Warren Buffett has earned the nickname ‘the Oracle of Omaha’ due to his place of birth (Omaha) and his apparent ability to foresee the future. His amazing propensity to know which stocks to invest in seems prophetic to many people.

Of course, there is no real magic involved.

As Buffett admits himself, his success is largely due to something we all have the ability to harness: compound returns.

The snowball effect

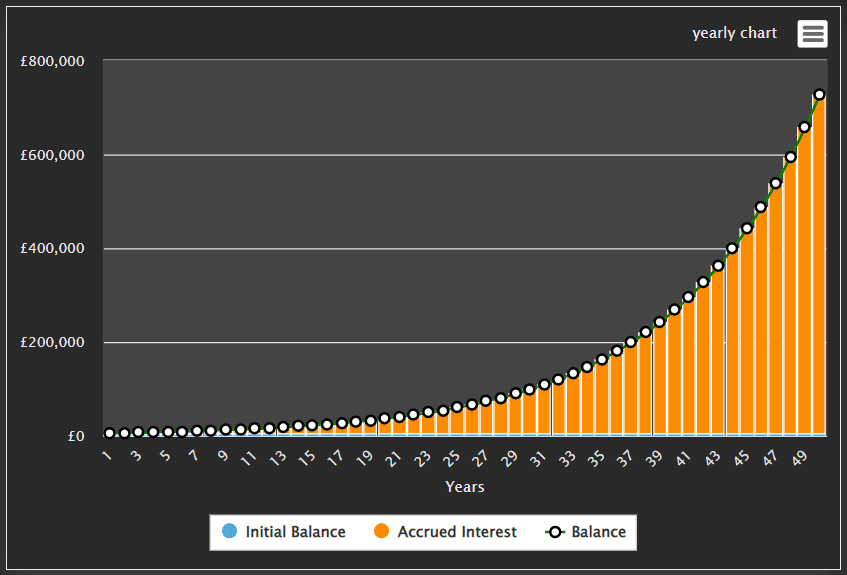

Buffett describes the power of compound returns as similar to that of a snowball: as it rolls downhill, it grows exponentially larger and larger.

In investing, this is exhibited by an increasing degree of growth over time.

The exponential growth of compounding returns

Let’s use the iShares Core S&P 500 ETF (LSE:IUSA) as an example. This UK-listed exchange-traded fund (ETF) provides exposure to major US companies listed on the S&P 500, such as Microsoft, Apple, Amazon, and Buffett’s own Berkshire Hathaway.

The ETF is weighted towards tech stocks (30%) but also includes exposure to sectors such as financials, health care, industrials, and energy.

Over the past 10 years, the ETF provided annualised returns of approximately 12% per year. It’s worth noting that it made losses in 2018 and 2022, by -4.7% and -18.4%. It has an average price-to-earnings (P/E) ratio of 25.5 but the price-to-book (P/B) ratio of 4.44 is quite high, suggesting the shares could be overvalued.

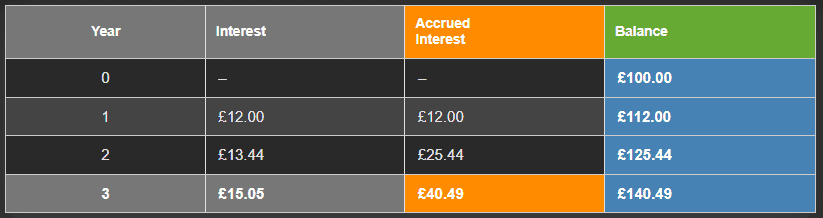

So, based on an average 12% rate of return, if I invested £100 in the iShares Core S&P 500 ETF, I could have £112 after the first year. Does that mean after the second year I’ll have £124? And after the third, £136?

No.

The magic of compounding returns means my total return grow even more because the initial investment now includes the accumulated returns. So after year one, I would have £112, but in year two, with £112, the returns would be £13.44, bringing my total to £125.44. In year three, the returns would be £15.05, bringing my total to £140.49.

Of course, this is just a simple example — in reality, these numbers would differ slightly due to price fluctuations throughout the year.

Time in the market

The magic of compounding returns is echoed in the popular saying ‘It’s not about timing the market, but about time in the market’.

Timing the market refers to the act of trying to buy and sell at opportune moments. This is opposed to ‘time in the market’, meaning being invested for a long period. Buying and selling frequently can be profitable for some but statistics show that usually it’s less profitable than simply staying invested for long periods.

Of course, it’s not all down to compounding returns. Experienced investors like Warren Buffett have a deep understanding of global markets and spend hours researching potential stock options.

For us lesser experienced investors, investments like the iShares Core S&P 500 ETF provide exposure to a well managed and diverse portfolio of stocks. I see it as a low-risk option that I hope will provide me with consistent and reliable returns for years to come.