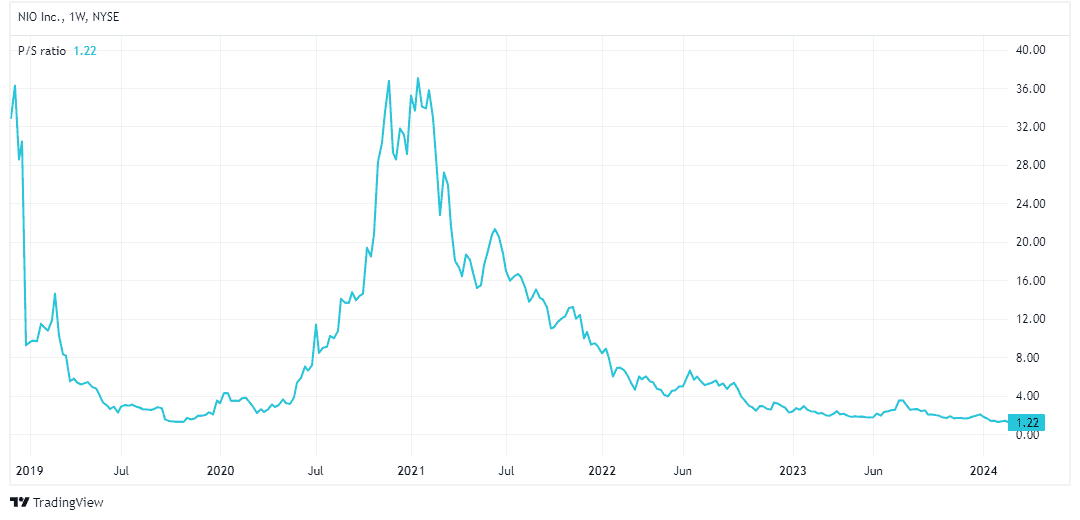

Once upon a time, NIO (NYSE: NIO) was regularly called the ‘Tesla of China’. However, as the companies’ respective share prices have diverged, I don’t hear such comparisons today. And at $5.40, NIO stock is trading at depths not seen since June 2020.

Is this a big buy-the-dip opportunity for my portfolio? Or is this stock one to avoid? Let’s take a look under the bonnet.

Analyst downgrade

On 23 February, NIO shares dropped 7.6% after JP Morgan analyst Nick YC Lai slapped a ‘sell’ rating on the stock and reduced his price target to $5 from $8.50.

Lai fears a lack of new electric vehicle (EV) models this year could hurt sales growth, especially as Chinese competitors like Xpeng and BYD launch theirs.

BYD, which overtook Tesla to become the world’s biggest EV seller in 2023, intends to launch 30 new models in the coming three years. So fierce competition is a concern here.

The analyst anticipates 2024 revenue coming in at CNY73bn ($10.1bn) rather than the current consensus for CNY78.9bn ($10.9bn). He also sees a widening adjusted per-share loss.

Needless to say, this wouldn’t be a recipe for share price appreciation.

A new mass-market vehicle

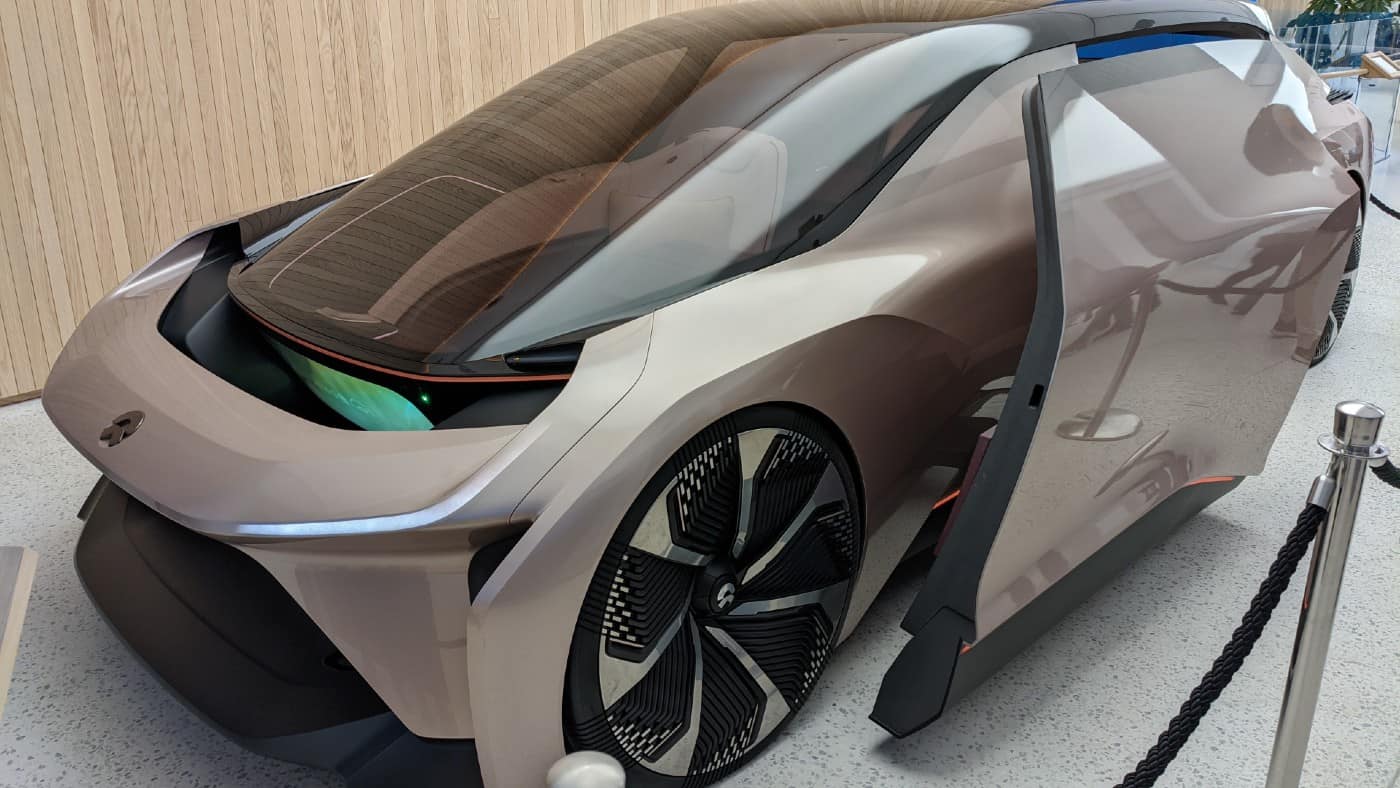

On the plus side, NIO is due to release the first model of its Alps sub-brand — a sport utility vehicle (SUV) codenamed DOM — in the second half of this year.

This will see the company expand beyond its current premium segment to the mass market.

Alps’ models will be built on NIO’s third-generation technology platform and will include its popular AI-powered in-car assistant. Reports suggest the first model will be priced at around $34,000.

The issue here, however, is that this sub-brand is entering an already overcrowded SUV market in China. There are literally dozens of similar offerings from various manufacturers, both domestic and foreign. So success is far from guaranteed.

Expansion doubts

NIO has long talked up its international growth ambitions. It already has a presence in Europe and is even launching a new brand (another one) called Firefly that is designed specifically for the continent.

However, things are looking increasingly uncertain here. In January, US Commerce Secretary Gina Raimondo described growing sales of Chinese EVs across the West as a national security risk.

She highlighted the fact that they’re packed with thousands of chips and sensors that collect huge amounts of driver and location information. “Do we want all that data going to Beijing?” she asked.

My guess is that the answer to this question will eventually be no. And unlike BYD, which is building a factory in Hungary to circumvent any European tariffs on Chinese-made EVs, NIO doesn’t have deep pockets.

Therefore, I’m sceptical about the company’s chances of international success.

I’m not buying

The stock is trading on an extremely low price-to-sales multiple of 1.22. This is the cheapest it has ever been.

Therefore, if NIO can progress towards profitability, the stock could surge from this point. But it’s big if, in my opinion, and this makes the low valuation warranted.

Worryingly, the company lost $663.9m in the third quarter of 2023. And it still appears years away from profits, even after significant cost-cutting measures.

On balance, I’d rather invest in other less-risky growth stocks right now.