I think this growth stock could be a very stable addition to my portfolio. With all of the hype around the technology sector at the moment, sometimes it’s nice to get some breathing room. I believe Breedon Group (LSE:BREE) provides a decent way to park some cash in a growing and healthy British construction business.

Company overview

The firm is a leading construction materials company in the UK and Ireland. It provides a range of products and services to the building industry, with core operations in quarrying, production, and sale of aggregates, ready-mixed concrete, asphalt, and cement. It also offers surfacing and contracting services.

Breedon has more than 100 quarries, over 50 asphalt plants, 170+ ready-mixed concrete plants, and two cement plants. It also employs 3,700 people, and management has a focus on generating high levels of profitability.

Long-term growth

Breedon has pulled off significantly strong financial results for over a decade, and my research on the company convinces me this is likely to continue.

In £ – Net Income, Yellow – Revenue, Blue – Net Margin, Green – Source: TradingView

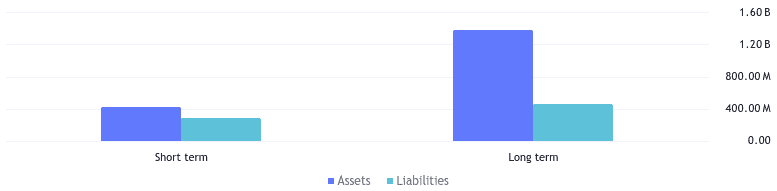

With its balance sheet having more equity than liabilities, that means the firm isn’t over-leveraged, and its growth in the future shouldn’t be overly inhibited by debt repayments.

Also, this investment has a healthy 3% dividend yield right now. And while the share price is down roughly 35% from its high after the pandemic struck, I think this could be the best time for me to buy in.

Exceptional value

I think Breedon Group offers wonderful value for the price it is presently selling at. On the surface, its price-to-earnings ratio is just 12 right now, which is appealing to me.

But also, on a deeper look, I consider the company 38% undervalued based on my discounted cash flow analysis. This takes into account future predicted earnings for the firm and discounts it back to what I estimate as today’s value for the stock.

Over the past 10 years, Breedon Group has maintained 22.5% earnings growth as an annual average. For my calculation, I only need the firm to hit 11% as an annual average for the next decade. I consider that a relatively safe bet.

Investment risks

Now, although I have a favourable view of the organisation’s future earnings potential, I have been made aware of a risk to its profitability.

The firm’s gross and operating margins have been in decline for more than five years. This could in turn have a negative effect on the earnings of the business. Therefore, I know I need to continue to carefully evaluate the firm’s profitability potential on a regular basis if I become a shareholder.

Also, with all of the firm’s revenues coming from the UK and Ireland, there’s some risk that if these countries face an economic downturn, Breedon Group could be severely affected. Compared to other construction companies that are diversified around the world, this is a significant weakness.

I might buy it soon

I am actively looking for great investments outside of the technology sector at the moment. Breedon Group certainly seems like a stable and prosperous choice for me to consider.

This business is high up on my watchlist. I think it’s likely I’ll buy a stake in the group when I next make some investments in March.