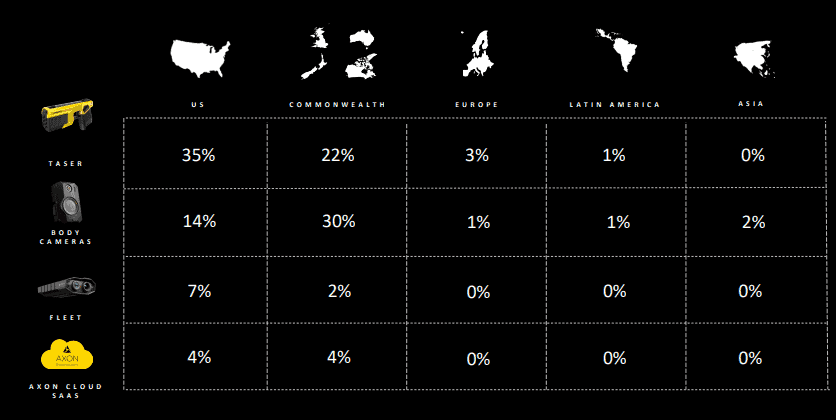

For those unfamiliar, Axon used to be called Taser International. And while its flagship stun gun still contributes significantly towards sales, the firm is also the market leader in body cameras worn by law enforcement officers as well as dash cams inside fleet vehicles.

However, this is no longer simply a hardware firm. These cameras and Tasers are sold as part of monthly subscription packages that often include Axon Cloud.

This fast-growing platform stores the collected evidence (videos, audio, images, documents) and offers a suite of digital evidence management and productivity tools.

Another year of eye-popping growth

In 2023, the company’s revenue rose 31% year on year to $1.56bn, its fifth consecutive year of 25%+ growth.

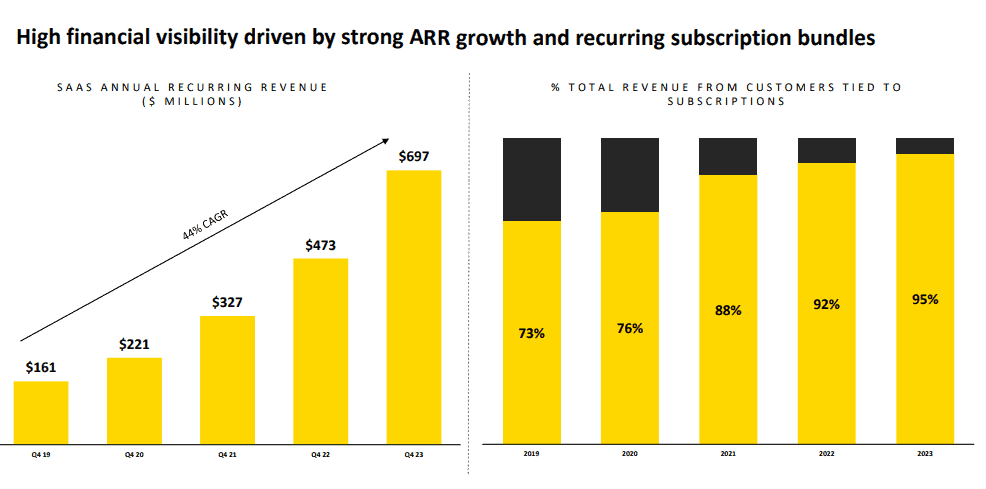

Axon Cloud and Services revenue surged 52% to $561m while annual recurring revenue (ARR) grew 47% to $697m. This subscription-based model continues to turbocharge the company’s growth.

Adjusted EBITDA jumped 41% to $329m, good for a 21% margin. Net profit margin reached a healthy 11%.

For 2024, management is guiding for revenue of $1.88bn-$1.94bn, representing 20%-24% growth. It also expects adjusted EBITDA of $410m-$430m, which would be a 27% improvement at the mid-point.

The secret sauce? Stickiness

Axon’s business model creates powerful flywheel effects. As more devices are added to the network, this generates additional data, from which machine learning and artificial intelligence (AI) can unlock value to make products even better.

Police departments are unlikely to abandon non-lethal weapons and risk losing the public accountability that body cameras provide. There’s also the risk of losing critical evidence by switching to a different software provider. This dynamic creates incredibly sticky revenue.

Throw in the long-duration contracts — upwards of 10 years — and the switching costs are probably among the highest in the world.

In fact, customers keep spending more, with net revenue retention at 122% in the fourth quarter. This is essentially revenue growth from existing customers. A 122% rate is exceptional.

Would I invest?

One issue here is valuation. Axon stock is rarely cheap, but after another surge upwards we’re looking at a forward price-to-earnings multiple of 71. That presents risk when investing today, particularly if growth slows.

However, 20%+ annual growth is forecast for the foreseeable future, with total future contracted revenue now standing at $7.1bn.

Furthermore, management estimates a new total addressable market (TAM) of roughly $63bn.

TAM penetration and global expansion opportunity

Considering 2023’s revenue was $1.56bn, the potential growth runway here is very long, even when factoring in the reality that most TAMs are never fully captured.

If Axon can keep up this growth, I think the stock will head higher long term. Therefore, it remains a high-conviction holding in my portfolio, despite the lofty valuation.